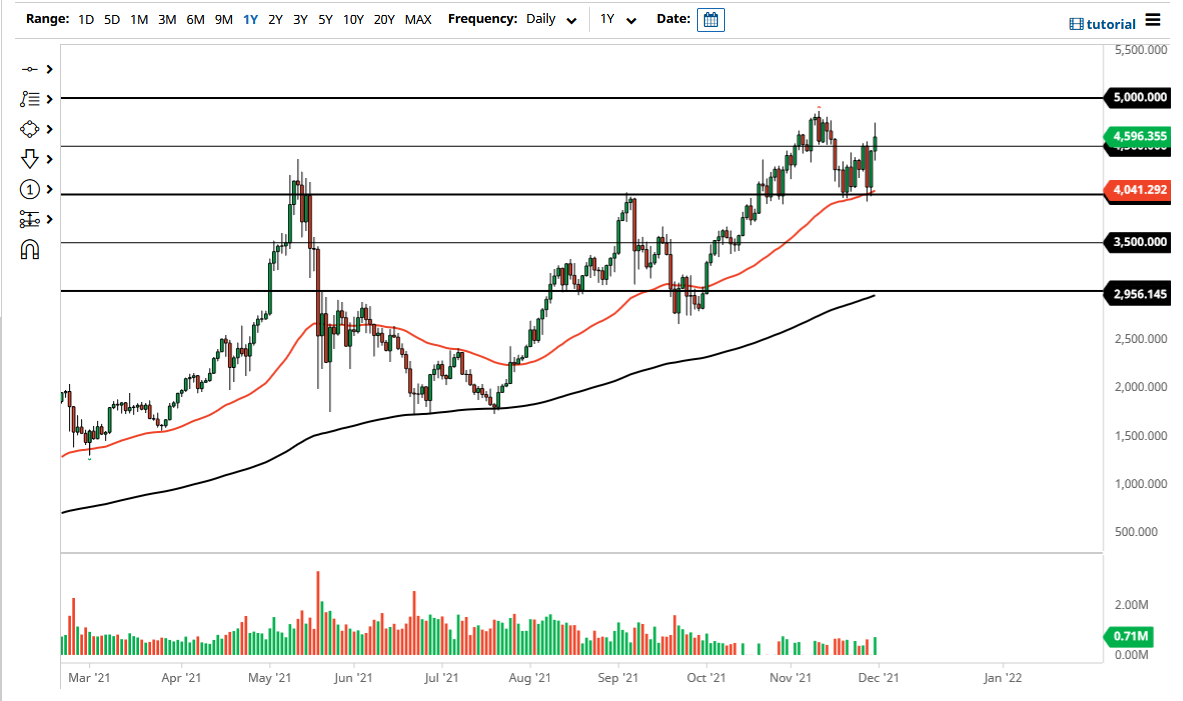

The Ethereum market initially pulled back a bit on Tuesday but then broke above the $4500 level to go as high as $4750 level during the day, only to pull back towards the $4600 level. The candlestick shows that we did break a significant amount of short-term resistance at the $4500 level, and it looks as if we will probably continue to see upward pressure. Ultimately, Ethereum has been a strong performer most of the year, as the chart clearly shows.

At this point, you could make a reasonable argument for a bullish sign, but even if you do not believe that, the reality is that the 50-day EMA sitting underneath at the $4000 level makes a bit of a “hard floor in the market” from what I can see. Ultimately, the candlestick does show a little bit of hesitation, but that should not be a huge surprise considering that we had such a strong day for the US dollar. Keep in mind that a lot of what we had seen is a reaction to Jerome Powell suggesting that inflation was no longer “transitory”, driving the US dollar higher. The fact that the Ethereum market held up the way it did suggest just how much buying pressure there is. Quite frankly, this is a day that could have been much worse for Ethereum, despite the fact that we did pull back from the highs. The resiliency is something worth paying attention to. At this point, I believe that nothing has changed, except for the fact that perhaps the buyers have stood their ground.

If we were to break above the high of the session on Tuesday, then I think we will make a serious move towards the all-time high, and eventually the $5000 level, which I think will attract a lot of attention. The headline noise at $5000 could cause a little bit of a selloff, but I think that would be more along the lines of profit-taking than anything else. If we break down below the $4000 level, then the next support level will be found near the $3500 level, which is an area we have seen clustering at previously. Underneath there, then we have the 200-day EMA hanging about the $3000 level, which should continue to attract a lot of attention as well. Even if we do get a significant selloff, I think this is a market that you have to look at through the prism of value.