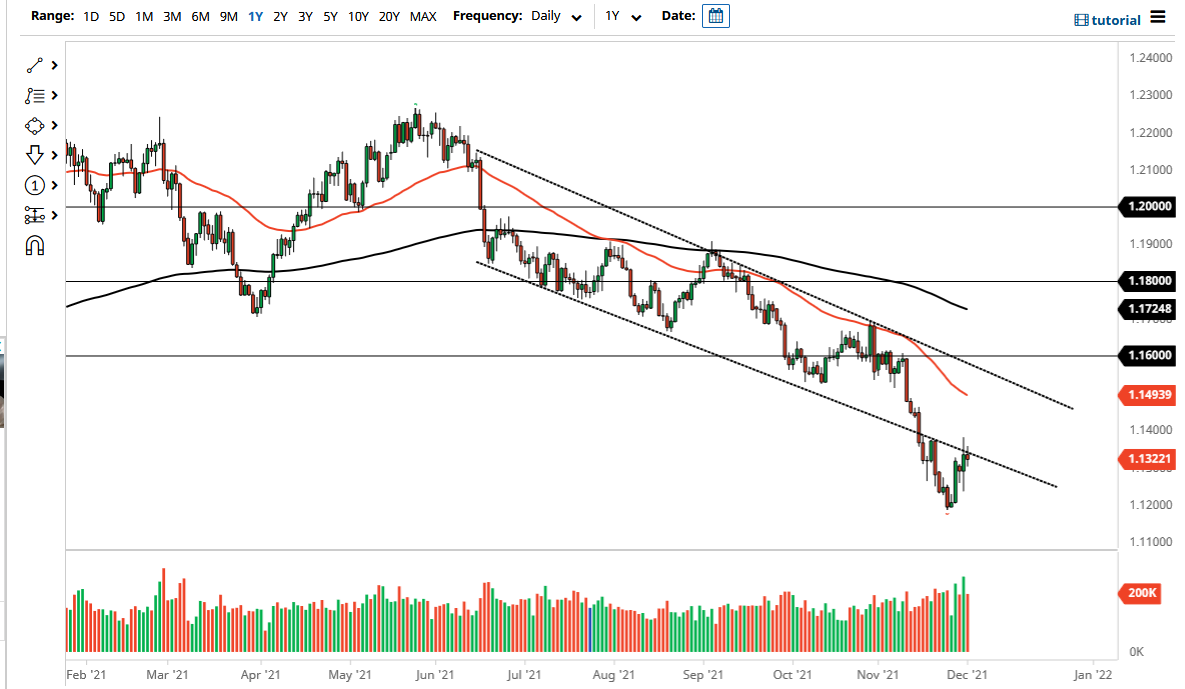

The euro went back and forth on Wednesday as we continue to respect the previous trend line that was part of the descending channel. At this point, the market looked bullish yet again during the session but fell apart just like it did the previous day, showing that the euro seemingly cannot get off of its back. The 1.14 level above is an area that a lot of people will be looking to for resistance, and it is worth noting that during the trading session on Wednesday, Jerome Powell did not walk back some of his more hawkish comments. Because of this, the US dollar started to see some strength against multiple currencies, not just the euro.

All of this being said, you could make an argument for a bounce being needed due to the fact that we had gotten so oversold. I can certainly see an argument being made for that scenario, as this pair essentially fell off of a cliff recently. That being said, it does not mean that we are going to change the trend. In fact, I think it is probably much more likely that we see sellers at every rally that shows even the slightest inclination of failing. After all, the trend is very strong to the downside, but we need some type of catalyst to get going.

That catalyst could very well be on Friday, when we get the non-farm payroll number coming out of America. This is a major catalyst for everything involving the US dollar, which in and of itself will have a lot to say in this pair. Because of this, I think the next day or so is going to be very difficult, but eventually we will get some type of bigger move. If and when we do, it is very likely that we will see a lot of trouble just above, as we have seen over the last couple of days. To the downside, the 1.12 level will offer significant support. Because of this, I would not be surprised at all to see this market stay in the same range through the end of the week. That is the normal behavior for the euro anyway, so I do not see any reason to think anything changes. I would be cautious with my position size.