Amid the relatively calm state of risk aversion, the EUR/USD gained some momentum and moved to the 1.1340 level, after recent selloffs pushed the pair towards the 1.1227 support level this week. Investor confidence returned after comments from Dr. Anthony Fauci, the White House's chief medical advisor, who said initial indications were that the Omicron variant may be less risky than the delta variant. The markets have fallen in the past two weeks due to several concerns, including rising inflation, the latest variant of the Corona virus and how both issues could affect economic growth.

Investors can get more information on the performance of the economy later this week and next week. On Friday, the Labor Department will provide an update on how price hikes will affect consumers with the release of the US Consumer Price Index for November. The Federal Reserve is scheduled to hold a two-day meeting of policy makers next week that could provide an update on the US central bank's plans to tackle inflation.

The Fed has said it plans to speed up the pace of reducing its bond purchases, which has helped keep interest rates low. This has raised concerns that the Federal Reserve will raise benchmark interest rates next year sooner than expected.

Meanwhile, center-left leader Olaf Schulz, the ninth chancellor of Germany after World War II, has ushered in a new era for the European Union's most populous country and largest economy after Angela Merkel's 16-year tenure. The Schulz government is taking on its duties with high hopes of modernizing Germany and combating climate change, but it faces the immediate challenge of dealing with the country's most difficult phase so far from the coronavirus pandemic.

Representatives voted 395 to 303 with six abstentions for Schultz—a comfortable majority though fewer than the 416 seats held by his three-party coalition in the 736-seat House. And Merkel, who is no longer a member of Parliament, looked on from the audience room as Parliament voted. Lawmakers gave her a standing ovation.

The new government aims to ramp up efforts against climate change by expanding the use of renewable energy and forward Germany's exit from coal-fired power from 2038 "ideally" to 2030. It also wants to do more to modernize the country of 83 million people, including the improvement of mobile phone networks and the Internet, which are notorious for their weakness.

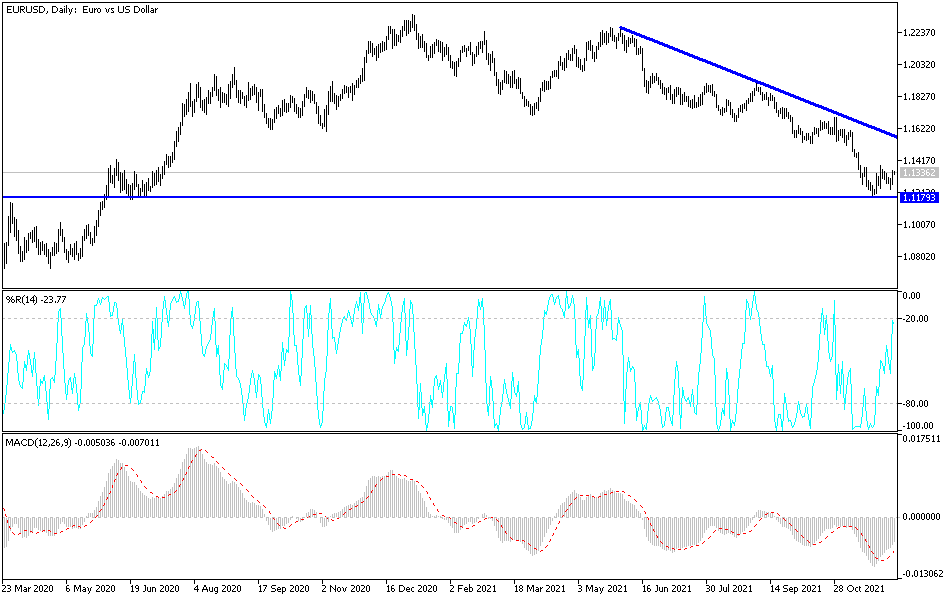

Technical Analysis

Despite the current rebound attempts, the general trend of the EUR/USD is still bearish. A move below the 1.1300 support will remain supportive of this trend because it stimulates the bears to move further downward. The closest support levels for the pair are currently 1.1245 and 1.1180 and 1.1090. Investors’ aversion to risk and the continuation of European restrictions to contain the virus, in addition to the disappointing results of economic releases from the Eurozone, in addition to increasing expectations that the US Federal Reserve will raise interest rates, will continue to pressure factors on the EUR/USD in the coming days.

On the upside, and according to the performance on the daily chart, the resistance levels 1.1525 and 1.1660 will remain crucial for a breakout of the current trend. Today, the trade balance figures for the Eurozone will be released, followed by the number of US weekly jobless claims.