The euro went back and forth significantly on Tuesday as we continue to try and figure out where we are going next. The candlestick for the trading session on Tuesday shows just how noisy and messy the markets are going to be, especially as at one point it looked like the euro was going to explode to the upside. At this point, enter J Powell. Jerome Powell started speaking of inflation as no longer being “transitory”, and it sent the US dollar higher as interest rates continue to rally.

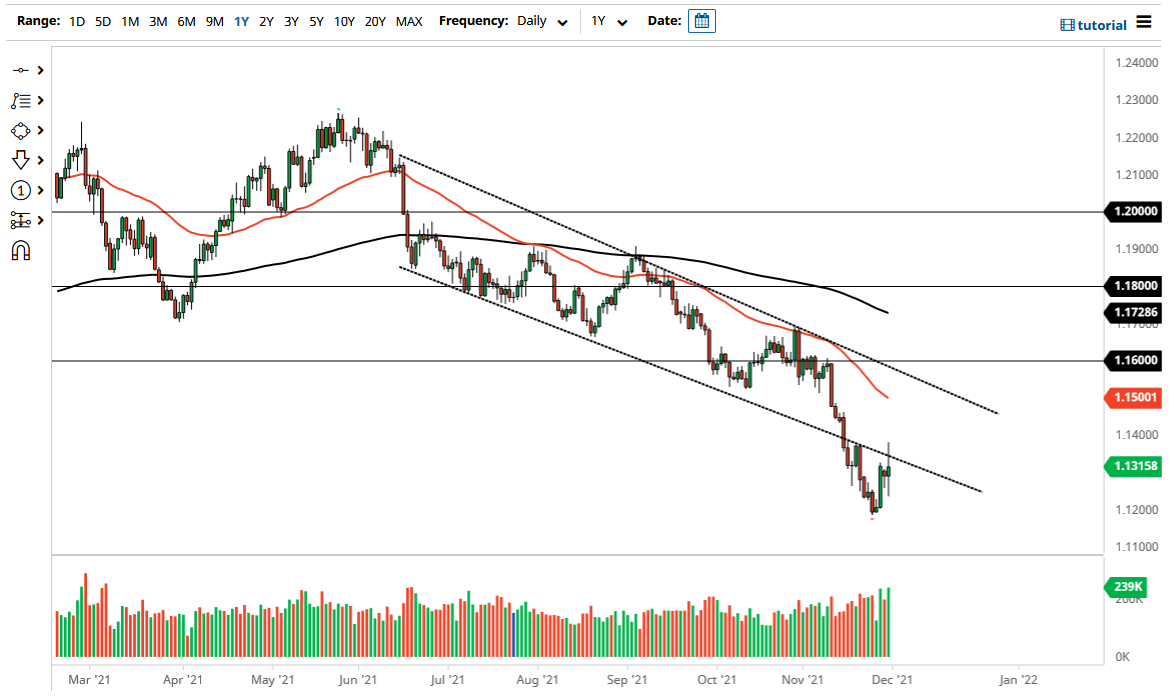

Because of this, we have seen a massive range for the trading session, and at this point in time we have turned around to close just slightly positive. At one point, it looked as if the euro was going to completely lose it and break down. However, you can also see that the body of this candlestick is very thin, so it does tell you that we are still trying to figure out what to do with all of this information. You can see that we tested the bottom of the previous downtrend channel and found it to be resistive. That is a typical turn of events when it comes to technical analysis, as “support becomes resistance.”

To the downside, if we were to break down below the bottom of the candlestick for the trading session on Tuesday, then it is very likely we will go looking towards the 1.12 level underneath, which is where we had bounced from previously. At this point, I think it is probably only a matter of time before we see some type of bigger move, and it should be noted that we are still in a significant downtrend. It is because of this that I prefer the idea of selling rallies that show signs of exhaustion, unless of course the interest rate situation changes. Currently, the US dollar continues to be one of the favored currencies around the world, but this market has been in desperate need of some type of bounce as it had gotten so oversold. I still look for signs of exhaustion to start shorting, because it gives you an opportunity to find a bit of “value” when it comes to the greenback. It is not until we break above the 50 day EMA that I even consider buying this market.