The assessment of the new Omicron variant continues to strongly affect investor sentiment and global financial markets so far. The pace of investors’ flight from risk is still weakening the EUR/USD currency pair, especially since Europe was the first to implement the epidemic restrictions, although it has never recovered from the effects of the epidemic so far. The currency pair's losses last week reached the support level at 1.1235, and its gains did not exceed the resistance level at 1.1383 and closed last week's trading stable around the 1.1308 level. The strength of the US job numbers plunged the currency pair to the 1.1266 support level on Friday.

The EUR/USD briefly fell below the 1.12 support before the latest strain of coronavirus was detected, apparently causing investors who had previously borrowed and then sold the euro to capitulate to funding bets on higher-yielding assets. Commenting on the performance of the EUR/USD pair, Chris Turner, analyst at ING Bank says, “EUR/USD is exactly in the middle of what could prove a multi-week trading range of 1.1180-1.1380 – bounded by Omicron and Fed news. While the recent strong non-farm payrolls report may see the lower end of this range test, investors may be reluctant to pursue a move too short for fear of some of the more damaging Omicron news.”

Accordingly, Turner and colleagues wrote in a research note on Friday: "In the meantime, the news of further shutdowns across continental Europe hardly makes the euro the safe-haven currency of choice and one suspects that the EUR/JPY remains under pressure." As such, Turner and colleagues suggested on Friday that the EUR and other currencies are likely to go through a period of stagnation as conflicting risks associated with a tighter Federal Reserve and the latest version of the coronavirus discourage risk-taking.

Overall, the prospect of investors being further shocked by negative information regarding the new strain of coronavirus, particularly regarding the effectiveness of current vaccines, could keep investors reluctant to bet heavily on the euro in the short term. Meanwhile, renewed restrictions on business and social activity in Europe have created more headwinds for the economy as the Federal Reserve prepares to accelerate the normalization of its monetary policy.

These opposing factors could keep the EUR/USD rate confined to a relatively narrow range and consolidation in the coming weeks.

More importantly for the outlook for the euro and the dollar, ECB Governor Lagarde told Reuters on Friday that inflation may already have peaked in Europe in November and that the ECB remains confident that it will decline on its own once until 2022. If Lagarde is Right, this would support the view that interest rates are unlikely to rise in the Eurozone next year, which could have bearish effects in the medium term for the EUR/USD in light of the Fed's policy shift.

US policymakers have increasingly warned in recent weeks that they may end the Fed's quantitative easing program at a faster pace than that stipulated in the November monetary policy decision, which would maneuver the bank into a position where it could also raise interest rates sooner. The bank recently directed it until last month. This comes after the US inflation rate exceeded six percent in October, the highest level since 1990, when many policymakers were looking for it to begin to stabilize.

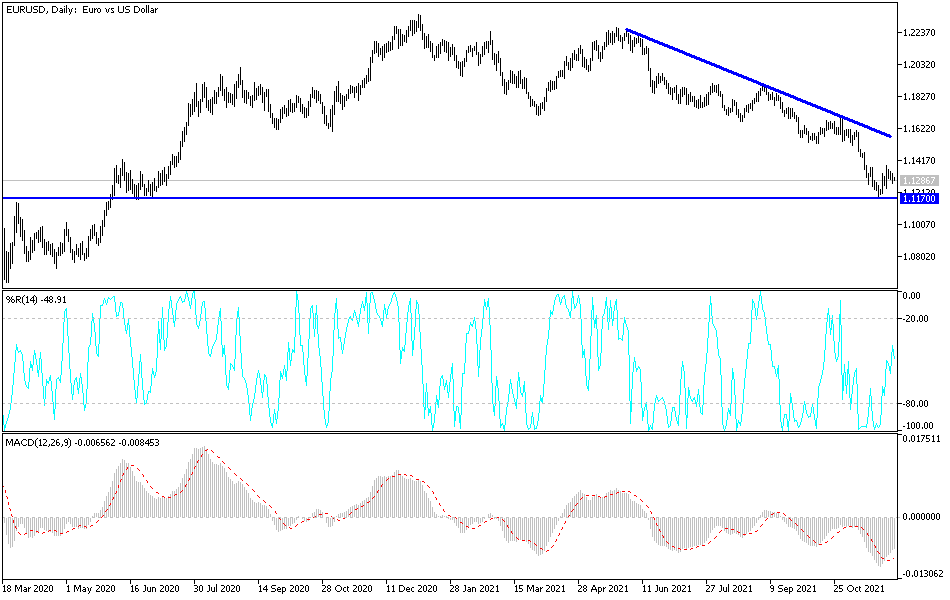

Technical Analysis

There is no change in my technical view of the EUR/USD currency pair. The general trend is still bearish, and moving below the 1.1300 support level still supports further downward movement to the support levels at 1.1255, 1.1180 and 1.1090. These would be enough to push the technical indicators towards oversold levels. On the upside, the bulls will push the currency pair to the resistance levels at 1.1485 and 1.1660 to make a breakout of the current descending channel.