Since the start of this week, the EUR/USD has been trying to recover from its recent collapse, but the rebound attempts did not pass the 1.1383 level. With the continuation of negative pressure factors on the euro, the currency pair could not go further and settled around the 1.1317 level as of this writing. I expect it to remain in a narrow range until the US jobs numbers are announced tomorrow. The euro faces European restrictions to contain the new Corona variant, which may further slow the growth of the Eurozone economy and thus impede any attempts by the European Central Bank to tighten its monetary policy as desired by the rest of the global central banks in light of severe global inflationary waves.

The Forex market is torn between competing motives: global interest rate differentials, risk-taking and risk-aversion, and the latter will win according to HSBC. How well the battle itself is resolved could determine how the year ends for FX and whether the euro extends a nascent rally against the US dollar.

Accordingly, HSBC strategists say the price action in EUR/USD on Federal Reserve Chair Powell's remarks to US lawmakers on Tuesday "show that there is still a battle between RORO and forex spreads".

The US dollar jumped after Powell said the Fed may consider accelerating the easing of quantitative easing at its December policy meeting. A decision indicates that the US interest rate hike may be faster than the market expected. “The EUR/USD initially fell after these headlines on a record rate differential as the Fed is hawkish on an uptrend in the USD,” says Daraj Maher, FX analyst at HSBC.

But stocks fell as investors feared that the US Federal Reserve was withdrawing the easy liquidity that has fueled a boom in stocks since the 2020 Covid market crisis, ensuring that dollar gains are quickly restored as the market bought the euro again.

US Federal Reserve Governor Jerome Powell told the House Financial Services Committee that most economists view the current price increases, which have driven consumer inflation to its highest level in three decades, as a response largely to ongoing disruptions to supply and demand due to the epidemic. As Americans spend more time at home, they ramp up spending on furniture, appliances, and laptops. The increasing demand for such goods, along with a shortage of spare parts, has led to supply chain clashes and price hikes.

Technical Analysis

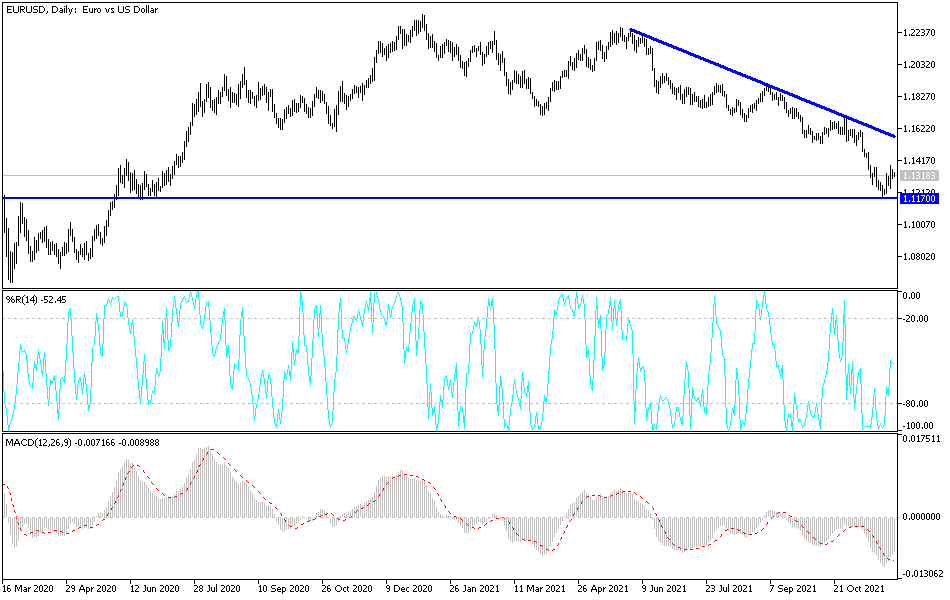

The general trend of the EUR/USD currency pair is still bearish, and stability aroun the 1.1300 support level will continue to support further movement downwards to the nearest support levels which are 1.1245, 1.1180 and 1.1090. On the upside, and according to the performance on the daily chart, the bulls need to move above the 1.1660 resistance, so that the chance of correction is stronger, otherwise the trend will remain bearish for a longer period.

Today, the Producer Price Index and the unemployment rate in the Eurozone will be announced. Then the number of weekly US jobless claims will be announced.