The euro is still suffering from weak investor sentiment and strong demand for safe havens. The EUR/USD continued to decline yesterday, as it tested the 1.1227 support level and settled around 1.1293 as of this writing. The Forex market avoided further collapse, but sentiment will appear cautious as long as COVID leads the world to closing policies that will hinder the path of global economic recovery.

“The year 2022 is likely to bring more recent history,” says Christopher Kejer Lumholt, senior analyst at Danske Bank. European institutions are following a negative policy for the euro in its fight against the Covid-19 virus, which will have negative repercussions beyond the Covid-19 crisis itself. The euro rebounded against the dollar until late November and early December, hailing a relentless slide since hitting a 2021 high of 1.2350 on Jan. 6.

The gains come as the region grapples with the COVID-19 wave, caused by the spread of a delta variant. More recently, the outlook has turned bleak as the Omicron variant begins to spread, amid fears that it is more virulent than its predecessor and avoids some vaccination defenses.

But the euro initially rose and markets fell as investors grappled with news of the new variant of the pandemic; although many analysts said the move was more about a question of removing positions from the market than any fundamental shift in the fortunes of the euro. However, the recent rebound is unlikely to continue towards the end of the year given a number of fundamental factors that It remain with the EUR/USD, say analysts at the Scandinavian Bank.

The euro's rise in 2020 - which came along with a broader recovery in "risk" assets - means it is becoming detached from fundamentals, says Danske Bank, and the 2021 slide is said to be part of a necessary correction that could extend into next year.

A hawkish Fed and a desire to acquire US stocks will be prominent factors that will lead to another year of outperformance for the dollar in 2022. Accordingly, Danske says that what appears to have contributed most to the “peak euro” at the beginning of the year was a similar fading away of peak credit supply in China, which in turn corresponds to a peak in upward revisions of global growth.

Technical Anaylsis

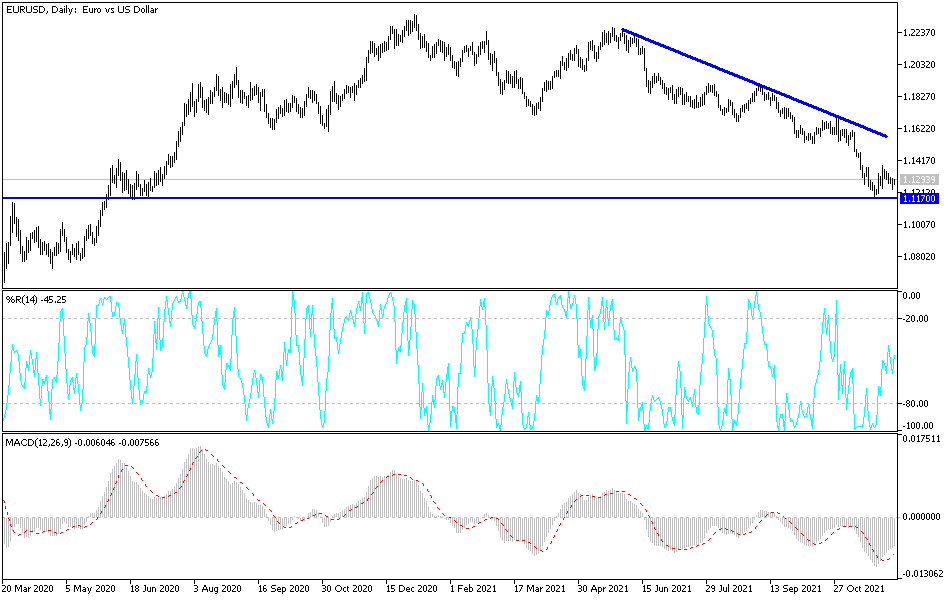

There is no change in my technical view of the EUR/USD currency pair, as the general trend is still bearish. The 100 SMA remains below the 200 SMA to confirm that the general trend has turned bearish and that the downtrend is more likely to resume than reverse. The gap between the indicators is widening to reflect increased selling pressure. Stability below the 1.1300 support opens for a move towards stronger bearish levels, the closest of which are currently 1.1220, 1.1180 and 1.1090. On the upside, according to the performance on the daily chart, the bulls must break through the resistance levels 1.1585 and 1.1640 to exit the current bearish channel.

The EUR/USD is not awaiting any important economic data from the Eurozone or the United States of America.