A temporary halt to the gains of the US dollar allowed the price of gold to stabilize around the $1791 resistance as of this writing. Since the beginning of this week's trading, the price of gold has been trying to recover from its decline to the $1,762 support, its lowest in a month. Gold still has the opportunity to rise as long as global concerns exist regarding the Corona variant and its negative impact on the path of global economic recovery, but what hinders gold from the strength of the US dollar is increasing expectations that the US Federal Reserve is close to raising US interest rates after its recent reduction of its purchases.

Real estate giant Evergrande is reported to be planning what could become China's largest-ever debt restructuring, sticking to all of its overseas commitments, as it set up a risk committee ahead of looming payment deadlines. The company's struggle to meet its obligations has fueled concerns about the real estate sector in China, which makes up a large part of the world's second largest economy. Grace periods for interest payments on an $82.5 million bond were due to expire on Monday - and could mark the company's first default.

Evergrande, the most prominent Chinese real estate company, plunged into crisis after Beijing launched a regulatory crackdown last year to curb speculation and pressure - cutting off a major avenue for access to cash. But there were indications that the government had begun to ease property restrictions.

Omicron cases have been confirmed in at least nine African countries, and some officials report initial cases appear to be mild. Countries that have reported omicron include: Botswana, Ghana, Mozambique, Namibia, Nigeria, Senegal, South Africa, Uganda and Zimbabwe. South Africa remains the epicenter of the Omicron outbreak, with experts saying the vast majority of the thousands of new cases daily are of the new type.

In East Africa, Uganda reported its first seven cases of Omicron on Tuesday. The type was detected in travelers from South Africa and Nigeria who arrived at Entebbe International Airport on November 29 and are currently in isolation, Charles Olaru, director of clinical services, said. Health experts there say early evidence suggests that Omicron is spreading faster, but symptoms at first appear to be mild.

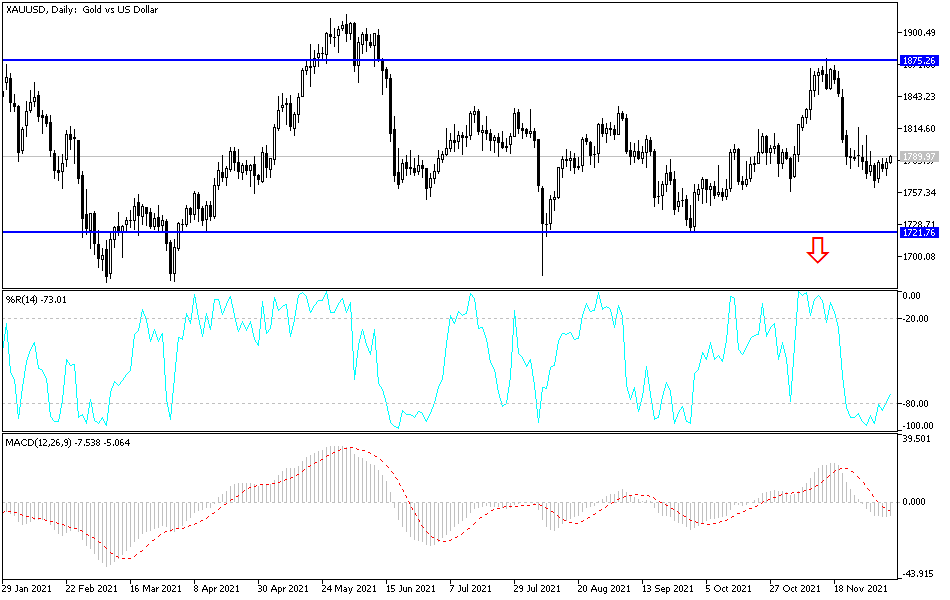

Technical Analysis

Gold is cautiously stable, and the psychological resistance of $1800 will remain crucial to maintain a bullish trend, because it may stimulate buying and move towards stronger resistance levels, the closest of which are $1819, $1828 and $1845 , which are the areas that strengthen the upward trend again.

On the downside, the $1775 support will remain the key to more downside momentum. I still prefer buying gold from every descending level, and the most appropriate buying levels are currently $1763, $1750 and $1738. The price of gold may remain subject to the announcement of US inflation figures and developments on the ground regarding the COVID variant. Today, I expect gold to move in narrow ranges.