Gold prices failed to maintain their recent gains, reaching the resistance level of $1815, then selling off to the support level of $1785, where it has settled as of this writing. Gold slipped as global stocks rebounded from losses in the previous session, buoyed by some encouraging earnings updates and a report from Moderna on the efficacy of a booster dose of a Covid-19 vaccine against the Omicron variant. Moderna announced that a booster dose of its Covid-19 vaccine increased levels of antibodies against Omicron. Moderna said the currently permitted 50-microgram booster increased levels of neutralizing antibodies against Omicron approximately 37-fold compared to pre-booster levels.

Also, the dollar's recovery after early weakness also affected the yellow metal. The US Dollar Index recovered, to 96.64, and the 10-year US Treasury yield rose to 1.48% from around 4.42%. US stocks rose strongly, recovering from the recent losses. The Dow is up about 1.53%, the S&P is up 1.63% and the Nasdaq is up about 2.15%.

Stock markets in Asia and Europe closed in positive territory, having rebounded well from the heavy selling in the previous session.

According to the Associated Press, "Much of the concern comes from Omicron, which federal health officials announced accounted for 73% of new infections last week, a nearly sixfold increase in just seven days." They also reported that “Centers for Disease Control and Prevention figures showed a nearly six-fold increase in the Omicron share of infection in just one week. It is even higher in most parts of the country. Omicron is responsible for an estimated 90% or more of new infections in the New York region, the Southeast, the industrial Midwest, and the Pacific Northwest. The national average indicates that more than 650,000 omicron infections occurred in the United States last week."

What is known about this new variant is that it is much more contagious than previous variants of the Covid-19 virus. However, although it is the predominant variant in the United States, leading virologists and the CDC have stated that much about this new variant remains unknown. The unknowns include whether or not this variant causes more or less serious disease once it is infected.

This leaves any potential economic downturn due to the virus unknown. As such it could be very supportive of gold assets as a safe haven, and put pressure on US stock markets until the end of the year and into 2022.

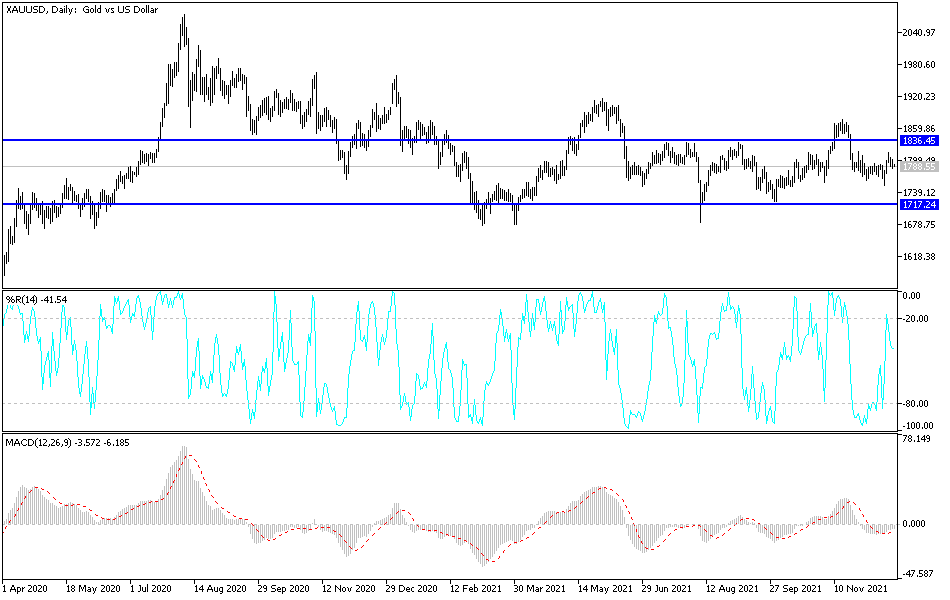

Technical Analysis

On the daily chart, the price of gold will move towards the neutral zone. It will have a bearish tendency if it moves towards the support level of $1775 because it brings the bears the impetus to move further downward. It may reach as far as the next psychological support at $1760. I still prefer buying gold from all descending levels. The gains of the US dollar impede the trends of gold from benefiting from the global concern over a rapid spread of the new Corona variant. On the upside, the $1800 psychological resistance will remain the most important for the bulls to control the trend.

The gold market will be affected today by the strength of the US dollar and the extent of risk appetite, as well as the reaction to the announcement of the economic growth reading for both Britain and the United States of America in the last trading sessions of the year.