Gold succeeded in launching towards the resistance level of $1820 this week, its highest in over a month, but the recovery of the US dollar yesterday caused rapid selling that pushed gold towards $1789 before settling around $1805 as of this writing. In general, gold prices are rising as 2022 approaches, with investors still assessing the impact of the Omicron variable and the increase in winter COVID cases. Meanwhile, the impact of inflation continues to weigh on capital markets. This allows gold to trade sideways instead of feeling the downward pressure of the big selloffs.

Recently, the city of Xi'an in China has become a major hotspot for the virus as the government seeks to curb rising cases with a travel ban. According to a Reuters report, Xian reported 150 new domestic coronavirus cases on Sunday, down slightly from 155 the day before, and officials warned that people who break travel or testing rules could face detention and fines.

This may help in a slight risk-taking mood for markets heading into the final days of 2021. Investors could add gold to help hedge the effects of the virus and market volatility despite the Dow Jones Industrial Average rising nearly 4% recently. And while the stock market is seeing a year-end rally so far, this has extended to gold. And according to some market analysts, this is simply equal to the natural cycle.

The gold situation was not helped by the US Federal Reserve in ending economic stimulus measures as bond purchases declined. The Fed has announced that it will see three rate hikes in 2022, which helps in the case of an upward trend in the dollar. Despite these headwinds, gold remained range-bound within a $1800 holding pattern instead of experiencing a sharp drop. It comes as more investors start brushing off the potential economic impacts of the Omicron variant on the notion that it will likely be less severe in terms of symptoms despite being more contagious.

Technical Analysis

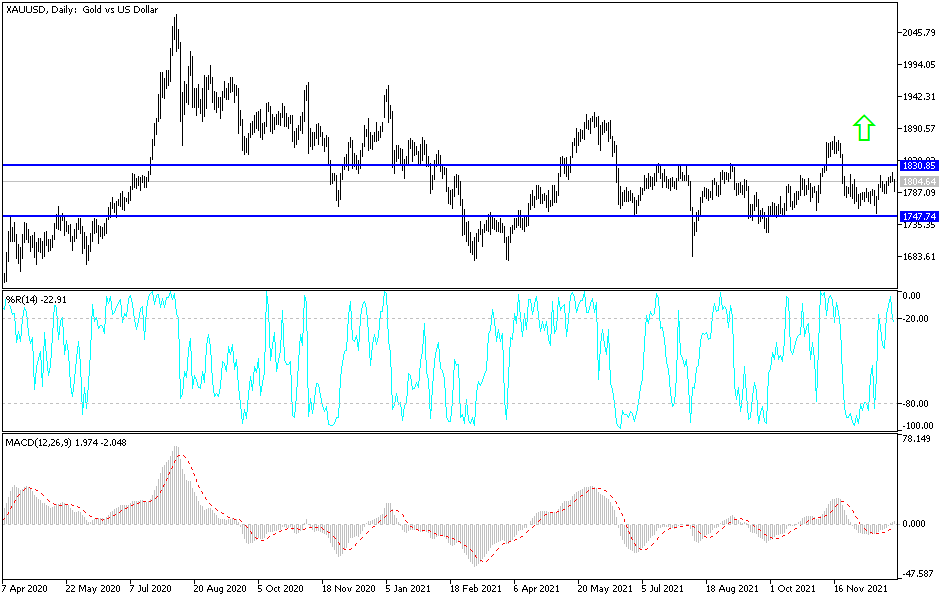

Yesterday's movements did not remove the price of gold from its bullish path, as the psychological resistance of $1800 is still crucial for the bulls to launch further. Stabilizing above it would open up for a mvoe towards higher resistance levels, the closest of which are 1818, 1827 and 1845. On the downside, this outlook will not change without the bears breaching the support level of $1,775. The expectations are indicated according to the performance on the daily chart below.

The price of gold will be affected today by the strength of the US dollar and risk appetite, as well as the reaction to the announcement of the number of US weekly jobless claims. Today's session is the most important for the conclusion of gold trading for the year 2021.