The price of gold fell strongly after the US Federal Reserve announced plan to end asset purchases and start with three interest rate increases in 2022. The price of gold fell to the level of $1753 and then quickly returned to the level of $1785 as of this writing, as the markets priced in exactly what was announced. Gold futures are struggling to maintain gains after the Fed announced plans to end its pandemic-era asset purchase program in March and begin raising interest rates three times in 2022.

Gold prices have fallen by more than 7% since the beginning of the year 2021 to date. As for silver, the sister commodity to gold, it also declined and reached the level of $21.645 an ounce. The price of the white metal has fallen by 19% this year.

The Federal Open Market Committee (FOMC) on Wednesday ended its two-day policy meeting in December. The rate-setting authority announced that it would accelerate its declining efforts and end the entire asset purchase program by March. The US central bank also expects three rate hikes next year to help curb 39-year high price inflation. The Fed is raising interest rates twice in 2023 and two more the following year.

At the Fed's press conference, Powell said he expects inflation to fall closer to the institution's target at the end of the year, adding that the Fed will use its tools to combat rising inflation if it becomes a constant component of the economy. Gold prices fell on the back of the dollar's strength as the US Dollar Index (DXY) rose to 96.86, and as you know, a stronger profit is bad for dollar-priced commodities as it makes them more expensive to buy for foreign investors.

US Treasury market yields were also stronger, with the 10-year bond yield rising to 1.474%. One-year yields rose to 0.287%, while 30-year yields rose to 1.856%.

In other metals markets, copper futures fell to $4.192 a pound. Platinum futures fell to $896.10 an ounce. Palladium futures fell to $1,559.50 an ounce.

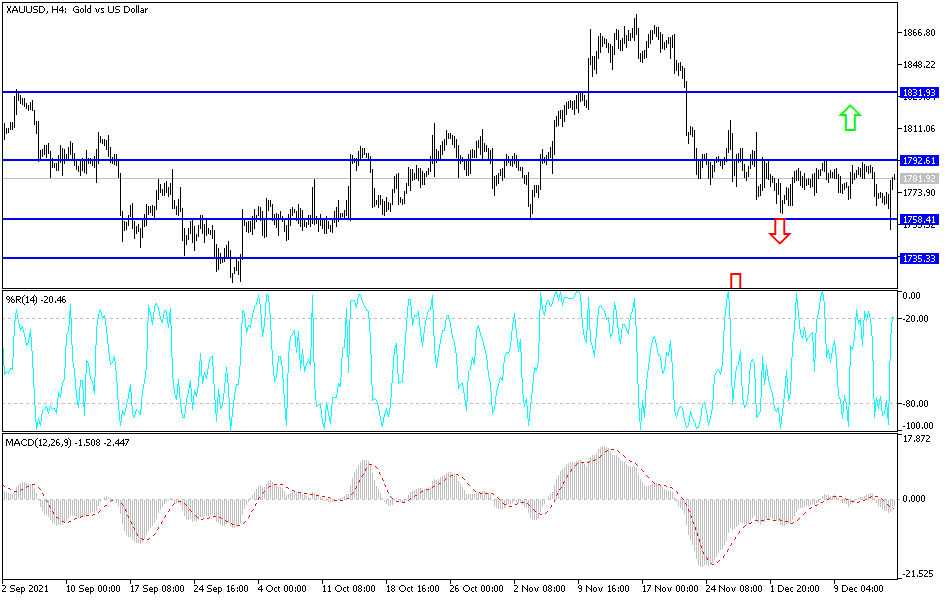

Technical Analysis

The current movement is important for the bulls, especially if the price of gold moves to test the psychological resistance of $1800. The performance on the daily chart is at an important level for bulls because it stimulates more buying of gold, and thus a move towards the resistance levels $1818, $1827 and $1845, which would confirm the strength of the bullish trend once again. On the other hand, unless gold gets enough momentum to move towards the $1775 support, expectations of a rise may evaporate temporarily, and gold will move to the $1752 support level it recorded yesterday after the US Federal Reserve’s announcement.

I still prefer buying gold from every bearish level.

The gold market will be affected today by the strength of the US dollar and the extent of risk appetite, as well as the reaction to the announcement of monetary policy decisions by the European Central Bank, the Bank of England and the Swiss Central Bank.