Gold futures remained stable at the end of trading last week, even with the turmoil in global financial markets. In Friday's session, the price of gold fell towards the support of $1766 and, after announcing the details of the US jobs report, found an opportunity to correct upwards to the resistance level of $1783, and to settle at $1786. Gold prices held steady after the disappointing US jobs report. In addition, with fears of the omicron variable and rising inflation fears making the headlines in this market, traders are holding on to gold.

Gold prices recorded a weekly loss of about 1.2%, which increases its loss since the start of the year 2021 to date, which is approximately 7%. As for the price of silver, the sister commodity to gold, it is still lower and silver futures contracts fell to $22,145. Accordingly, the white metal recorded a significant weekly decline of more than 4%, which raises its decline since the beginning of the year 2021 to date, to approach 17%.

On the economic side, according to the US Bureau of Labor Statistics (BLS), the US economy created a total of 210,000 new jobs in November, well below the average estimate of 550,000. This is also down from 546,000 jobs in October. The unemployment rate fell to 4.2%, beating market expectations of 4.5%. This is down from the 4.6% rate in the previous month. According to the results, the average hourly wage rose 0.3% to $31.03, the average weekly working hours increased to 34.8, and the labor force participation rate jumped to 61.8%.

On the other hand, investors are still afraid of the omicron variant, as traders await the latest updates from the World Health Organization (WHO) and countries around the world. In the United States, five cases of the omicron variant have been confirmed so far. The trend currently is that no deaths associated with the new COVID strain have been reported.

Although the US central bank has indicated that it could start tapering off its pandemic stimulus and relief program faster, which could raise interest rates faster, experts note that this could be a hard pill to swallow if the omicron begins to affect economies. “Of course, there are many factors to watch for gold at the moment but the fact that the central bank’s hands are tied means that the bad news around the Omicron variant may not be bullish,” Craig Erlam, chief market analyst at OANDA, said in a note to clients. "Unless, of course, the central bank prioritizes the economy over inflation that would be an enormous risk.”

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major rival currencies, rose to 96.35, and in general a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors. Also, the bond market was mostly down on Friday, with the benchmark 10-year bond yield dropping to 1.409%. One-year bond yields fell to 0.259%, while the 30-year bond yield rose to 1.735%. Weaker treasury yields are good for metals because they reduce the chance of holding non-yielding bullion.

In other metals markets, copper futures fell to $4.267 a pound. Platinum futures fell to $923.50 an ounce. Palladium futures rose to $1815 an ounce.

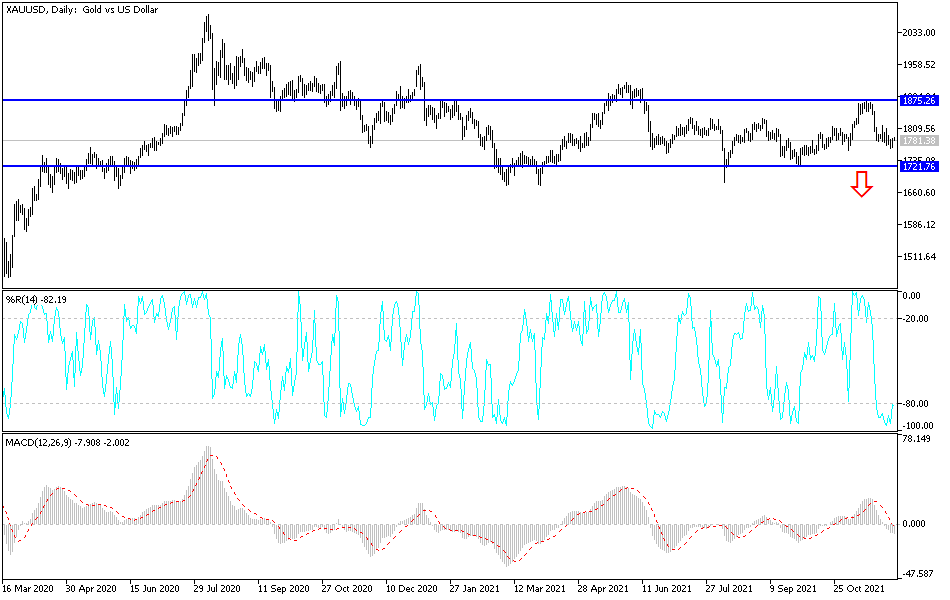

Technical Analysis

In the near term, and according to the performance on the hourly chart, it appears that the price of gold is trading within the formation of a descending channel. However, Friday's rebound pushed the yellow metal price above the 100-hour moving average, near the overbought levels of the 14-hour RSI. Therefore, the bulls will target profits for a breakout of the bullish channel around $1,792 or higher at $1,802. On the other hand, the bears will target pullbacks at around $1,773 or lower at $1,764.

In the long term, and according to the performance on the daily chart, it appears that the price of gold is trading within the formation of a sharp descending channel. This indicates a significant long-term bearish momentum in the market sentiment. Therefore, the bears will look to extend the current downtrend towards $1,752 or below to $1,723. On the other hand, the bulls will target long-term profits at around $1,814 or higher at $1,847.