Despite the state of optimism regarding the new COVID variant and risk appetite, gold prices rebounded higher, stable around $1811, near its highest in a month, amid the decline of the US dollar. Recently, various studies have indicated that the latest wave of the epidemic will be less economically harmful than the previous ones. In this regard, the two vaccine companies, AstraZeneca and Novavax Inc, said that their doses protect against Omicron. The new UK data indicated that it may cause relatively fewer hospital cases than the delta variant.

American consumers took a breather in November after a month of increased holiday spending, but that pause risks becoming more permanent if Americans pull back when faced with the fastest inflation in decades and an omicron variant. The US government figures were the focus of a wave of economic reports preceding the holidays which showed stronger orders for durable goods, increased new home sales and firm consumer confidence. There is a series of cross-currents underlying the spending figures. Many Americans, made headlines about crowded supply chains, began holiday shopping earlier than usual this year, which helped explain the strong progress the previous month.

But consumers are also facing the fastest inflation in decades. The personal consumption expenditures rate measure, which the Fed uses to target 2% US inflation, rose 0.6% from the previous month and 5.7% from November 2020, the highest reading since 1982.

The data comes on the heels of a hawkish trend by US central bank officials who have come under pressure to take action against rising prices. Accordingly, the Bank has announced that it will expedite the termination of its asset purchase program, and new expectations for interest rates indicate that policy makers favor an increase in borrowing costs by three quarters of a percentage point next year.

China's central bank pledged more support to the real economy and said it would make monetary policy more forward-looking and targeted. The People's Bank of China made the comments in a statement posted on its website on Saturday after a quarterly meeting.

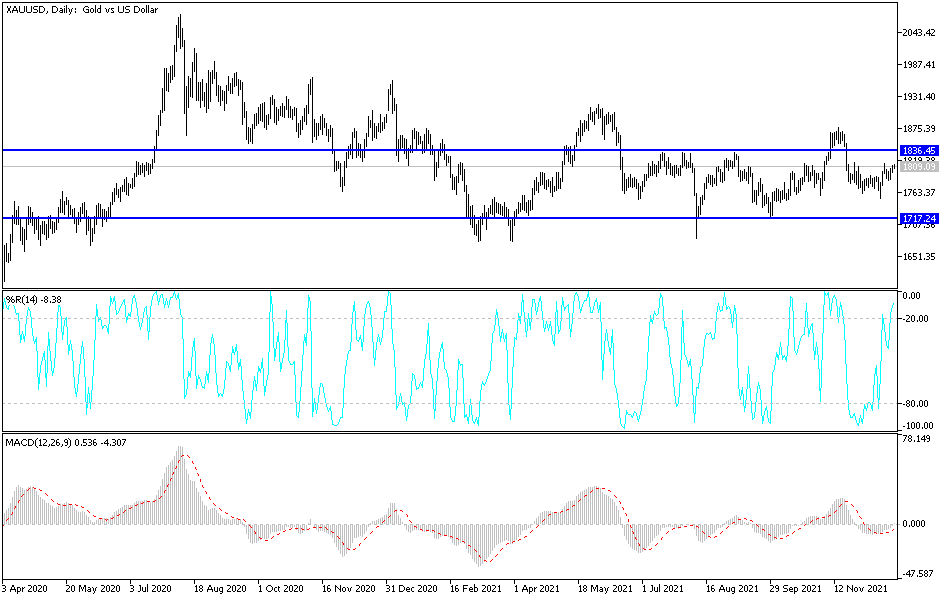

Technical Analysis

The stability of gold will remain around and above the psychological resistance of $1800, supporting the upward trend and movement towards stronger resistance levels, the closest of which are $1818, $1827 and $1845. These are important levels to support a bullish trend. On the other hand, the support level of $1775, according to the performance on the daily chart, will remain a threat to the expectations of an increase in the price of gold. Bearing in mind that the closing of many global financial markets for Christmas may affect the liquidity in the market and, accordingly, investors' desire for adventure. I still prefer buying gold from every bearish level.