Amid a temporary halt in the gains of the US dollar, gold found the opportunity to achieve gains yesterday, but they did not exceed $1794, instead settling again around $1775 as of this writing. The gold market, like the rest of the other global financial markets, is cautiously watching the developments of global concerns regarding the new South African COVID variant. It is being studied for the extent of its impact, and accordingly, investor sentiment has shifted. Currently, concern is alert amid monitoring. Countries were quick to impose restrictions so that things would not get out of control, as happened with the delta variable.

The gold price rebound came even though the value of the US dollar showed no direction. Currently, the US dollar index is almost unchanged. Gold may have benefited from its appeal as a safe haven amid heavy volatility on Wall Street, as US stocks have shown sharp volatility over the past few sessions as traders react to news related to the novel coronavirus variant.

Buying interest remained somewhat subdued, however, as investors also continued to digest comments from Federal Reserve Chair Jerome Powell hinting that the US central bank may be quick to scale back its bond purchases. And this is after the minutes of the November meeting revealed last week that a number of US interest rate setters at the Federal Reserve already believed that it might become necessary for the bank to accelerate the pace of ending its quantitative easing program in the coming months even before revealing that the rate of inflation in the US It exceeded six percent in October.

As a result, investors and analysts were quickly convinced that the Fed was likely to announce such steps as soon as it met in December with the goal of working itself into a position in which it could start raising US interest rates much earlier in 2022 than it had previously. .

Economists now expect the FOMC to accelerate the pace of quantitative easing reduction and end the process in mid-March. They also now expect three US interest rate increases of 25 basis points next year instead of twice (in June, September and December, compared to July and November previously), and a pace of twice a year thereafter.

Overall, the threat of an early rate hike by the Federal Reserve supports the US dollar.

A report released by the payroll processor ADP showed that US private sector employment increased slightly more than expected in November. The ADP said that employment in the private sector jumped by 534,000 jobs in November after rising by a revised 570,000 jobs in October. Economists had expected US private sector employment to jump by 525,000 jobs, compared to an addition of 571,000 jobs originally reported for the previous month.

Nella Richardson, chief economist at ADP, noted that "it is too early to tell whether the alternative Omicron can slow the job recovery in the coming months."

The Institute for Supply Management released a separate report showing manufacturing activity grew at a slightly faster rate in November. The ISM said its manufacturing PMI rose to 61.1 in November from 60.8 in October, and any reading above the 50 level indicates growth in the sector. Economists had expected the index to reach 61.0.

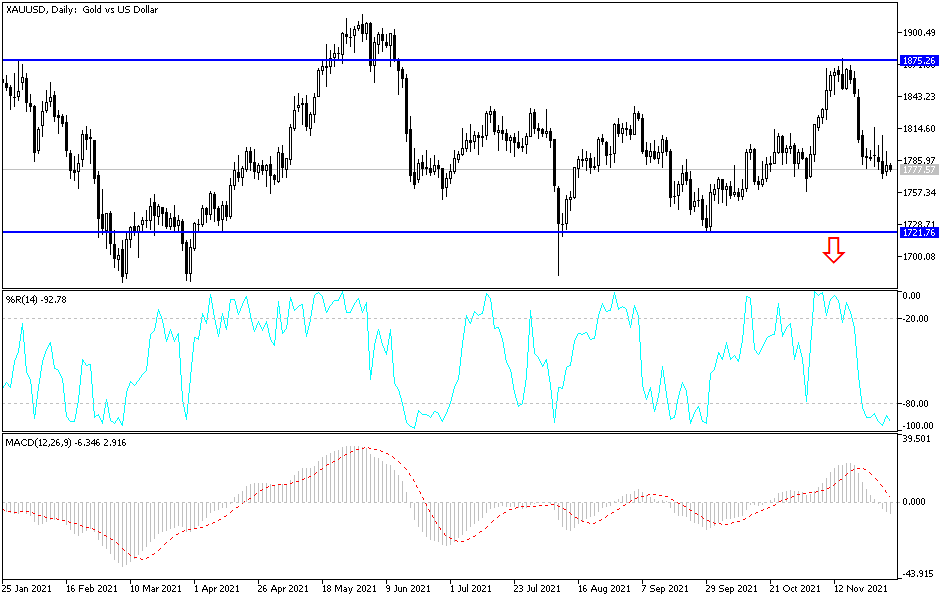

Gold Technical Analysis

Stability below the psychological resistance of $1800 still supports the bearish shift in the price of gold. A move towards the support level of $1775 will support the strength of the bears to move towards stronger support levels, the closest of which are $1760, $1745 and$1725. These levels are enough to push the technical indicators towards oversold levels, and I still prefer buying gold from every descending level. On the upside, it is necessary to settle above the psychological resistance of $1800, because it stimulates buying again.