Yesterday's session was exciting for the gold market, as prices jumped to the level of $1809, but soon were sold off to the $1770 support level. The US dollar trimmed some losses after Federal Reserve Chairman Jerome Powell indicated that the US central bank had accelerated monetary policy tightening. The price of gold is stable around the level of $1788 as of this writing.

Jerome Powell told the Senate committee that he believes reducing the pace of monthly bond purchases could move more quickly than the $15 billion timeline announced earlier this month. Gold prices rose earlier in the day as stocks tumbled amid growing concerns about the new variant of the coronavirus after Moderna CEO Stefan Bancel expressed concerns about the effectiveness of current vaccines against the newly identified variant of Omicron.

Silver futures ended trading as low as $22.815 an ounce, while copper futures settled at $4.2800 a pound.

Jerome Powell's comments pointing to acceleration of tapering come as he told the Senate Banking Committee that the recent rise in new Covid-19 cases and the emergence of the Omicron variant poses downside risks to employment and economic activity and heightened uncertainty over inflation. "Bigger concerns about the virus could reduce people's desire to work in person, which would slow progress in the labor market and increase supply chain disruptions," Powell said. The possibility of intensifying disruptions in the supply chain comes as Powell noted that the pandemic-related supply and demand imbalances have already contributed to marked price increases in some regions.

The MNI released a report showing a slowdown in the pace of business growth in the Chicago area in November. The report said that the Chicago business gauge fell to 61.8 in November from 68.4 in October, although the reading above 50 still indicated growth. Economists had expected the business gauge to fall to 67.0. Meanwhile, another report showed US consumer confidence deteriorated in November. According to the results, the index fell to 109.5 in November from 111.6, revised downward in October. Economists had expected the index to fall to 110.7 from 113.8 originally reported for the previous month.

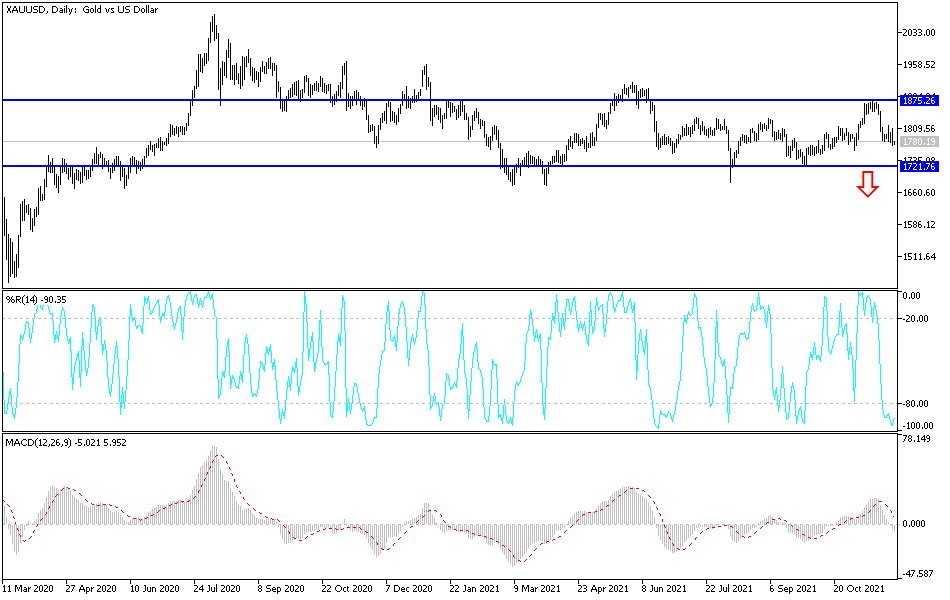

Technical Analysis

The price of gold still approaching the $1775 support level provides enough momentum for the bears to control the general trend of gold, so expect more testing of support levels, the closest of which are $1763, $1750 and $1725. It is enough to push the technical indicators towards strong oversold levels. On the other hand, and as I mentioned before, stability will remain above the psychological resistance of $1800, which is important for the bulls because it motivates gold investors to think about buying and returning to the bullish channel that it abandoned since the middle of last month’s trading.

I still prefer buying gold from every bearish level. The gold price will be affected today by the strength of the US dollar and the extent of risk appetite, as well as the reaction to the announcement of the ADP reading to measure the change in the number of US non-agricultural jobs and new statements from Fed Chairman Jerome Powell.