Gold futures rose this week, violating the general bearish trend that dominates global financial markets. The price of the yellow metal is recording tepid weekly gains, as it attempts to break the $1800 psychological resistance barrier. The price of gold is stable around the level of $1787 as of this writing. Gold prices rose 0.6% last week, but are still down about 6% since the beginning of 2021. The price of silver, the sister commodity of gold, has recently reversed its losing streak, rising to $22.35. All in all, the price of the white metal fell 0.2% last week, adding to its 2021 decline of 15.75%.

Gold prices rose yesterday ahead of this week's important Federal Reserve monetary policy meeting. The precious metal found some support over the past week, but failed to surpass the $1,800 high, despite factors to its gains. Accordingly, market analysts say that it will be difficult to determine any momentum for gold towards the end of the year.

In this regard, Cray Erlam, chief market analyst at Oanda, said in a market update: “If the price of gold manages to break above $ 1,810, it may gain some momentum to the upside, but I find it difficult to see that before the Fed’s decision on Wednesday. And then it comes to the question of what the gold bulls want to see from the meeting. Not accelerating to shrink? Opposition to higher interest rates? and others. And I'm not sure we'll see any of those.”

While most do not expect the US central bank to raise interest rates at this month's policy meeting, financial experts from the Federal Open Market Committee (FOMC) are preparing to raise rates earlier than expected. This could be bad news for gold as the price environment increases the opportunity cost of holding non-yielding bullion. Meanwhile, gold may find some additional support from the UK to confirm that its first death with the Omicron variant is accelerating across the developed world. In the United States, at least six states have reported Omicron infections.

US Treasury market bond yields have been declining. With the 10-year bond yield dropping to 1.416%. One-year bond yields fell 0.011% to 0.251%, while 30-year yields fell to 1.806%. Also, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, rose to 96.26, from opening at 96.09. A strong US currency gain is bad for dollar-priced commodities because it increases the cost of buying them for foreign investors.

In other metals markets, copper futures settled at $4.2835 a pound. Platinum futures fell to $926.60 an ounce. Palladium futures fell to $1,691.00 an ounce.

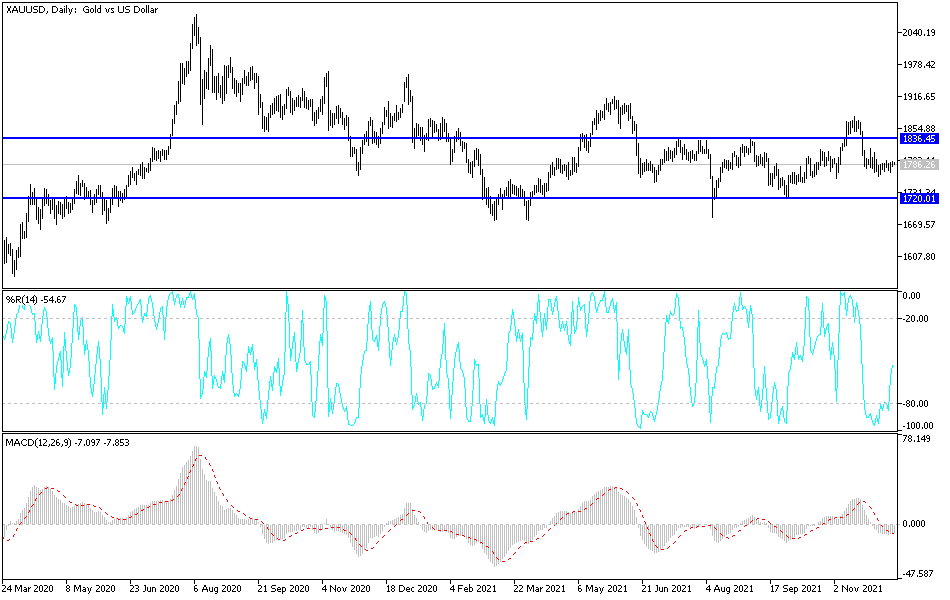

Technical Analysis

The psychological resistance of $1800 is still crucial for gold bulls to launch higher and change the bearish outlook that dominated the gold market in the recent period, as the price of the yellow metal fell to the support level of $1762 at the beginning of this month’s trading. The psychological high of $1800 dollars will increase buying and a move towards stronger resistance levels at $1819, $1828 and $1845. This is especially true if the US Federal Reserve disappoints investors this week.

On the downside, and as I mentioned before, a move below the $1775 support level will remain vital for a bearish outlook and trend.