Global geopolitical tensions pushed investors to buy gold, which rose to the $1793 resistance before settling around $1783 as of this writing. Contributing to investors' appetite for safe havens were fears of escalating tensions between the United States and Russia over Ukraine.

After a tense two-hour summit, the United States said it was preparing a "strong response" to fears of a Russian invasion of Ukraine. Investors also watched the latest developments in China's real estate sector after troubled Evergrande failed to make overseas debt payments within a grace period. In another development, shares of Chinese property developer Kaisa Group Holdings have been suspended in Hong Kong, sparking fresh concerns about a possible default.

On the Covid-19 front, Pfizer CEO Albert Borla said this week that the Omicron variant appears to be milder than previous strains, but also appears to be spreading faster and could lead to more mutations in the future. However, South African scientists cautioned that the variable cutoff significantly protects against antibodies generated by the Pfizer and BioNTech vaccines.

Scientists don't yet know how much of a threat the omicron variant really poses. Currently, the highly contagious delta variant is responsible for most cases of COVID-19 in the United States and other countries. But the omicron variant, discovered late last month, carries an unusually high number of mutations and scientists are racing to see how easily it can spread, whether it causes more serious or milder disease than other types of coronavirus — and how well it can be avoided.

Pfizer's findings, which were announced in a press release, are preliminary and have not yet been the subject of scientific review. But it is the first from a vaccine maker to examine whether the booster doses health authorities are urging people to get might actually make a significant difference. Scientists have speculated that the high jump in antibodies that comes with a third dose of COVID-19 vaccines may be enough to counteract any decline in efficacy.

Pfizer and BioNTech are already working on creating an omicron vaccine in case it is needed.

Also, British drugmaker GSK said its antibody-based treatment for COVID-19 with US partner Vir Biotechnology (VIR.O)) is effective against all mutations in the Omicron variant.

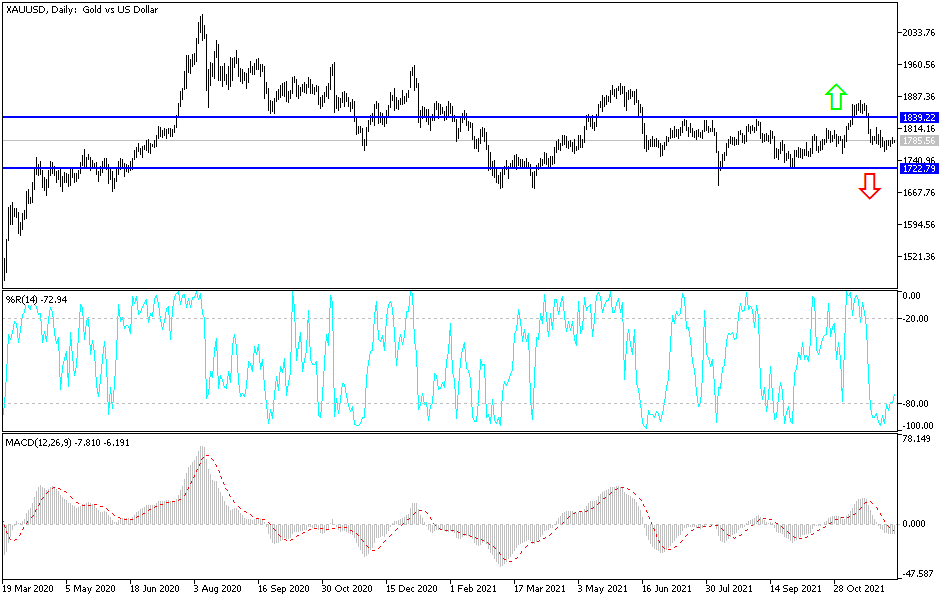

Technical Analysis

I still see that the psychological resistance of $1800 is crucial for the gold market to become bullish again. This resistance, as I mentioned before, stimulates buying, which contributes to a bullish price explosion, especially if the gains of the US dollar stop. There are many factors that contribute to the purchase of gold, including global geopolitical tensions and fears of impeding the global economic recovery from COVID variants. Once the resistance is breached, we may see stronger ascending levels, the most important of which are $1819, $1828 and $1845. On the downside and according to the performance on the daily chart, the $1775 support is still vital for the bears to move further downwards. I still prefer buying gold from every descending level.