Gold futures are trading in a relatively stable performance with a bearish bias as gold moved towards the $1,776 support level before settling around $1,782 as of this writing. According to recent trading, the rebounding stock market and the rise of the US dollar affected the yellow metal. With early data suggesting that the Omicron variant isn't as serious as many had feared, investors were hitting the "buy" button across the stock market. In the last few weeks of trading, generally, gold prices began to exit a weekly loss of about 0.1%, in addition to its decline since the beginning of the year 2021 to date by more than 6%.

Silver, the sister commodity to gold, is retreating at the start of this week's trading, as silver futures fell to $22.31 an ounce. The price of the white metal fell more than 2% last week, intensifying its decline since the start of the year 2021 to date to nearly 16%. Investors were excited about the news that the worrisome Omicron variant was not as serious as many were initially concerned about. While it appears to be more contagious, it is not more deadly. This led to a massive rally in the financial markets, with major benchmark indices posting notable gains.

Moreover, the possibility of higher interest rates and Fed monetary policy will likely affect gold prices as well.

All eyes will be on US inflation figures on Friday. The market sets an annual inflation rate of 6.7% for the month of November. And if the forecast is accurate, the consensus is that a sharp CPI will support gold prices. Meanwhile, the strength of the dollar is affecting gold prices. The US dollar index (DXY), which measures the performance of the dollar against a basket of six major competing currencies, rose to 96.33, and the rise in the value of the dollar is bad for commodities priced in dollars because it makes them more expensive to buy for foreign investors.

On the other hand, affecting the gold market, US Treasury yields also rose on Monday, with 10-year yields rising to 1.426%. One-year yields rose to 0.264%, while 30-year yields advanced to 1.754%. A higher yield for Treasury bonds is a downward trend for metals because it raises the opportunity cost of holding non-yielding bullion.

Relative to the prices of other metals, copper futures rose to $4.309 a pound. Platinum futures rose to $936.80 an ounce. Palladium futures jumped to $1,848.00 an ounce.

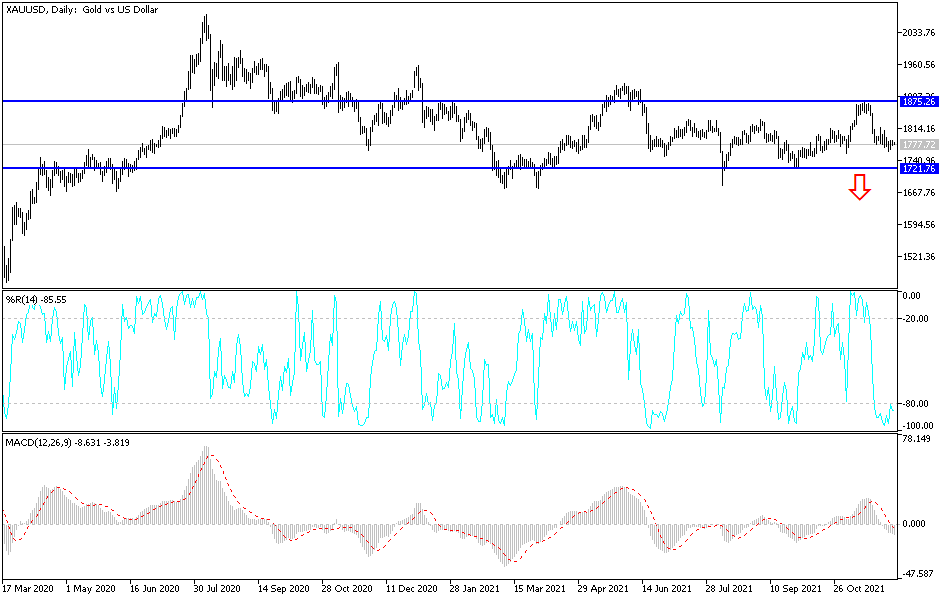

Technical Analysis

Gold is being cautiously stable, waiting for any news or catalyst. The psychological resistance of $1800 will remain crucial for the bulls to control the performance, because it may stimulate buying, and therefore move towards stronger resistance levels, the closest of which are $1819, $1828 and $1845, which are the areas that strengthen the bullish trend. On the downside, the $1775 support will remain the key to more downside momentum. I still prefer buying gold from every descending level, and the most appropriate buying levels are currently $1763, $1750 and $1738. The price of gold may remain subject to the announcement of US inflation figures and developments on the ground regarding the COVID variant.