Gold futures posted modest gains at the end of the trading week amid the US annual inflation rate rising to its highest level in nearly 40 years. Gold prices struggled to stay in positive territory last week as financial markets now prepare for Federal Reserve Board decisions to act on high price inflation. The price of gold rose by $1789 before settling around $1785 at the beginning of this trading week. In general, gold prices have stabilized almost during the past week, leaving its loss since the beginning of the year to date at about 6%.

In the same way, silver, the sister commodity to gold, is back above $22 by the end of last week. Silver futures rose to $22.175 an ounce. The metal is still ready for a weekly decline of about 1.7%, adding to its decline since the start of the year to date by about 17%.

According to the Bureau of Labor Statistics (BLS), the US Consumer Price Index (CPI) rose 6.8% year over year in November, up from 6.2% in October. This was the highest reading since 1982. On a monthly basis, the inflation rate rose by 0.8%. Core inflation, which excludes the volatile energy and food sectors, rose at an annualized rate of 4.9% last month. The monthly core inflation rate also jumped by 0.5%. Rampant price inflation was seen across the board, with food and energy prices up 6.1% and 33.3%, respectively.

The expectation now is that the Fed will raise US interest rates earlier than previously expected to crush inflation. But the central bank is threatening the post-COVID economy by pulling the trigger to raise interest rates. Commenting on the outlook, Jeff Klerman, portfolio manager at GraniteShares, said: “The very aggressive Fed, which is working to combat inflation, may also adversely affect economic growth causing stock prices (and other assets) to fall, providing support for gold prices.”

The US bond market was lower across the board, with the 10-year bond yield dropping to 1.47%. One-year bond yields fell to 0.254%, while 30-year Treasuries fell to 1.865%. Lower returns are usually better for metals because it reduces the opportunity cost of holding unproductive bullion. Gold prices also benefited from the weak dollar. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major rival currencies, fell to 96.01, from an opening at 96.27. The DXY is on track for a weekly decline of about 0.11%. The lower price is a good thing for dollar-denominated goods because it makes them cheaper to buy for foreign investors.

In other metals markets, copper futures fell to $4.287 a pound. Platinum futures fell to $933.90 an ounce. Palladium futures fell to $1,748.00 an ounce.

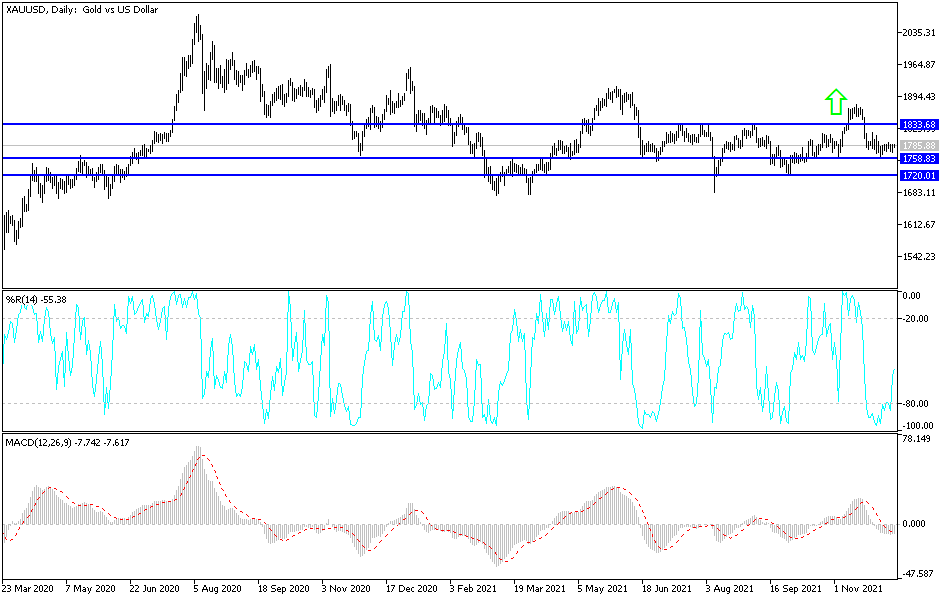

Technical Analysis

In the near term, and according to the hourly chart, it appears that gold is trading within the formation of a neutral channel. However, gold rose recently to trade near the overbought levels of the 14-hour RSI. Therefore, the bulls will target a potential channel breakout around $1,792 or higher at $1,802. On the other hand, the bears will target short-term profits at around $1,774, or lower at $1,764.

In the long term, and according to the daily chart, it appears that gold is trading within the formation of a sharp descending channel. This indicates a strong long-term bearish momentum in the market sentiment. As a result, gold fell near the oversold levels of the 14-day RSI. The bears will target long-term earnings at around $1,753, or lower at $1,724. On the other hand, the bulls will target long-term profits at around $1,812 or higher at $1,841.