The NASDAQ 100 pulled back a bit on Tuesday as Jerome Powell has done everything he can to wreck the markets. Speaking in front of Congress, he suggested that inflation was no longer “transitory”, which is quite convenient now that the Federal Reserve members are no longer able to day trade the equity markets. While I may sound a little bit cynical, this is exactly what has been going on in America. We have seen this game played by the Federal Reserve where they say or do something to wreck the markets, but the next day they come back to make Wall Street happy again. As news came out that various members were actively trading million-dollar positions, suddenly everything became a little bit clearer.

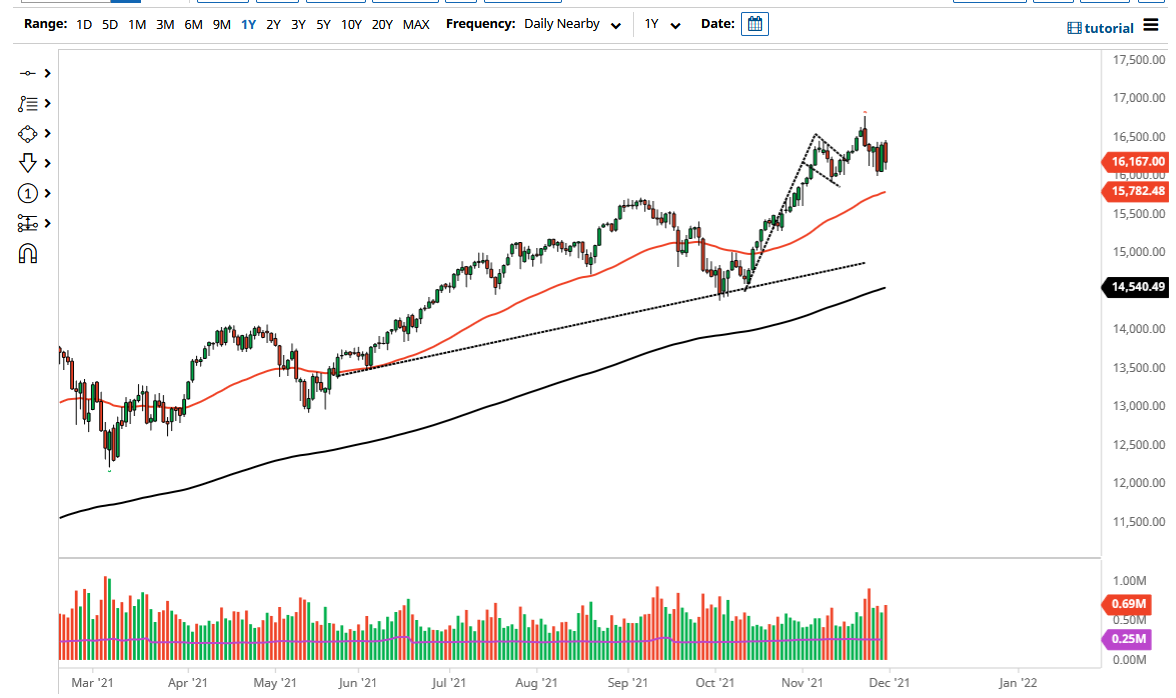

The real question is now that they are no longer allowed to do that, what will the markets do? They will not necessarily be doing everything they can to stoke Wall Street higher, which explains a lot of their actions over the last 13 years. That being said, we still have the Santa Claus rally to pay attention to going forward, as money managers will simply have to do something in order to try to make some type of return. I think we are still stuck in that phase, and even though we sold off quite drastically, it is worth noting that the market stayed within the previous range. Having said that, it was as soon as he started speaking that the markets fell apart.

Keep in mind that Jerome Powell is a huge private equity guy who has made over a hundred million dollars trading. In other words, he knows what he is doing and what it will do to the markets. It is interesting that he behaved like this during the day, which is a complete turnaround from what he had generally been for so long. The question now is that if the Federal Reserve is mentioning inflation, has it gotten out of control? It is interesting, because when you watch the rate of change when it comes to inflation, it looks as if it is getting close to peaking. With that being said, we can only go with the trend, which is to the upside, but be aware of the fact that a break below the 16,000 level could offer more selling pressure.