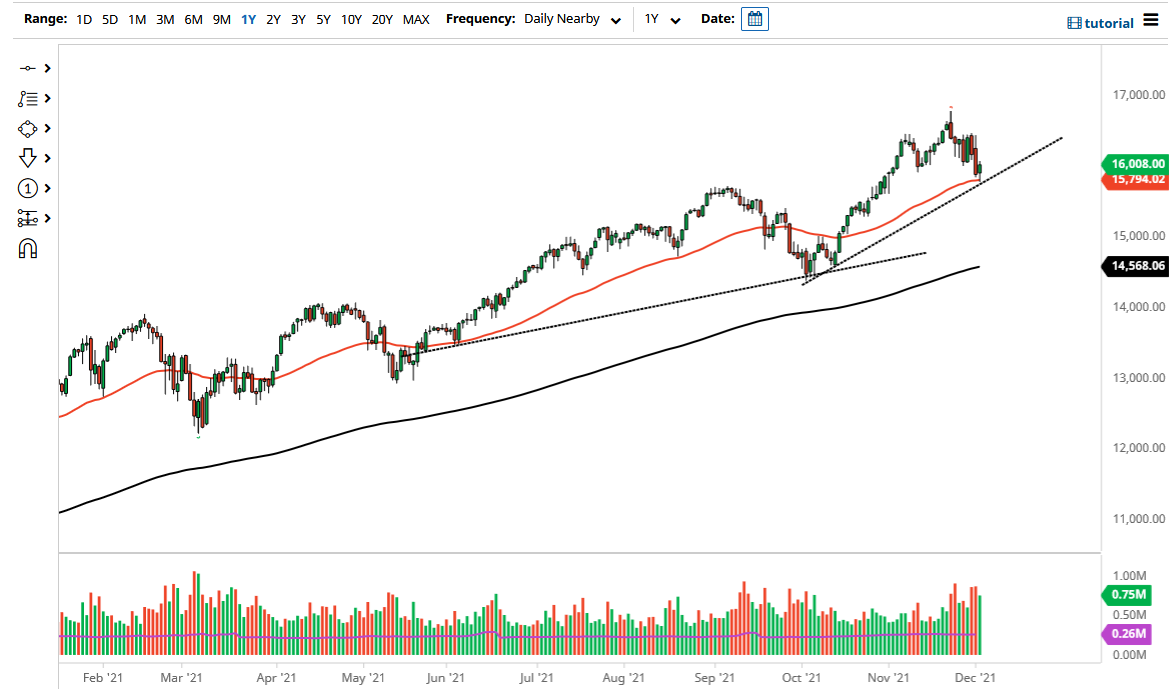

The NASDAQ 100 fell during trading initially on Thursday, only to turn around and show signs of strength again. The resulting candlestick was a bit of a hammer, sitting right on top of the 50 day EMA as well as the uptrend line. The 15,800 level seems to be of interest, and of course we have been a bit oversold over the last couple of days. However, the most important thing to pay attention to is the fact that the Friday session is of course going to be a major session, due to the fact that the Non-Farm Payroll numbers are coming out.

The uptrend line of course has to be paid close attention to, so if we were to break down below it, it is possible that the market could go down to the 15,500 level. That being said, I still think there are plenty of buyers out there that will pick this market. That being said, I think that the value hunters will continue to come back into this market, due to the fact that it is the end of the year, and a lot of people are out there chasing returns to show their clients.

To the upside, I believe that the 16,400 level is an area that I think a lot of people would have to pay close attention to, as it had previously been resistive. The market is likely to continue seeing that as an area of resistance but given enough time I fully believe that the market breaks out and goes higher. At that point, the market will more than likely go to all-time highs and beyond. I think that every time we dip there will be plenty of people willing to take advantage of value, as the NASDAQ is in such a strong uptrend. The last couple of days have been a bit of an overreaction to the latest coronavirus care, so that being said it is likely that we have a bit of a significant correction as word gets out that the omicron version of coronavirus is not as bad as previously thought. If that is going to be the case, then I think stock markets have much further to go to the upside over the next several days. Keep in mind that Friday is the jobs number, so the volatility will be a real threat.