The NASDAQ 100 initially tried to rally on Wednesday but gave back the gains to crash back down towards the lows of the previous couple of days. The market looks as if it is trying to figure out whether or not we have enough momentum to continue going higher, and the fact that the jobs number comes out on Friday is probably what most people are focusing on now. After all, Jerome Powell is out of the way.

During the session on both Tuesday and Wednesday, Jerome Powell had been speaking in front of Congress, and surprised the market due to the fact that he said it was time to retire the word “transitory” when it comes to inflation. In other words, that was a relatively hawkish statement coming from the Chairman. On Wednesday, he did very little to correct that position, as he testified in front of the House of Representatives. This had people running for cover, because they do not know how to trade without cheap money.

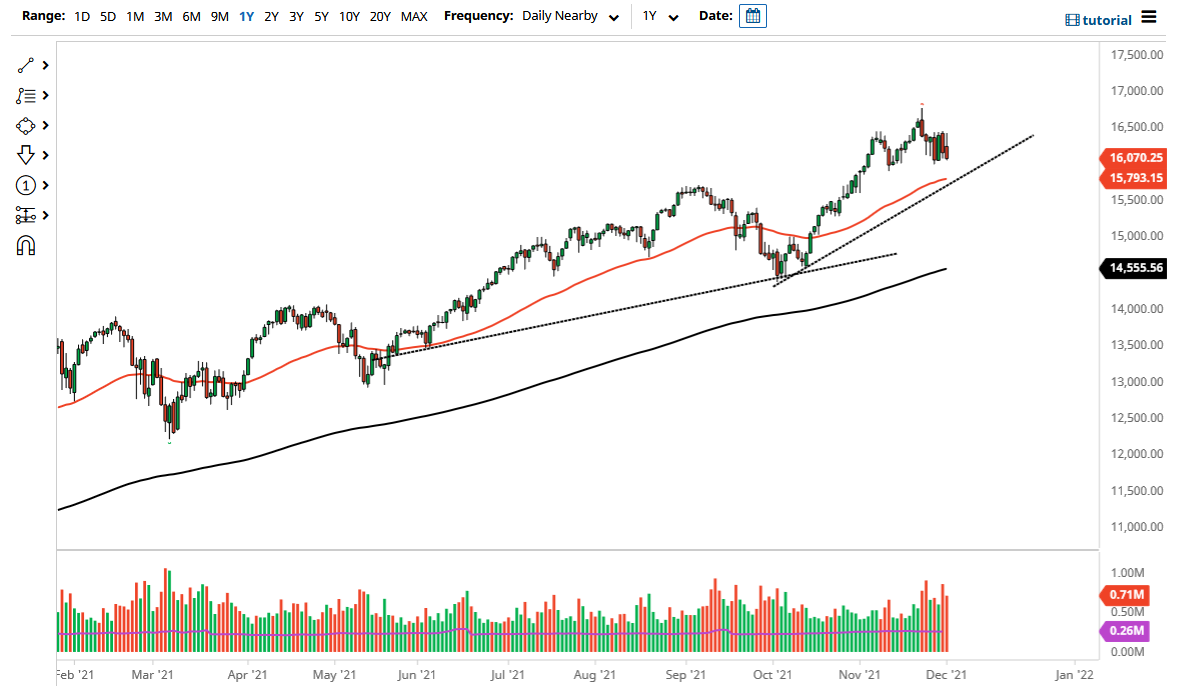

The market giving up the gains the way it had is very negative, but at the end of the day, we are still very much within the overall consolidation area. If we break down below the lows of the last couple of days, it is likely that we could go looking towards the uptrend line. The 50 day EMA sits just above there as well, so I do think there are buyers in that general vicinity. Ultimately, this is still a “buy on the dips” type of market, as we have seen so much in the way of upward pressure over the longer term.

If we do turn around and break above the 16,500 level, then the market is likely to go much higher. If we can break above there, then we will simply continue to see the uptrend come into play. The jobs number will have a major influence on what happens next, but Thursday is going to be very quiet more than anything else. I think we will probably go back and forth in a relatively choppy range for the next 24 hours, but eventually we will get an idea as to how the employment situation is in America on Friday morning. Ironically, this may be a “bad news is good news” type of scenario for the market.