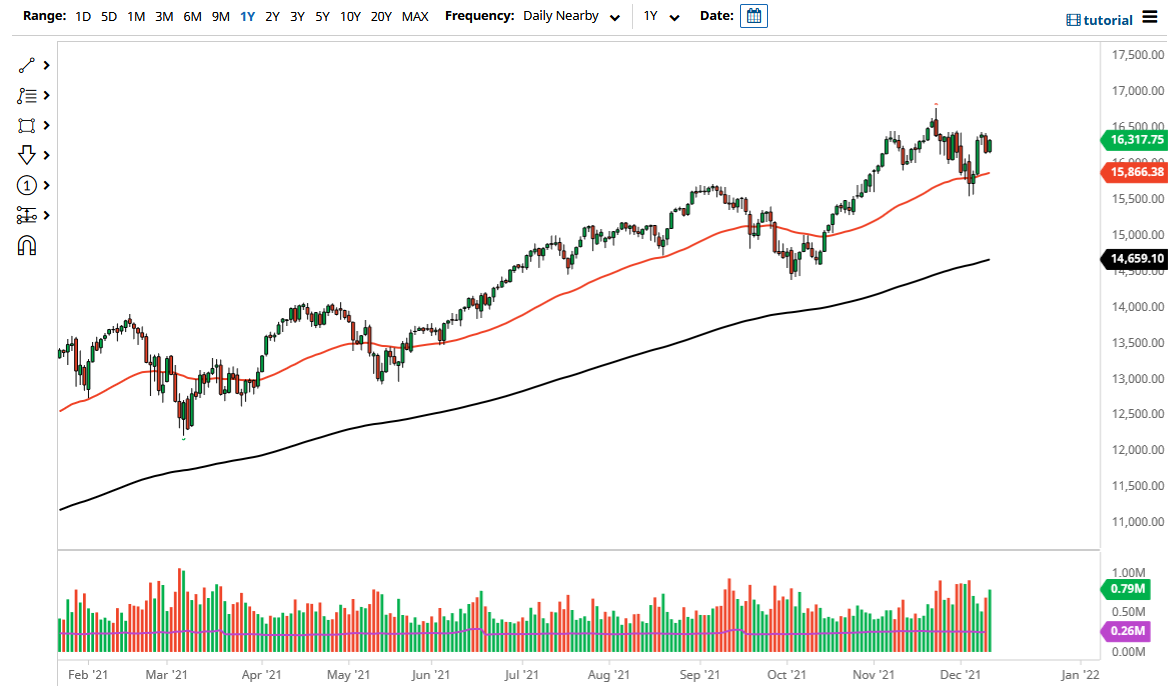

The NASDAQ 100 recovered quite nicely on Friday as we have seen the market show signs of life yet again. In fact, if you look at the chart, you can see that we might be forming a little bit of a bullish flag. Breaking above the 16,500 level would almost certainly send this market higher, as we have seen that area be so resistive. Breaking above that allows us to go looking towards the all-time high at the very least.

Keep in mind this time of year we do tend to see a lot of buyers come in and try to pick up value and make returns for clients out there if they have missed their benchmarks. With that in mind, it is probably only a matter of time before any dip gets bought all the way down to the 50 day EMA which is currently sitting at the 15,876 level. On the other hand, if we simply take off to the upside it is likely that we will see the market go looking towards its all-time highs almost immediately, and breaking that level would allow the NASDAQ 100 to go looking towards the 17,000 handle.

The NASDAQ 100 is highly sensitive to just a handful of stocks, not the least of which would be Amazon, Tesla, and Microsoft. If those markets rally, then typically this index will move right along with it. I do not have any interest in shorting this market regardless, and I think that any pullback at this point in time should be thought of as more or less a gift. The 15,000 level underneath should be the “floor in the market”, especially now that the 200 day EMA is reaching towards it. As long as we can stay above there, I think there will be plenty of value hunters assuming that there is even an attempt to break down to that level. This is the wrong time of year to think about shorting, and shorting US indices is a fool’s errand to begin with. If we break down below the 200 day EMA I might be convinced to buy puts, but I do not necessarily think that is likely to happen anytime soon.