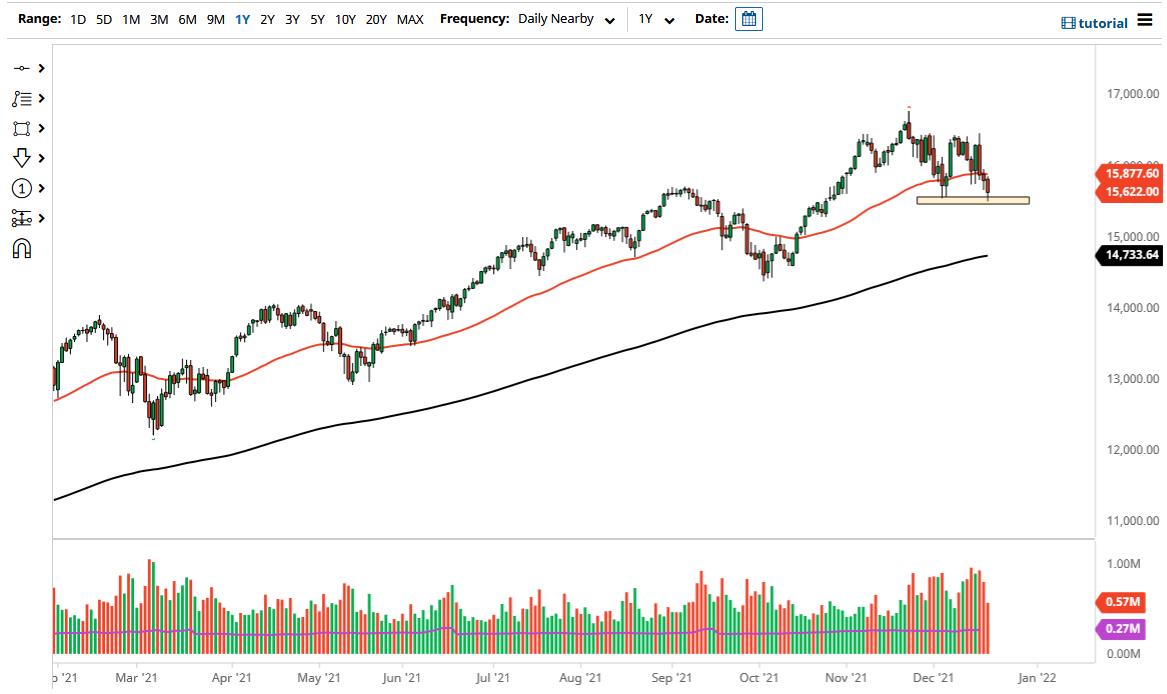

The NASDAQ 100 fell significantly on Monday, reaching down towards the 15,500 level. That being said, we have bounced just a bit towards the end of the day, so it looks like we are trying to hang on to some semblance of stability. At this point, we are heading towards the end of the year, so I do think that liquidity is going to be an issue, and we could see sudden moves. If we break down below the 15,500 level, then it is likely that we could make a move down towards the 15,000 level, which is a large, round, psychologically significant figure, and also features the 200-day EMA racing towards it.

That being said, it certainly looks as if the market is trying to hang on to the consolidation area that we have been in, but it must be noted that we have tested this support level multiple times, and it suggests that somebody out there is trying to break the market down. Even if they do, I think it is not until we break down below the 15,000 level that I would be a buyer of puts. In general, this is a market that I think is going to be noisy, but as far as buying is concerned, I would probably need to see this market break above the highs of the session on Monday, and at that point I might be willing to get long.

On that move, I would anticipate that we could go looking towards the 16,500 level, but quite frankly I do not know that you can count on much due to the fact that we are at the end of the year, so with this being the case it is likely that you are going to be better off trading smaller positions, due to the fact that the lack of liquidity could throw this market around. The noisy behavior will continue, and we will not have anything close to a normal market until we get into the second week of January. That being said, be very cautious about jumping into the market with a huge position. I am more likely than not to trade smaller positions in more of a back-and-forth type of action. Quite frankly, most bigger traders that I know are already gone for the holidays.