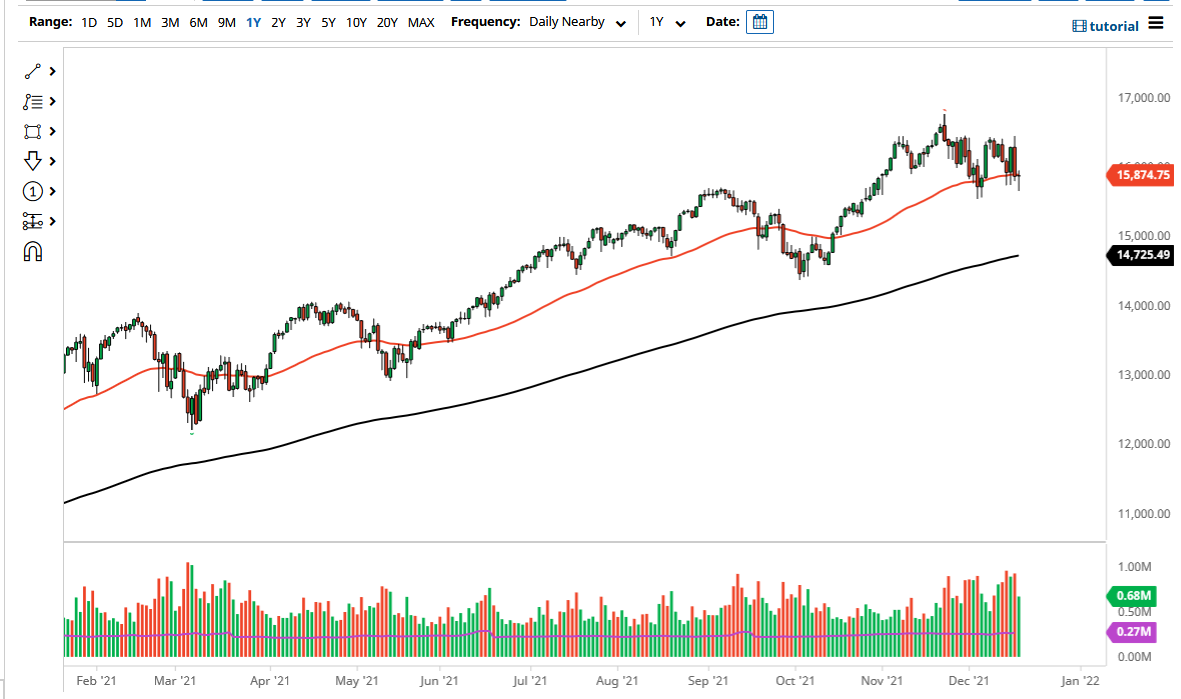

The NASDAQ 100 initially fell on Friday but turned around to show signs of life again. In fact, we ended up forming a hammer, which is a very bullish turn of events. Ultimately, this 50-day EMA indicator sitting right at the same closing level is a magnet for price, and the fact that it was quad witching during the day probably had a lot to do with why we plunged in the first place.

Looking at this chart, it appears that we are going to try to keep the market in the same consolidation area we have been in for a while, so I would not be surprised at all to see the market go looking towards the 16,400 level. Breaking above there could then open up for a bigger move, but in the short term it certainly seems as if we are trying to figure out where to go next. The NASDAQ 100 has been beaten down over the last couple of days, but ultimately it is still a leader in New York, so I think we will continue to see the same major components of the NASDAQ 100 push the thing around and to the upside.

If we were to break down below the bottom of the candlestick, that could open up a bigger move to the downside, but right now that is not what I am seeing as the most likely of outcomes. In general, the markets tend to do very little during the last couple weeks of the year, and that is exactly where we are heading. Ultimately, I think buying the dips continues to be a strategy that a lot of people will be looking into, as the market is likely to continue to see a bit of a “Santa Claus rally” as we head into the end of the year as traders are trying to take advantage of liquidity games and the fact that the market can be pushed around a bit. As they chase returns, a lot of other traders will jump in and join them, and it causes a lot of noisy behavior in the market, but more likely than not it will be to the upside as per usual.