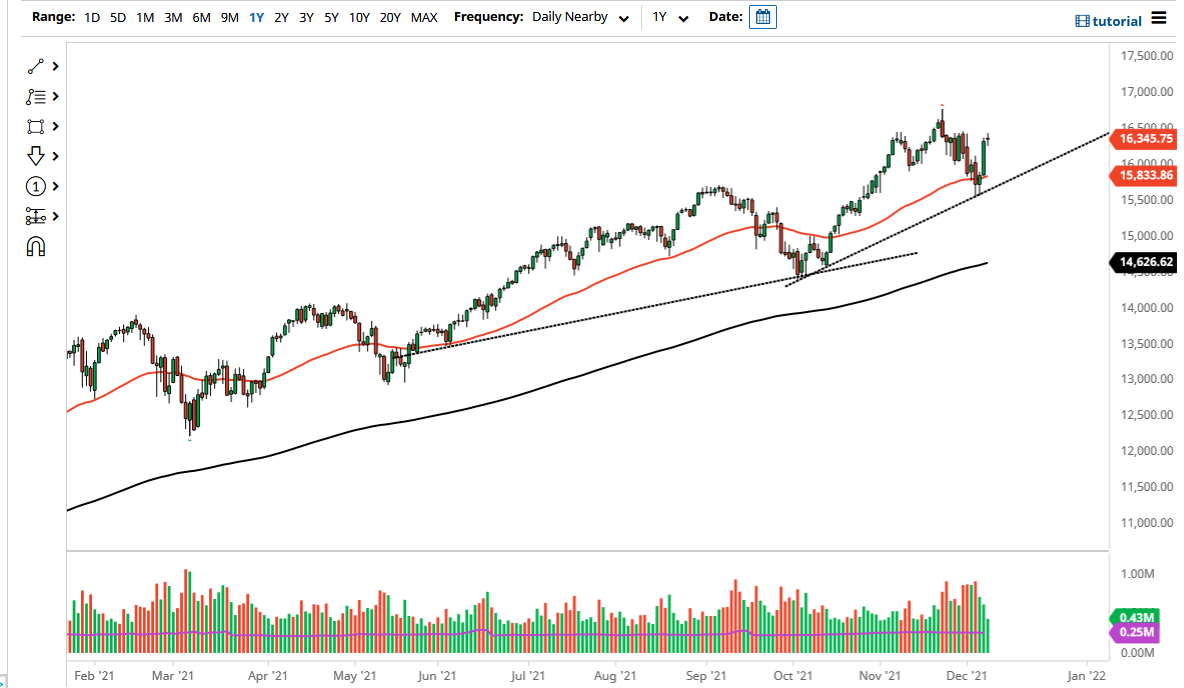

The NASDAQ 100 went back and forth on Wednesday as the 16,500 level continues to see a lot of resistance. That being said, if the market can break above that level, then the NASDAQ 100 is very likely to take off to the upside. However, this is a market that has been a bit overdone over the last couple of days, so I think a pullback makes quite a bit of sense.

Any pullback at this point in time probably offers a bit of value that people will be more than willing to take advantage of, as the NASDAQ 100 is in a massive uptrend and has bounced from the 50-day EMA. By doing so, the market is likely to continue to reach towards the upside, maybe building up the necessary momentum to finally go towards the 17,000 level. The uptrend line underneath continues to offer quite a bit of support as well.

The NASDAQ 100 will be moved back and forth by just a handful of stocks out there such as Tesla, Microsoft, and Amazon. Because of this, the index itself can go higher while most stocks fall. I think we will continue to see people jumping into this market trying to take advantage of value, offering up the possibility of a longer-term “buy on the dips” type of situation. This is a market that I think ultimately will be tested more than once, but we have the Santa Claus rally going on, when money managers around the world are trying to make up for missing out on their benchmarks. While that seems like a narrative, the reality is it is something that happens every year.

I believe at this point in time that there is no way to sell this market, and as long as we stay above the 15,500 level, it is very likely that there will be plenty of people willing to pick up little bits and pieces of value if it occurs. The traders around the world continue to flock towards the same handful of stocks, so that will benefit this index. If we were to break down below the 15,500 level, then I would probably reassess the whole situation and look to get long somewhere near the 200 day EMA.