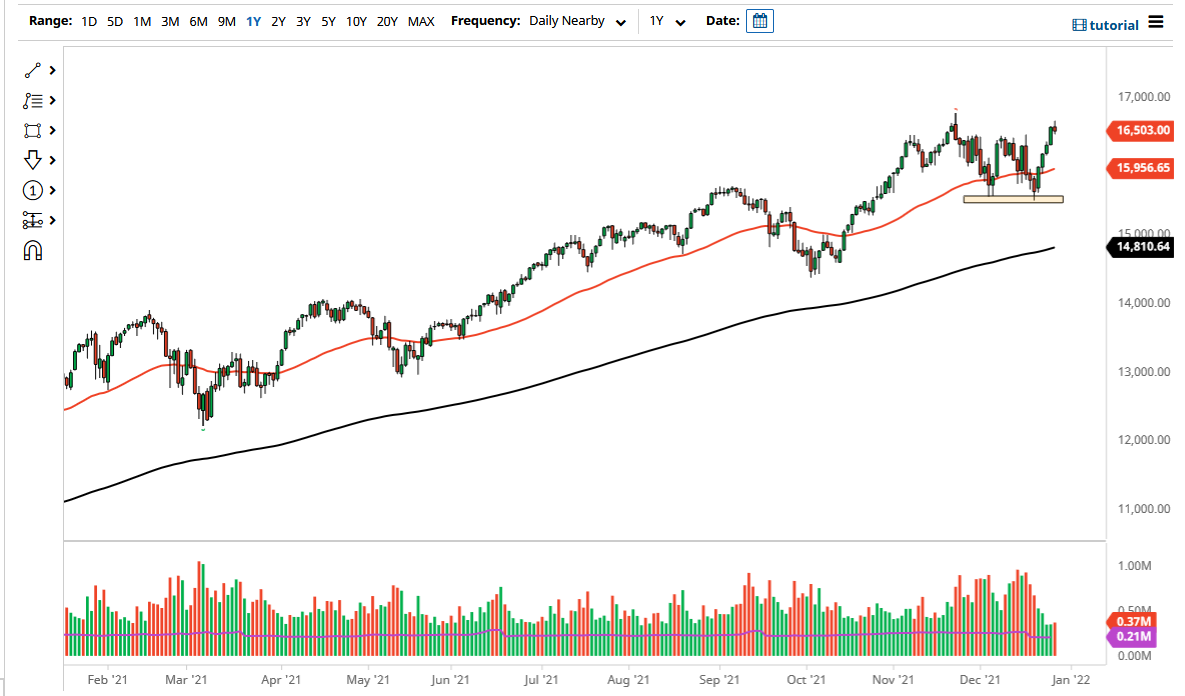

The NASDAQ 100 has had the Santa Claus rally, and now looks as if it is likely to pull back a bit as we head into the month of January. I do not think this is a permanent thing by any stretch of the imagination, but what I do believe is that we may have a little bit of hesitation ahead of the jobs number.

Once we get through the jobs number, people will be much more comfortable going risk back on and buying the NASDAQ 100 yet again. At that point, I would anticipate that the market will go looking towards the 17,000 level and beyond. The NASDAQ 100 is driven by just a handful of major stocks so all you have to do is watch the Wall Street darlings.

Underneath, the 50 day EMA sits just a bit underneath the 16,000 level so I think that is an area that will attract a lot of attention if we do get a pullback that far, but I do not think that is very likely. The market is supported at multiple levels between here and the 15,500 level. In fact, it is not until we get below the 15,500 level that I should be concerned about the uptrend, and even then I'll only be a buyer of puts. After all, the NASDAQ 100 is where money goes when it is trying to make strong returns, based upon Tesla, Microsoft, and the like.

When you look at the pattern of recent trading, we have formed a bit of a W pattern I suppose, but just noisy consolidation would be the best way to describe it. The market will certainly have its pullback, but that pullback should be thought of as an opportunity to get long of what is an obvious uptrend. The overall attitude of this market is one of buying the dips, and I just do not see why that would change in the month of January. Once we get those jobs numbers out of the way, then it is very likely that we will smash through 17,000 and start looking towards 17,500 rather quickly. I have no scenario in which I am a seller, but I do not essentially want to chase the trade all the way near the top of the range that we had been in.