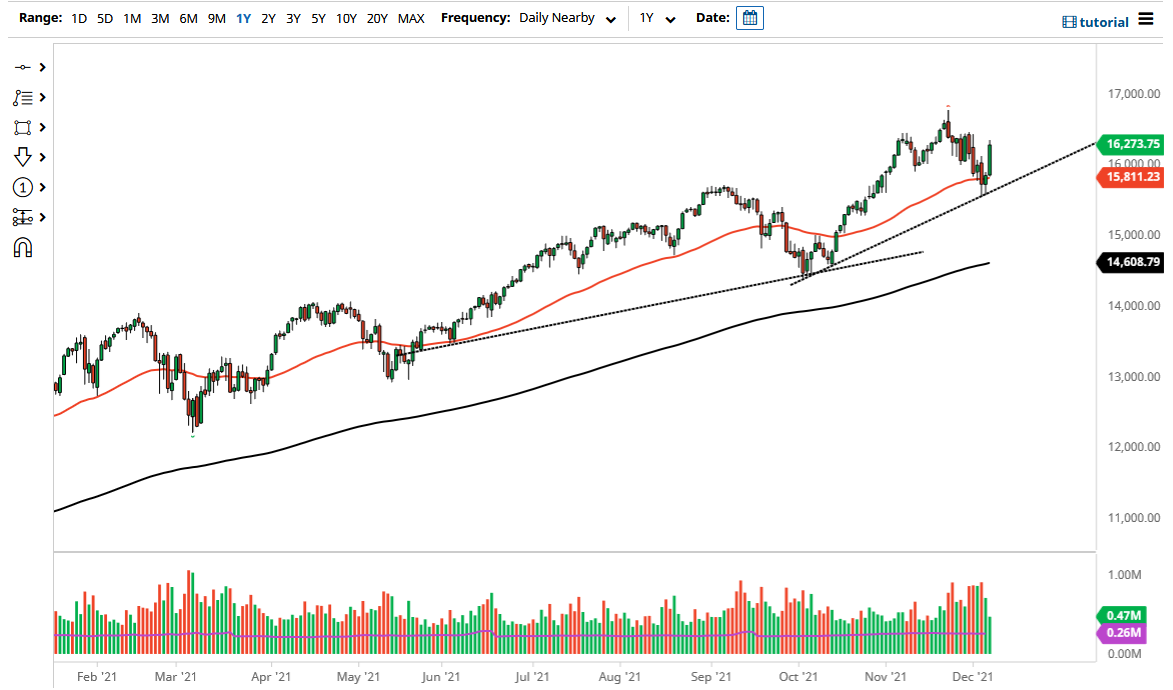

The NASDAQ 100 shot straight up in the air on Tuesday as fears of the omicron variant have abated. With that being said, stock markets around the world rallied, so there is no real reason to think that the NASDAQ 100 will be any different. That being the case, it is also worth noting that the market had bounced from the 50 day EMA, and if you read my analysis during the trading session yesterday, you will note that I was talking about a “tweezer bottom” that had formed.

Another thing that is worth paying attention to is the fact that the “tweezer bottom” formed right at the 15,500 region, so a certain amount of psychology could come into the picture. Furthermore, the uptrend line sits right there, so it all makes quite a bit of sense. With all that being said, it now looks as if we are facing the next major resistance barrier just above.

The 16,500 level will be a very difficult area to overcome, and I do not think that we will be able to simply slice through that area. It is because of this that I would not be surprised at all to see a certain amount of a pullback, perhaps in order to buy a bit of value. That value should send the market back to the upside, and as a result I think the 16,000 level might be a short-term floor. It is not to say that we cannot go to the upside without pulling back, just that it is probably an easier route higher.

Regardless, I think it is only a matter of time before the market reaches the all-time highs and higher. We are starting to kick off the “Santa Claus rally” that we see a lot of during the month of December, as traders around the world are trying to figure out what to do in order to catch up to their benchmarks, which have been straight up in the air for a majority of the year. This is a market that will probably rise right along with all the other stock indices as these money managers have to show positive returns by the end of the year for clients.