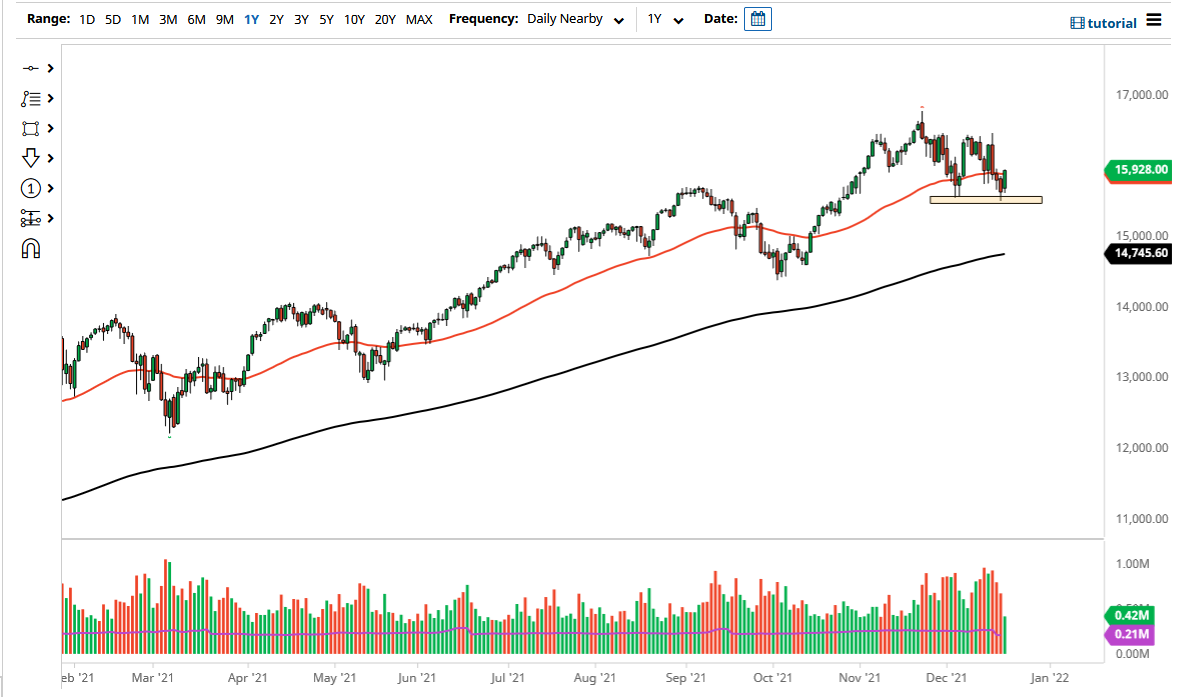

The NASDAQ 100 rallied quite nicely on Tuesday, breaking above the 50 day EMA late in the session. At this point, it looks like we are going to continue to recover, which is not a huge surprise considering that we had been a bit negative of the last couple of days and not much has changed. With this being the case, I think that it is probably only a matter of time before we reach towards the 16,400 level, where we had seen a lot of resistance.

If we could somehow break above that level, then it is likely that we will go much higher, perhaps taking out an all-time high and entering more of a “buy-and-hold” type of scenario. I do not necessarily think that will happen in the short term, but that might be what happens early next year. In the short term, I think we will have a day or two of positivity, and then we probably roll over to continue the overall sideways action. Keep in mind that it is just a handful of stocks that move the NASDAQ 100, so basically you need to keep an eye on the usual seven, as US indices are not equally weighted.

If we were to turn around and break down below the support level near 15,500, we could see this market drop down to the 15,000 level, where the 200 day EMA is racing towards. If we break down below there, I might be willing to buy puts, but I will not short this market. I understand that liquidity will be an issue and therefore we could get sudden moves to the downside, but years of trading have taught me that the Federal Reserve will either do something to pick this market up or say something.

We are essentially consolidating at the moment, and I think that will continue to be the way going forward. It won't be until January of next year that we start to see a bigger move, which I do expect to be higher. In the short term, I look at dips as potential buying opportunities, but I do not want to get overly aggressive with my position size, because the markets will be very erratic. Because of this, I am cutting my position sizes to about half of what they normally are.