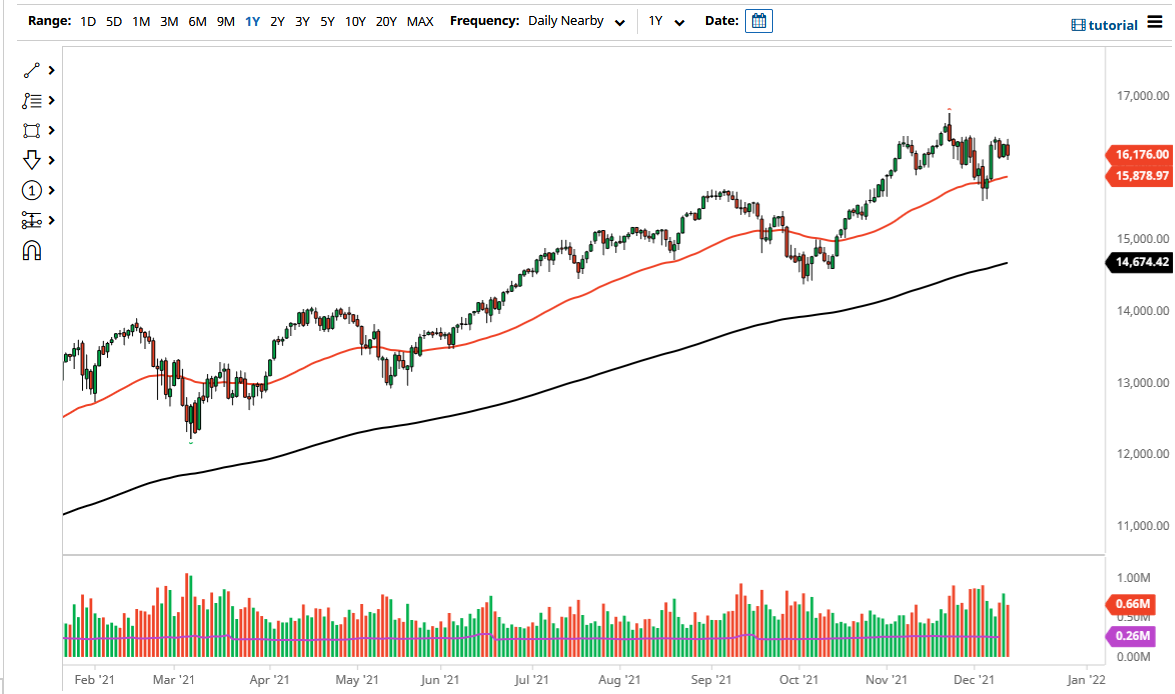

The NASDAQ 100 initially tried to rally on Monday but gave back gains in order to continue to see the same consolidation area that we have been in for a while. Ultimately, this is a market that will find buyers eventually, but it certainly did not close well. If we break down below the lows of the last couple of days, then it is likely that we will see the 50 day EMA come into the picture, which is just below the 15,900 level. If we break down below there, then the next major support level would be the 15,500 area, where we had seen the market bounce from previously.

I think that the area near the 16,500 level will continue to be a difficult barrier to overcome, so if we were to break above there, it is likely that we will go looking towards much higher levels. That being said, it certainly looks as if the market is going to struggle to go higher in the short term, but if and when we can finally break to the upside, it is likely that we will take off. Keep in mind that the Federal Reserve has a two-day meeting coming, and that will have a lot to say about where we go next. The meeting will be paid close attention to, but perhaps more importantly the market will probably pay attention to the press conference afterwards, as the expectations of bond purchase tapering could be a bit of an issue.

When we look at this chart, it is easy to see that we could see a certain amount of noisy behavior over the next couple of days, especially as we get closer to the New Year holiday. Ultimately, this is a market that I think if you are cautious enough with, you could probably buy dips and it certainly looks as if we may get one. The market is still decidedly in an uptrend and am not concerned about the overall attitude of the market until we break down below the 15,000 handle. The aware the fact that the closer we get to the holidays, the less it will take the throw the market around, so we may get sudden moves down the road, but the next 48 hours will be about positioning for future bond purchase expectations.