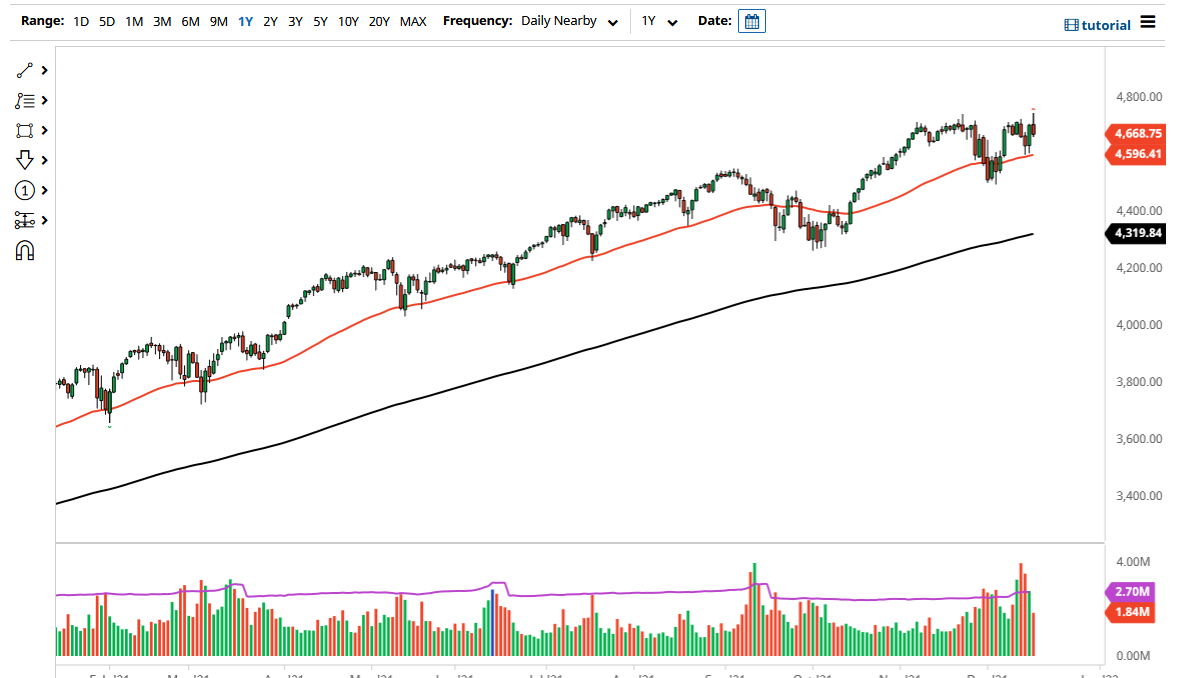

The S&P 500 initially rally during the trading session on Thursday, but then sold off quite drastically. Quite frankly, it was a sudden change of events right at the open in New York, as traders continue to focus on central bank intervention, as the Federal Reserve had already suggested that they were going to start tightening even more aggressively, which of course is negative for stocks. The reaction during the previous session was very bullish, perhaps as a lot of people had thought the Federal Reserve is going to be even more hawkish than anticipated. Once that fear abated, traders started to buy stocks. However, it seems as when the traders had a little bit of time to think about it, they decided it was bearish.

That being said, I think that a pullback probably gets bought into given enough time, and the 50 day EMA underneath could offer a bit of support. We are closing towards the bottom of the range though, so we may have a bearish Friday to deal with. The “Santa Claus rally” is coming, at least assuming all things are normal again, and therefore it will be worth paying attention to. If we can break above the highs of the candlestick during the trading session on Thursday, that would be an extraordinarily bullish sign, as we would have a new all-time high again.

If we break down below the 50 day EMA, it is very likely that we could go looking towards the 4500 level, which of course is a large, round, psychologically significant figure. Raking down below that then brings the 200 day EMA into the picture. That being said, the market is very unlikely to get that low, because there will be more of a “buy on the dips mentality” as we have seen for months. All things being equal, I think that simply waiting for signs of stability will be the best way to go going forward. The market is one that I do not short, but if we break down below the 50 day EMA I might consider buying puts, at least for the short term to take advantage of the negativity. I do not short indices in the United States, because quite frankly they are far too manipulated, and of course not built to fall for any significant amount of time.