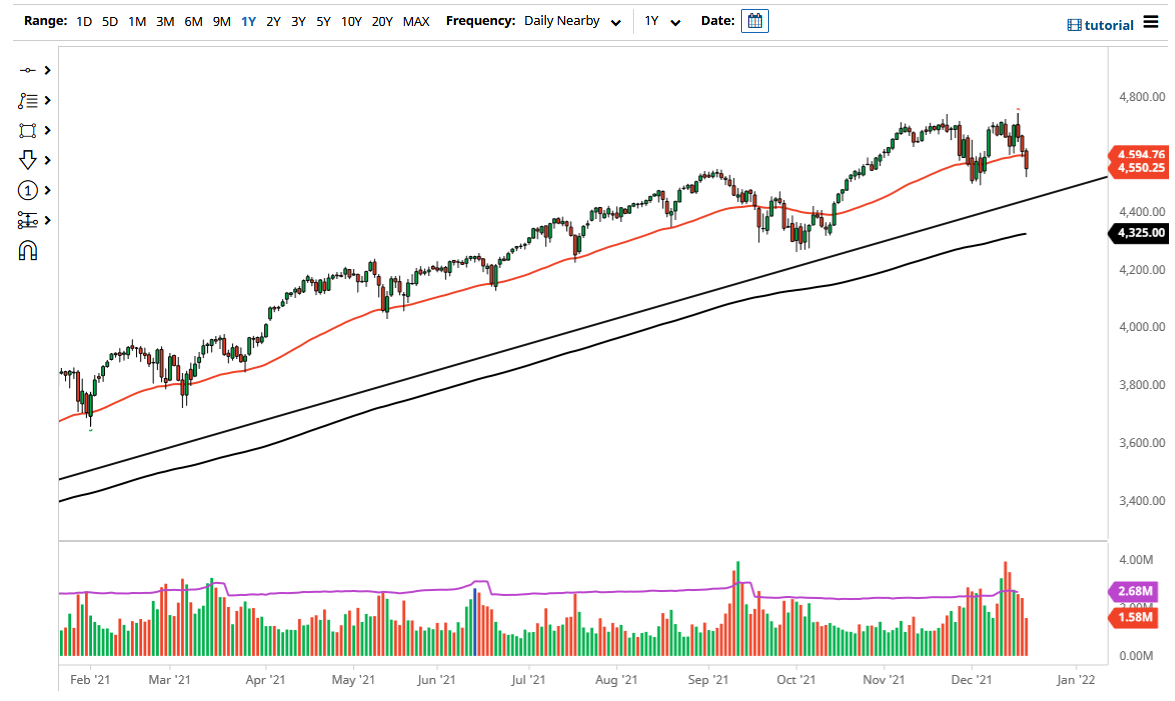

The S&P 500 fell significantly on Monday as we continue to see quite a bit of hesitation. This is a market that is going to suffer at the hands of liquidity, and the fact that the “Build Better Back” plan in the United States seems to be dead. This was a repricing of potential stimulus, which of course is part of what Wall Street was hoping to capitalize on. The 50 day EMA is at the top of the candlestick, and that offers a bit of resistance on the way back up.

The market did bounce just a bit on Monday at the end, but ultimately this is a market that I think is going to continue to be very noisy, especially considering that the liquidity is going to be an issue and people are trying to close out their books for the end of the year. If we can break down below here, then the 4500 level offers a massive amount of support. If we break down below there, then it is possible that I might be a buyer of puts for the short term. The 200 day EMA currently sits at the 4325 level, and is rising, and it is also worth noting that a lot of algorithms will be influenced by any move towards that direction.

As things stand right now, it looks to me as if we are at the bottom of an overall range more than anything else, but I would not put a huge position on anyway. This is a market that will continue to see a lot of back and forth, and I think that is how you have to look at it. Quite frankly, it would not be a huge surprise at all for me to be flat when it comes to the indices between now and the end of the year. The market continues to wait for the end of the year to pass so that traders can put more risk on, as they have to report gains to clients at the end of the year, and are looking to lock those in and focus on holidays.