The S&P 500 plunged on Friday after the jobs number came in much lower than anticipated. The United States added just 210,000 jobs for the month of November, much lower than the 550,000 or so expected. This had a major “risk off effect” on markets around the world, and the S&P 500 was front and center for that situation. I think at this point in time it makes sense that we would see this market struggle, but just for the short term. In fact, by the end of the day, we had already seen traders coming back into pick up value in the market, as the late day saw a bit of a rally.

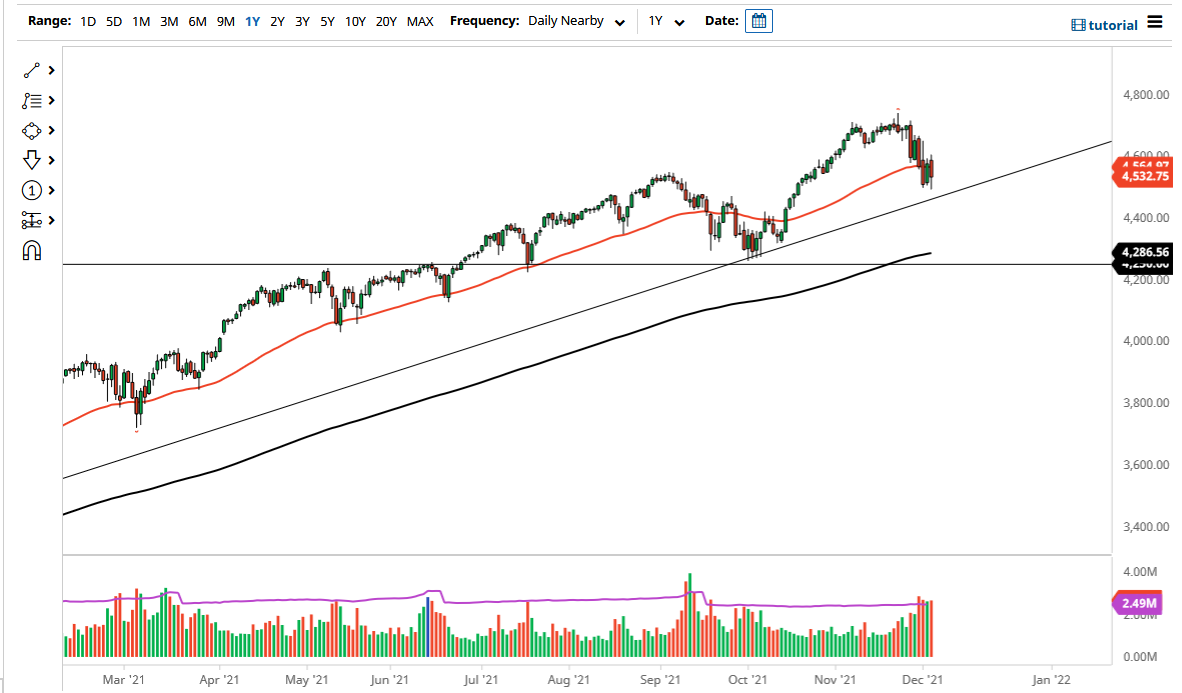

The 50-day EMA sits just above, so if we can break above that, I think the technical traders will probably take over at that point, offering the possibility of a move much higher. I do think that will happen given enough time, as traders around the world will have to chase returns if they have not hit their benchmarks. A break above the top of the candlestick for the Friday session opens up the possibility of a move towards the 4700 level, and then possibly even the all-time highs, which were just a couple of weeks ago. Yes, it has been extraordinarily painful, but when you look at the longer-term chart it puts a lot of perspective into the picture. We are down about 6% or so from the highs if that.

Underneath, we have a certain amount of psychological support in the form of the 4500 level, and we also have the trendline that I have drawn. Underneath that level, then we have the 4250 level and the 200-day EMA bunching up, making the “floor in the market” for the longer-term traders. It is not until we break through all of that that I would be a buyer of puts. I do believe in buying the dips, but I also recognize that with this type of volatility you will probably need to be somewhat nimble. If that is going to be the case, then you need to take a serious look at this through the prism of value, but I would not jump “all in” when it comes to any index right now, because we have seen so much volatility.