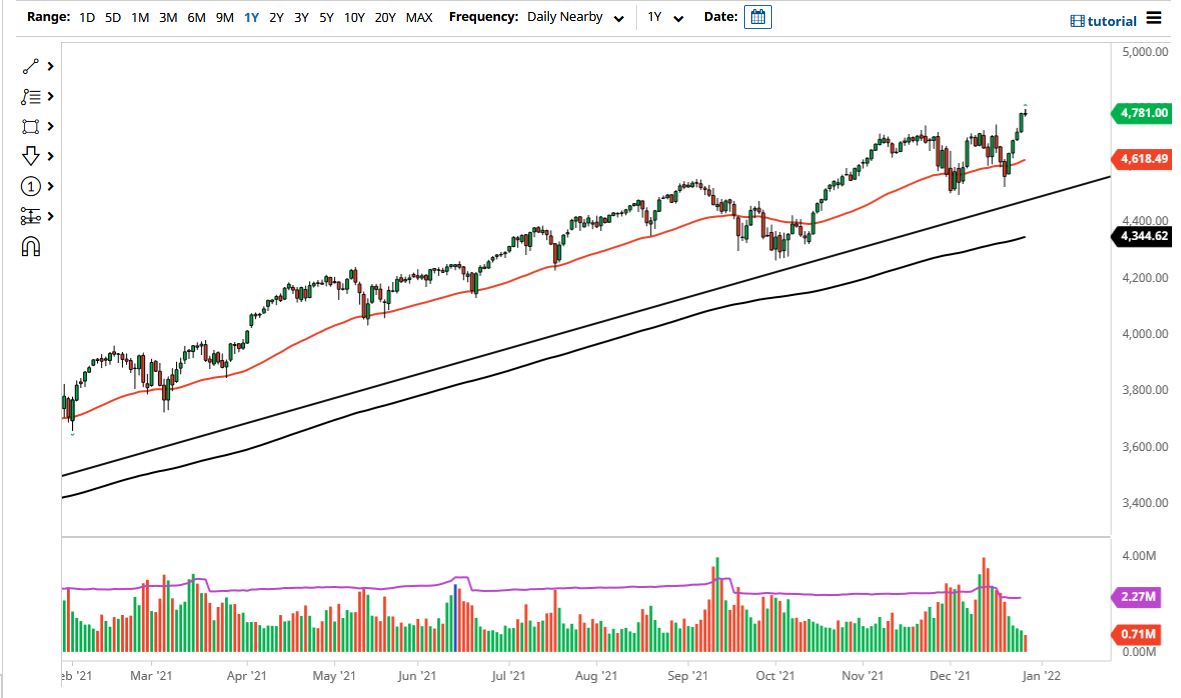

The S&P 500 has been bullish again during the month of December, especially as we got the “Santa Claus rally” going late in the month. That being said, I think that the most likely of scenarios that we will find ourselves in during the month of January is traders waiting to get through the jobs report to put money back on the table. The risk appetite will almost certainly still be strong, so I believe that most of January is going to be about buying dips. I also believe that sometime this spring, although not necessarily right away, I expect to see the S&P 500 touch the 5000 level.

The 50 day EMA currently sits at the 4618 level and is rising and is something that a lot of people will use as dynamic support. Ultimately, I believe that the first few days of January might be more or less simple malaise, but once we get through that non-farm payroll announcement, I suspect that people will be looking to put a lot of risk back on in order to get books working for the year.

The 4500 level is the absolute floor in the market right now, and I would be stunned to see us try to get through that level. I would be a buyer anywhere near that level, just due to the fact it would be such a value proposition. That being said, if we were to break down through there then I might be able to be convinced to buy puts, but that seems very unlikely to happen. This is a market that has been in an uptrend for ages, and even though the Federal Reserve is starting to taper its bond purchases, the reality is that the monetary policy is still extraordinarily loose, and there is a real consensus that at the first signs of trouble, the Federal Reserve will turn right back around to save the markets. In other words, the Federal Reserve may be trapped, and if that is going to be the case, then risk assets will continue to climb in value one way or another. That being said, I believe January is yet another bullish month for the index, and once we get through the first week or so, the momentum will start to become a major tailwind again.