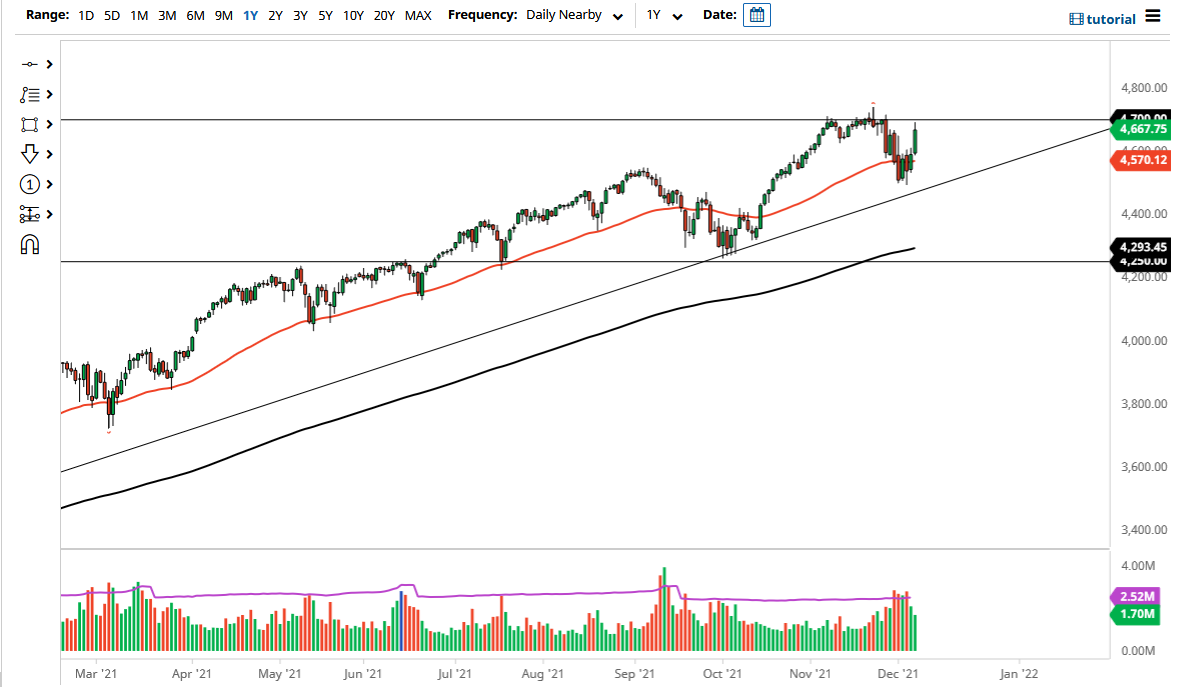

The S&P 500 rallied significantly on Tuesday to show extreme strength as we rocketed towards the 4700 level. The 4700 level is an area that would attract a certain amount of attention due to the fact that the market had stopped at that area previously. We did pull back just a bit from there during the day, but that is not a huge surprise considering that we shot straight up in the air to get there. I think a pullback makes sense, but it is clear that the buyers are back.

Because of this, I think this is a market that will eventually find buyers on dips, and we are more likely than not going to be able to see value hunters come back into this index on any signs of weakness. The 50 day EMA currently sits at the 4570 handle and is flat. In other words, this was an area where we had seen a lot of consolidation, and that consolidation should continue to attract a certain amount of attention. The consolidation means that there are buyers and sellers there, so a certain amount of support will come into the picture.

The market participants continue to look at this through the prism of potential moves to the upside as we approach the end of the year. That being said, the market breaking above the all-time high seems to be more likely than not. I think that any short pullback that we get at this point in time will attract a lot of people looking to get involved that may have missed out on the move. The 4500 level underneath is the floor in the market from what I can see, and the markets will continue to look at that as a short-term floor. As traders continue to chase returns for the end of the year to show clients, it provides a little bit of a natural short squeeze as it were. People will start to chase markets in order to make good on benchmarks, causing what is known as the “Santa Claus rally.” I think we will have plenty of buyers to catch any short-term fall that we see in the index. Yes, it was a little overdone during the day on Tuesday, but it is a clear sign that there is a lot of interest.