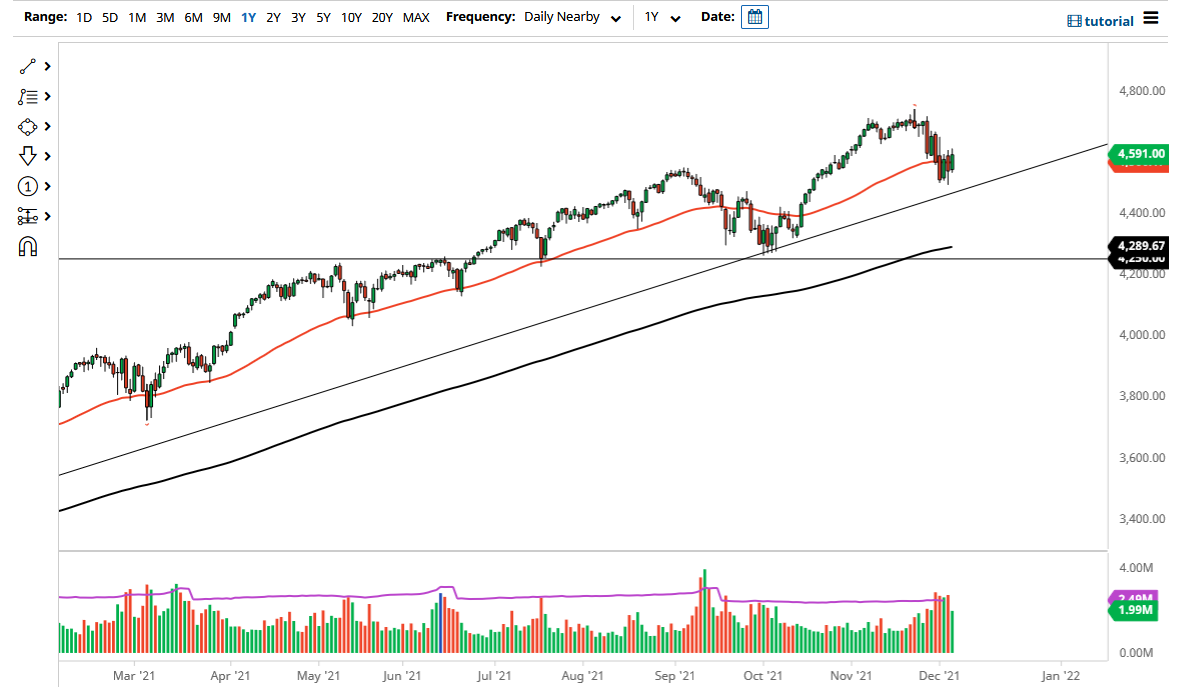

The S&P 500 was rather noisy on Monday, reaching to break above the 4600 level at one point. This is a good sign though, because the market has been bouncing around sideways as we hang around the 50-day EMA. By doing so, longer-term technical traders will start to look at this as a potential stabilization that could lead to a longer-term move higher. After all, we have been in an uptrend for quite some time, and it does make quite a bit of sense that we would continue to see this as a market that is in the midst of trying to recover.

Underneath, we have a nice uptrend line, and then after that the 4500 level. All of that together should offer plenty of support, thereby allowing traders to find little bits and pieces of support. Ultimately, this is a market that I think will try to figure out a way to find buyers. After all, we have the “Santa Claus rally” getting ready to kick off, as people are trying to catch up with their benchmark for the year. With that being the case, it makes sense that we will see a “buy on the dips” mentality going forward. Even if we were to break through all of that support, the 4250 level is a major support level, especially now that the 200-day EMA is sitting just above it.

I think at this point, the market is very likely to go back towards the highs of the year, and the fact that we have gone sideways for the last four days or so is a good sign. After all, for a minute there it felt like it was really starting to fall apart, but now we are quietly going sideways. There is the old axiom, “never short a quiet market”, and I think that is exactly what is going on here. Eventually, we could break above the 4600 level, opening up the possibility of a continuation of the longer-term uptrend. If we were to break down below the 4250 handle, then I might be convinced to buy puts, but we are so far away from that it is not even funny.