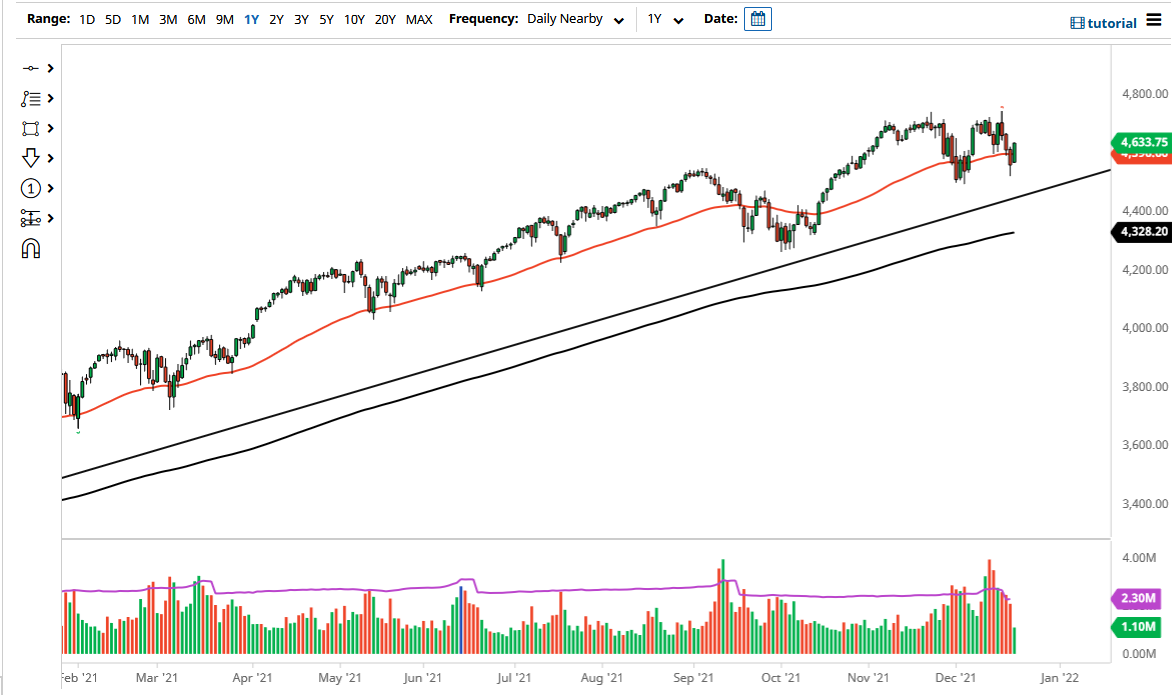

The S&P 500 rallied significantly on Tuesday, recapturing the 50-day EMA. By doing so, the market looks as if it is ready to go higher, but at this point I think short-term pullbacks are likely. With that, I will look at those pullbacks as potential buying opportunities, but I keep my position size about half of what would normally be this time of year, due to the fact that the illiquid markets can have a massive move suddenly due to a headline or simple position squaring.

To the downside, I see the 4500 level as a significant support level, right along with the trendline that follows just underneath there. With that, I look at any pullback to that area as value and would be more than willing to take advantage of it. If we broke significantly below there, then I might be convinced to be a buyer of puts, but that is about as negative as I would get. To the upside, if we break above the highs of the day then I anticipate that we would go looking towards the 4700 level, an area that has been resistance previously. Breaking that opens up more of a “buy-and-hold” scenario but I do not see that happening between now and the beginning of next year.

I do believe that we will rally at the beginning of next year, but you will probably be put to sleep trading this market the closer we get to both Christmas and New Year’s Day. Because of this, I would be very cautious but I also recognize that you need to know the environment that you are in, and that is one in which buying the dips has worked for the last 13 years. If you keep your position size small enough, then you do not have to worry about sudden moves, and you can hang onto a trade if it does in fact work out in your favor. I do not expect major moves, but there have been a couple winters where I have seen sudden spikes due to a surprise announcement that has wiped out a lot of accounts. You have to trust me on this: it is simply not worth risking your hard-earned trading capital to pick up a few points.