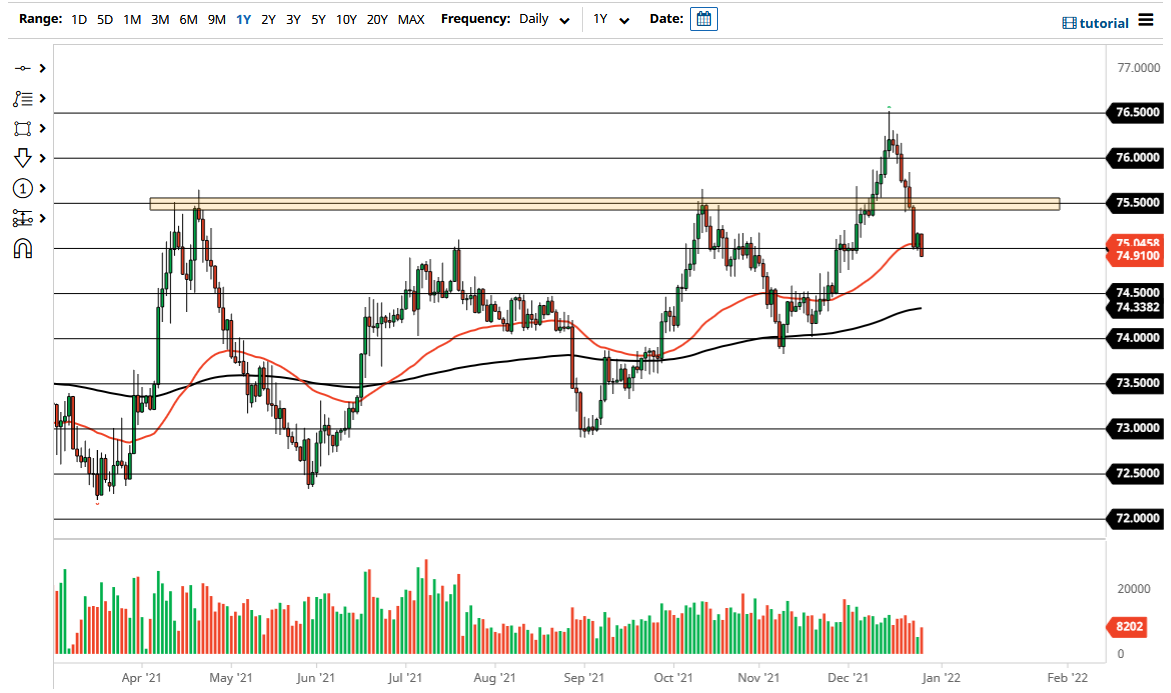

The US dollar has been falling against the Indian rupee as of late but falling from a significant overextension. The ₹75 level has been sliced through, and now it looks like we could go a bit lower. However, it is the wrong time of year to make too much in the way of guesstimates until we get through the first jobs report. The US dollar falling against the Indian rupee does suggest that perhaps we are looking at a little bit more “risk on” than we had been previously.

If we do break down significantly from here, we could go as low as the 200 day EMA, which is at the ₹74.33 level. We may even overshoot and go to the ₹74 level, and we could have a bit of follow-through from the last couple of weeks. However, if we get a sudden “risk off” type of move, that will send this pair right back up in the air, as the US dollar is considered to be a major safety currency while the Indian rupee is an emerging market currency.

The beginning of the month will probably be choppy to say the least, because there will be a lot of people out there trying to put money to work for the year. In that scenario, you get a lot of crosswinds that you do not necessarily think of when putting money to work right away. After all, once we kick off the year, traders will have to put risk on in various ideas, meaning that money will be undulating around the system, so it is not easy to get a grasp on which way the market wants to break for the bigger move right away. However, I think at this point in time we are trying to settle into this little pocket of support and resistance before big players come in and put money into emerging market bets such as India. The Indian rupee represents one of the world’s largest economies, so that is definitely something worth paying attention to going forward, because if it is going to be a good year, it should be showing itself in India itself. Things look as if we are finishing out the year on a strong note, so unless something changes drastically, I suspect that emerging market currencies should do okay.