The US Federal Reserve’s indications about the future of tightening its policy contributed to strong gains for the dollar pairs. The USD/JPY rebounded to the level of 114.27, but investors returned to buying havens amid global concern about the Omicron variant, which hampered the optimism of central banks. Accordingly, the currency pair returned to the support level at 113.13 at the end of last week's trading, before closing trading around the 113.70 level, waiting for anything new. In a surprising pivotal policy, the US Federal Reserve accelerated the withdrawal of its asset-purchasing program and laid out a roadmap for eight interest rate increases through 2024. Chairman Jerome Powell also raised the possibility that the US central bank would start withdrawing liquidity before too long by reducing its large balance sheet.

While stock investors welcomed the combination of certainty from the Fed and a confident outlook, there were also signs of caution as analysts identified risks that could be undermined by aggressive policy or omicron's impact on the economic recovery. Commenting on this, Charlie Ripley, chief investment analyst at Allianz Investment Management, said, “The Fed is likely to continue to walk lightly while walking a thin line to try to cool inflation without slowing the economy too dramatically.” The Fed is elevated and is likely to remain that way as Powell attempts to uninterruptedly solve the largest monetary stimulus package in history.

Nomura Securities in Tokyo saw the outcome as broadly positive for global stock markets, with the added possibility that Japanese stocks could create some outperformance - and not just because the yen weakened significantly after the meeting. Accordingly, Takashi Ito, stock market strategist at Nomura, said: “The purchase in US stocks has concentrated in names or sectors in which high growth can be expected even in light of the rate-raising cycle. It would not be surprising to see the discount on Japanese stocks narrow after the FOMC, with market attention focused on electronics, machinery, automakers and shipping stocks."

"It is clear that there has not been enough drama to warrant a material extension of the dollar's rally," HSBC Holdings Plc strategists including Daragh Maher wrote in a note.

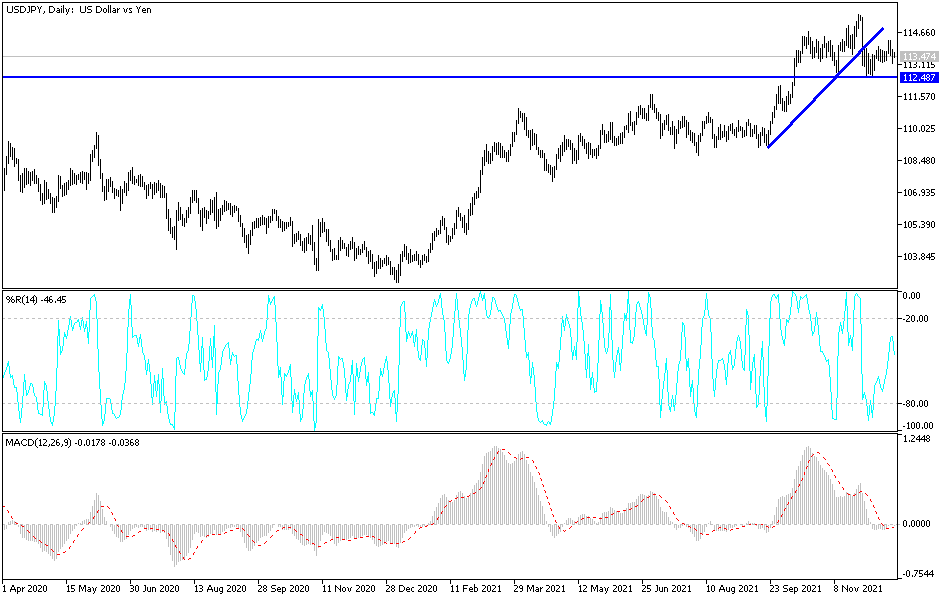

Technical Analysis

There is no doubt that the USD/JPY is suffering from investor confusion regarding risk appetite, as the dollar is a safe haven and the Japanese yen is a traditional one. Technically, stability above the resistance 114.20 will be important for the bullish outlook for the currency pair. On the downside, according to the performance on the daily chart below, the 112.55 and 112.00 support levels will remain crucial for a bearish outlook, and a launch to lower support levels. I still prefer to sell the currency pair from every bullish level.