Immediately after the US jobs report, the USD/JPY fell to the 112.55 support level, and as the markets absorbed the results, the pair returned to settle around 113.05 as of this writing. The Japanese yen is still reaping its gains against the rest of the currencies, as it is a traditional safe haven for the markets. The markets are concerned about the new Omicron variant, which is under study to identify the extent of its impact and its resistance to the currently approved vaccines.

The US unemployment rate fell last month to its lowest level since the pandemic began, even as employers appeared to be slowing hiring - a mixed picture that suggested a resilient economy that was putting more people to work. On Friday, the government reported that US companies and other employers added only 210,000 jobs in November, the weakest monthly gain in nearly a year and less than half of October's increase of 546,000 jobs. But other data from the Labor Department report painted a brighter picture. The US unemployment rate fell from 4.6% to 4.2% as 1.1 million Americans said they found jobs last month.

Overall the US economy remains under threat from rising inflation, shortage of labor and supplies and the potential impact of the coronavirus omicron variable. But for now, Americans are spending freely, and the US economy is expected to grow at an annualized rate of 7% in the final three months of the year, a sharp rebound from the 2.1% pace in the previous quarter, when the delta variable hampered growth.

Employers in some industries, such as restaurants, bars and hotels, pulled back hiring in November. By contrast, job growth has remained strong in areas such as transportation and warehousing, which are benefiting from the growth of online commerce.

The drop in the unemployment rate was particularly encouraging because it coincided with the influx of half a million job seekers into the workforce, most of whom quickly found work. Many of these people usually take time to find jobs and will be considered unemployed until they do. The influx of job seekers, if it continues, will help reduce the labor shortage that has baffled many employers since the economy began recovering from the pandemic.

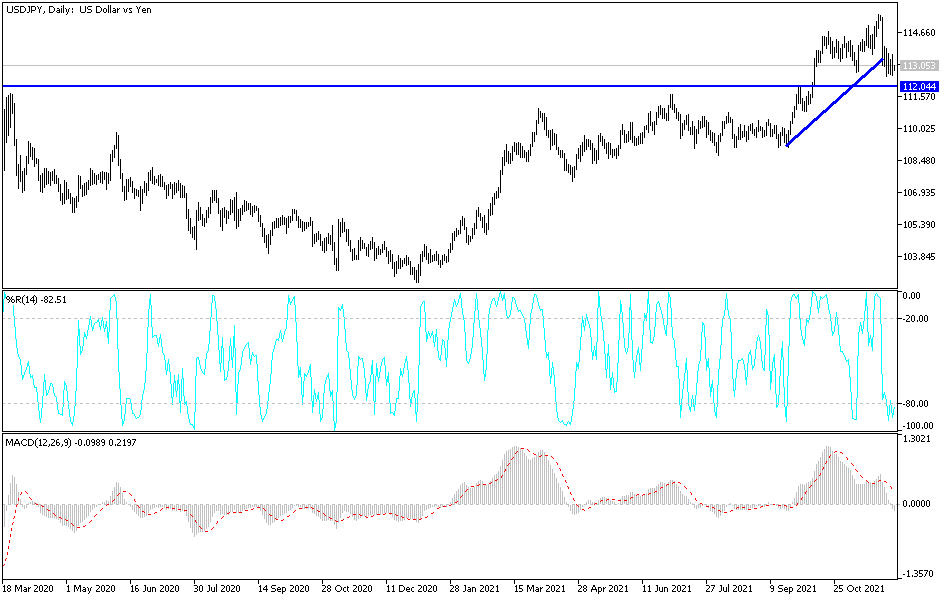

Technical analysis

On the daily chart, the USD/JPY is still moving after turning the trend bearish, and stability below the 113.00 support motivates the bears to move further downward, especially if the current global concern continues regarding the Omicron variant and the US-Chinese skirmishes. The MACD indicator is shifting its direction to the upside, but more momentum is needed to confirm the chance of a rebound higher. The closest support levels for the pair are currently 112.65, 111.80 and 110.90. I still prefer selling the currency pair from every bullish level.

The resistance level at 114.35 may give the bulls some impetus to change the current trend. The USD/JPY currency pair is not expecting any important data, whether from the United States or Japan, and will react more to risk appetite, in addition to studying the reaction to the latest US jobs report.