The recent sell-off of the USD/JPY currency pair pushed it towards the 112.53 support level, its lowest in more than a month, but it settled around the 113.55 level after the dollar’s gains from Jerome Powell’s warning that the interest rate hike may come sooner than expected. Jerome Powell stated that it would be "reasonable to consider ending tapering a few months in advance" if concerns about the Omicron variant prove to be overblown.

The dollar jumped after the comments, reversing the widespread losses it incurred earlier, confirming that the market was repricing for a slower unwind of monetary stimulus from the Fed. The US central bank began reducing the amount of bonds it bought under the quantitative easing program in November with the aim of ending it completely in the first half of 2022, but the emergence of the Omicron variable made investors begin to expect an extension of this schedule.

This means that the first rate hike will come later than expected heading into last Friday's Omicron sell-off. Commenting on this, Joshua Mahoney, chief market analyst at IG, said: "Jerome Powell offered a surprisingly hawkish stance, with the Fed Chairman stating that he could see the tapering process accelerate if Omicron's current concerns prove incorrect."

The thrust on Powell's testimony to US lawmakers has been choppy, falling sharply earlier in the day on comments from Moderna's president that current vaccines are likely to be less effective against the Omicron variant. The losses were pared after comments from BioNTech Uğur Şahin - the inventor of the vaccine that Pfizer makes and distributes - that the new alternative could lead to more infections, but that vaccinated people would likely remain protected from severe disease.

The University of Oxford, which created the vaccine distributed by AstraZeneca, also provided some supporting news with a statement that said: “Despite the emergence of new variants over the past year, vaccines have continued to provide very high levels of protection against severe diseases and there is no evidence to date that Omicron is completely different.”

Amidst charged investor sentiment, Powell was expected to point to the risks posed by another potential Covid wave associated with Omicron and release an air of caution. But his assertion that higher inflation means the withdrawal of supportive monetary policy should go ahead came as a surprise. Accordingly, IG Bank's Mahoney says: "Another bout of comments from Jerome Powell about the economic and inflation risks posed by the latest Covid strain highlights how the bank remains in a position to tighten policy further if necessary."

"We are still in a phase of uncertainty, as the Fed is expected to adjust or reconfirm its policy stance once scientists provide more clarity on this strain," Mahoney adds.

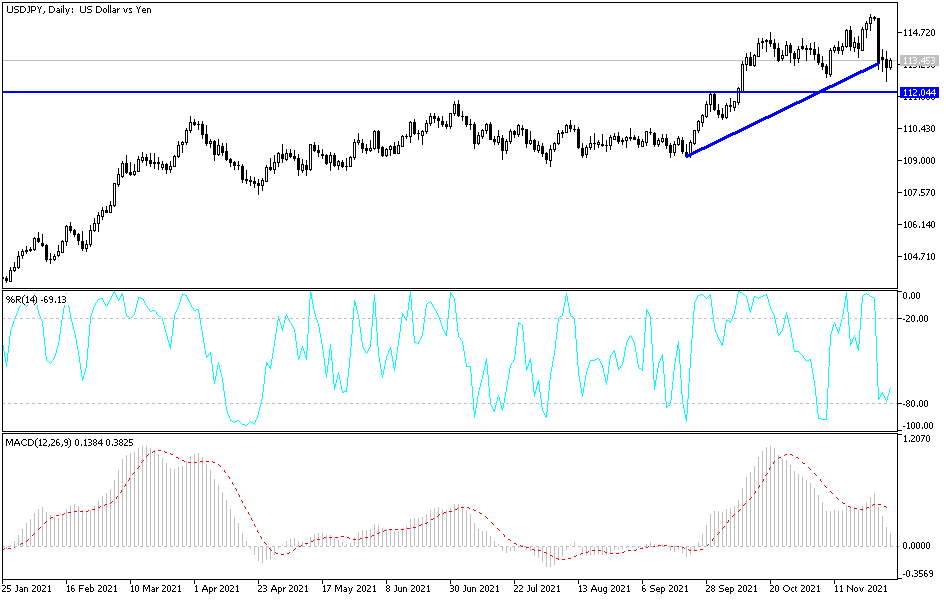

On the daily chart, there is a clear bearish turn in the direction of the USD/JPY currency pair, especially as it crossed the support 113.00 because it increases downward momentum towards the support levels 112.50, 111.80 and 110.90. On the upside, the currency pair may go bullish again by breaching the 114.30 resistance again. I still prefer selling the currency pair from every bullish level.

The currency pair will be affected today by the extent to which investors are taking risks or not, as well as the reaction to the announcement of the ADP reading of the change in the number of non-farm payrolls, the ISM Manufacturing Purchasing Managers' Index and Jerome Powell's comments.