For the second day in a row, the USD/JPY is moving with bullish momentum, reaching the resistance level of 114.20, where it has settled as of this writing. The last US data for the year will be announced this week. The US dollar is still strongly supported in the Forex market by expectations of the imminent date of raising US interest rates and the demand for it as a safe haven.

Besides, investors are assessing the impact of the COVID-19 spikes as the omicron variant spreads rapidly. Countries in Europe and Asia have implemented a variety of restrictions aimed at curbing the spread of the virus, and this has alarmed investors about the impact on the global economy. The latest wave of the coronavirus is adding to ongoing concerns about the impact of rising inflation on economic growth. Supply chain shortages and rising raw material costs have affected businesses, leading to higher costs for consumers. Accordingly, US consumer prices rose 6.8% in November from a year earlier, marking the fastest rise in inflation in nearly four decades.

Rising inflation has also prompted the Federal Reserve to expedite the withdrawal of its aid to the markets and the economy and put interest rate increases on investors' radar in 2022. The prospect of higher interest rates has added some volatility to the market as investors funnel money around, particularly from high-value technology stocks. .

Technical Analysis

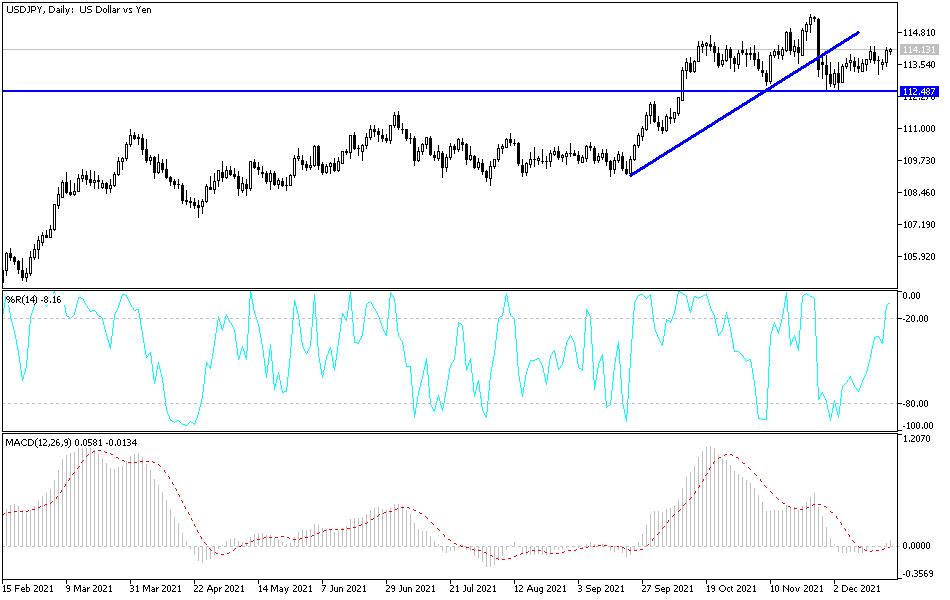

As I mentioned before, the stability of the USD/JPY above the 114.20 resistance will continue to support the bulls to move further upwards. The direction of the technical indicators moved to the upside, but they still need more momentum for a bigger move, as more demand for buying safe havens may be in favor of gains for the Japanese yen, as the interest there is negative, unlike the situation in the United States.

I still prefer selling the currency pair from every bullish level. The closest resistance levels to do so are 114.45, 115.20 and 116.00, and on the bearish side, the breakout of the 113.15 support is back, according to the performance on the daily chart, which is important for the bearish trend again.

The currency pair will be affected today by risk appetite, in addition to the announcement of the US economic growth, US consumer confidence and US existing home sales.