Due to the risk appetite currently in the markets, the Japanese yen lost many of its gains against the rest of the other major currencies. Yesterday, the price of the USD/JPY currency pair tested the resistance level of 114.36 and settled around the level of 114.20 at the time of writing. The pair is waiting for any new movements in narrow ranges in light of the approaching holidays, which means less liquidity. The Japanese yen was hit hard by the Japanese parliament's approval this week of a record additional budget of about 36 trillion yen ($317 billion) for the fiscal year through March to help families and businesses affected by the pandemic.

The budget is largely earmarked for funding COVID-19 measures, including booster vaccines and oral medications. It also includes cash payments to families with children and a promotional campaign for the hard-hit tourism industry. For his part, Japanese Prime Minister Fumio Kishida said that the supplementary budget aims to revive an economy that has not yet fully recovered from the epidemic and achieve stronger growth and a more equitable distribution of wealth under his "new capitalism" policy.

Under Kishida, the government has tightened border controls to help avoid cases of the fast-spreading Omicron virus, after it managed to reduce infection levels sharply in the past few months. The budget includes 100,000 yen ($880) in payments to families with children 18 or younger and 2.5 million yen ($22,000) in support for businesses that have suffered major sales losses due to the pandemic. It will also pay to increase the salaries of nurses and other caregivers.

It has allocated 617 billion yen ($5.4 billion) to promote semiconductor manufacturing within Japan as the country moves to improve its economic security and address shortages of computer chips essential for a wide range of products. The budget will also finance tourism promotion, sustainability and digitization. Deputy Prime Minister Seiji Kihara told reporters on Monday that the government plans to urgently submit the planned measures to the people to support "rebuilding the economy affected by the pandemic and resuming social and economic activity" after the widespread imposition of public health precautions to combat the coronavirus outbreak. .

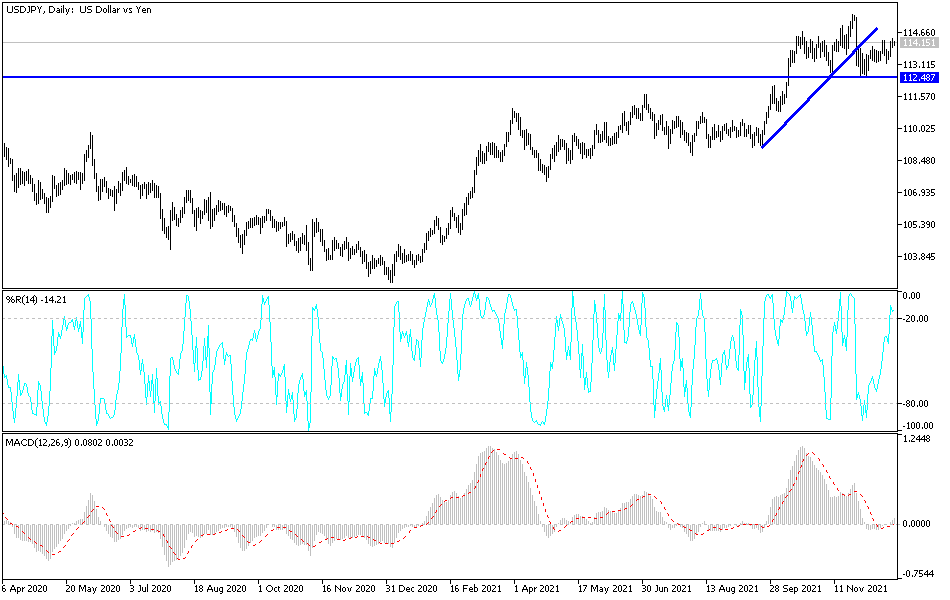

Technical Analysis

As I mentioned before, stability around and above the 114.20 resistance will continue to support the bullish reversal. The technical indicators have some room before they reach overbought levels according to the performance on the daily chart. The closest targets for the bulls are currently 114.60, 115.20 and 116.00. On the other hand, a rebound to the 113.30 support level brings the bears back in control again. I still prefer selling the currency pair from every bullish level.

The US dollar pairs will be affected by the announcement of the durable goods orders numbers, the personal consumption expenditures price index, the number of weekly jobless claims, new US home sales, and the average income and spending of the American citizen.