For three trading sessions in a row, the USD/JPY has been trying to stop its losses, moving towards the 113.61 resistance amid a relative calm in the markets considering the Chinese crisis and the new COVID variant. The strength on Wall Street partly reflects calming concerns about the Omicron variant of the coronavirus amid indications that the new strain is causing milder symptoms.

In this regard, President Joe Biden's chief medical advisor, Dr. Anthony Fauci, told CNN that it was too early to make definitive statements, but said that early indications about the severity of the Omicron variant were "encouraging." Fauci also expressed optimism that the Biden administration could lift travel restrictions on many African countries in a "reasonable period of time."

Derek Halpini, head of research and global markets at MUFG, says: “With the US Federal Reserve poised to accelerate tapering on the back of uncertainty in Omicron and emerging signs of easing commodity-related inflation risks, real yields could rise in the US. The next two weeks will see eight G10 central bank decisions, and other G10 central banks may take a more cautious approach to removing monetary stimulus.”

Therefore, we see that the near-term outlook remains favorable for the US dollar. Leveraged long USD positions have been reduced by about a third in just two weeks which suggests there is room to rebuild those positions providing room for USD/JPY to rise and for DXY to break through 97.000.”

US President Joe Biden on Friday highlighted the decline in the US unemployment rate, which he described as "an extraordinary amount of progress." However, the slowdown in job growth, if it continues, will pose a challenge to Biden, who has scored poorly in public opinion polls on how he handles the economy. And while most indicators show that the US economy is still on the mend, White House aides privately expressed frustration that the president is not responsible for the improvement, and instead faces criticism over the rise in inflation and gas prices that has weighed on Americans in recent months.

The government's survey of businesses indicated that some employers were more cautious about hiring last month. Restaurants, bars and hotels added just 23,000 jobs, down from 170,000 jobs in October. This could reflect the effects of a slight increase in COVID-19 cases last month and a decrease in outdoor dining.

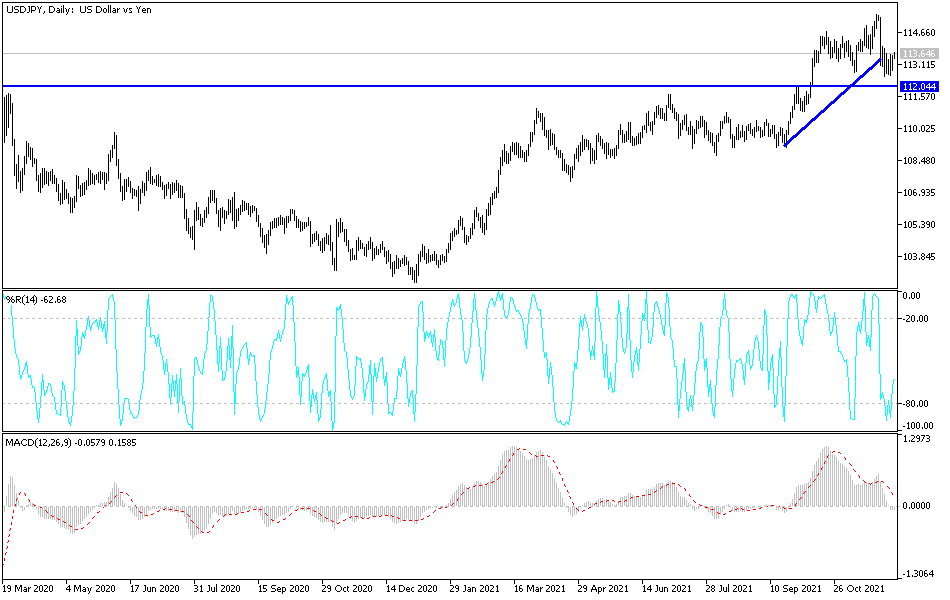

Technical Analysis

On the daily chart, the bulls are trying to push the USD/JPY currency pair to breach the 114.00 psychological resistance to save the bullish trend that suffered a setback recently to the 112.53 suppor . Breaking the 114.00 resistance will stimulate the bulls' dominance to move towards the resistance levels 114.55 and 115.30 again. Unless the currency pair gets enough momentum to make that happen, it may collapse to the 112.00 support, which supports turning the general trend bearish. I still prefer selling the currency pair from every bullish level.

The USD/JPY currency pair may keep moving in narrow ranges until the release of US inflation figures.