The USD/JPY pair's stable performance is expected to remain until investors and markets identify and interact with the important events of this week, starting with the FOMC. The USD/JPY is stable in a range between the level of 113.27 and the level of 113.72 at the beginning of this week's trading, in the same performance as the last trading sessions.

Commenting on the performance and outlook, Goldman Sachs currency strategist Zach Bundle said, “The recovery in risk assets and more stability in front interest rates in the US allowed the dollar to fall from its highs in late November. The Fed is likely to determine the direction of the currency in the near term,” the analyst added, “If the “dot graph” at this week’s FOMC meeting shows the average of two highs for 2022, we may see an extension of the recent weakness, while it is likely that A baseline of 3 or more hikes in 2022 causes a resurgence in the US dollar (markets are currently pricing in a 2.6 Fed rate hike next year)."

The US central bank is widely expected to speed up the easing of its quantitative easing program this week so that it ends sooner than the June 2022 date envisaged and announced in November. That should create scope for a rate hike sooner than previously thought likely by the market and its updated dot chart on Wednesday for policy makers' expectations which will provide ample evidence of how soon that could happen.

This is the main point of interest for the market after 10 voting members of the Federal Open Market Committee - a decisive majority - indicated in recent weeks that they might support a decision to end the $120 billion per month quantitative easing program sooner this week.

On the other hand, it affects morale. Chinese leaders on Friday pledged tax cuts and support for entrepreneurs to shore up sluggish economic growth after a campaign to rein in soaring corporate debt that triggered bankruptcies and defaults among property developers. A statement issued after the annual planning meeting led by Chinese President Xi Jinping called for "maintaining stability," reflecting concern about rising risks after economic growth slumped to an unexpectedly low 4.9% over the previous year in the quarter ending in September.

"Our country's economic development is facing triple pressures represented by contraction in demand, supply shocks and weak expectations," the statement added.

The ruling Communist Party is trying to keep the world's second-largest economy on track while forcing real estate developers and other companies to cut debt, which it fears is dangerously high and threatens financial stability and long-term growth.

China was the first major economy to recover from the coronavirus pandemic, but that recovery quickly stalled. The economy grew 7.9% year-over-year in the second quarter of 2021 but slackened after tighter restrictions imposed last year on borrowing by real estate developers caused a slump in construction and sales. The planning meeting, the Central Economic Work Conference, outlines the party's economic agenda for the coming year. Officials usually begin to announce the details at the ceremonial legislature's annual meeting in March.

The leadership promised tax cuts and "enhanced support" for private enterprises that generate new wealth and jobs in China, but did not elaborate. She said Beijing would invest in infrastructure but gave no indication of large-scale spending to stimulate the economy. Investors are waiting to see what happens to Evergrande Group, a developer that financial analysts say is increasingly likely to default on its $310 billion in debt. Smaller developers have defaulted on millions of dollars in debt or went bankrupt. The government has tried to reassure the public and investors that the economy can be protected from the financial fallout of Evergrande. China's central bank governor, Yi Gang, said Thursday that financial markets can handle Evergrande, noting that Beijing has ruled out a bailout.

Friday's statement also promised more antitrust and other enforcement which it said would boost market players' confidence.

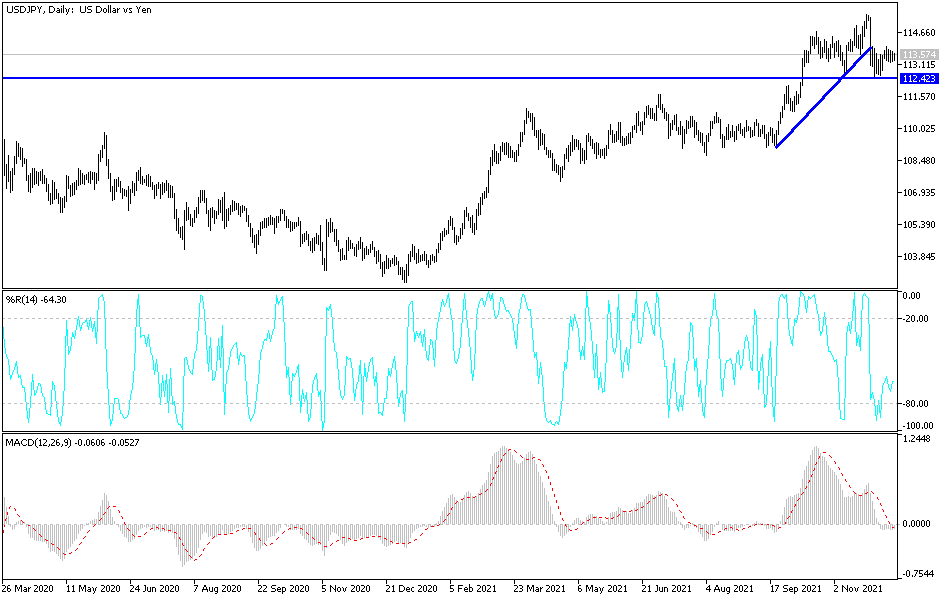

Technical Analysis

How the USD/JPY closes for the year will depend on what will be issued by the US Federal Reserve this week. So far, the currency pair is in a neutral position with a bearish bias, and stability below the 113.00 support will increase the bears' control to move further downwards. According to the performance on the daily chart, the next bearish targets will be 112.50, 111.75 and 110.60.

On the upside, and according to the performance over the same time period, the 114.20 resistance will be vital for the bulls to launch further and change the current situation. In addition to the expectations of raising interest rates, it is necessary to take into account risk appetite.