The Japanese yen's decline continued this week, despite optimism about the world's third largest economy. The yen is looking to end the year on a higher note after becoming one of the worst performing currencies in the global Forex market this year. The question now is: Can it recover in 2022? For now, it's all about the data. In the case of the USD/JPY currency pair, it moved in early trading today towards the 114.94 resistance, its highest in more than a month.

In November, Japanese retail sales rose 1.9% on a yearly basis, beating market estimates of 1.7%. This was up from a 0.9% gain in October. On a monthly basis, retail trade rose 1.2% last month, up from 1% the previous month. This is the best performance since July. Activity in Japan's retail sector was led by gasoline and beverages, but there was a significant decline in cars, machinery and equipment.

On Friday, the Japanese government reported that home construction rose at a less-than-expected 3.7%, lower than the median estimate of 7.1%. Building orders were consistent. Meanwhile, Tokyo raised its monthly view of the economy for the first time in 17 months, indicating that officials are confident of economic recovery, although risks from the Omicron variant remain elevated.

According to the report from the Cabinet Office, the economy is expected to recover in the coming months, supported by increased consumption, increased business confidence, and an improving labor market. This comes after Prime Minister Fumio Kishida unveiled a massive stimulus package to support the economy. The Japanese government has approved a record $941.5 billion budget for the next fiscal year, as Prime Minister Fumio Kishida attempts to cushion the blows of the coronavirus pandemic and tackle systemic problems, including an aging population and geopolitical tensions with China.

Kishida's spending plan will also include new spending on social welfare and servicing the country's spiraling debt, which has doubled the size of its $5 trillion economy. Debt represents more than a third of the budget. This represents the largest initial spending plan in the nation's history. The Japanese prime minister has stated that his budget will attempt to restore the long-term financial health of the world's third largest economy.

Looking ahead, real economic growth is expected to be 3.2% in the next fiscal year, up from the previous estimate of 2.2%.

Technical Analysis

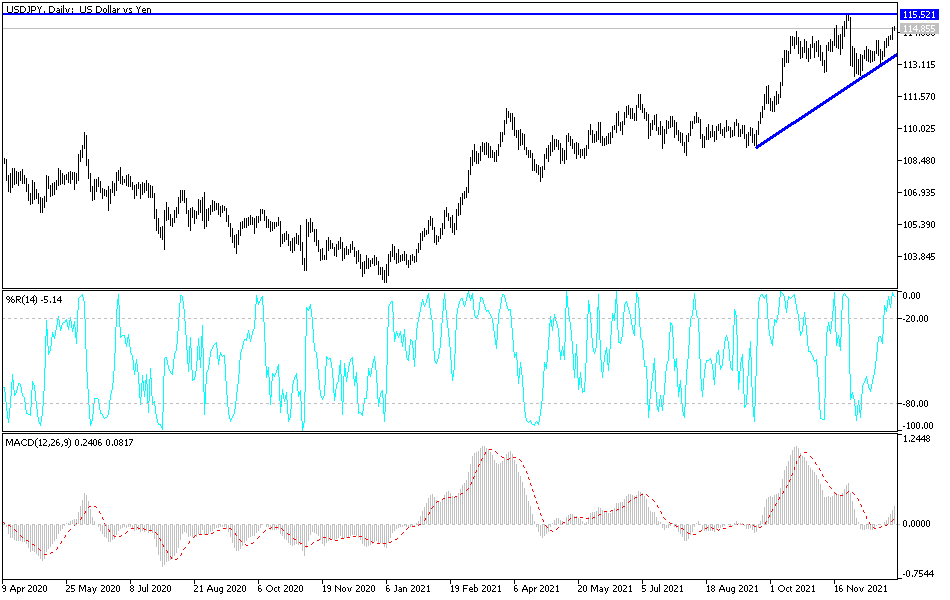

As I mentioned before in the recent technical analyses of the USD/JPY currency pair, stability above the 114.20 resistance will continue to support a bullish performance and a move towards stronger resistance levels, the closest of which are 114.75, 115.20 and 116.00, which support the movement of technical indicators towards strong overbought levels. On the other hand, bullish hopes may be dashed if the bears return to the 113.50 support area. I still prefer selling the currency pair from every bullish level.