Since the beginning of this week, the USD/JPY has been moving in narrow ranges in the vicinity of the 113.33 level and the 113.75 level, where it has settled as of this writing. Investors are balancing the US Federal Reserve's move towards raising interest rates and global concerns about the Omicron, where restrictions threaten the future of global economic recovery. The USD/JPY currency pair includes the most important safe havens for investors in times of uncertainty.

Commenting on the US central bank's policy, which has provided strong support to the US dollar, Athanasios Vamvakidis, Forex analyst at BofA Global Research, says: “The Fed pivot is far from complete, in our opinion. We are seeing US inflation well above market expectations next year, and as a result, the Fed is lagging the curve, forced to rise further than the consensus forecast, beginning in March and at least every quarter thereafter through early 2024.”

Still, market pricing implied last Friday that the US Federal Reserve is unlikely to raise interest rates before June next year, which means the dollar exchange rate may be sensitive to the outcome of US PCE figures next Thursday. As the PCE price index is the Fed's preferred inflation measure, the dollar may therefore be sensitive about whether it extends more than 5% this week as that could lead the market forward when the Fed funds rate is expected to start to rise.

Commenting on this, Goldman Sachs analyst Zach Bundle said: “The Fed's shift has been priced in part, but we believe markets may still underestimate the timing and pace of money rate increases (our economists now expect an initial rate hike in March) “. Our forecast continues that the dollar will be flat over the course of 2022 due to healthy global growth and interest rate hikes by other central banks (such as the Bank of Canada) keeping pace with the Fed. But in the near term we expect the dollar to continue to strengthen.”

All in all, Omicron may be the most feared force hitting the market, but it's not the only one. The proposed $2 trillion spending program by the US government received a potential fatal blow over the weekend when an influential senator said he could not support it. Markets are also still digesting the Fed's big move last week to remove the help it's throwing on the economy faster, due to rising inflation.

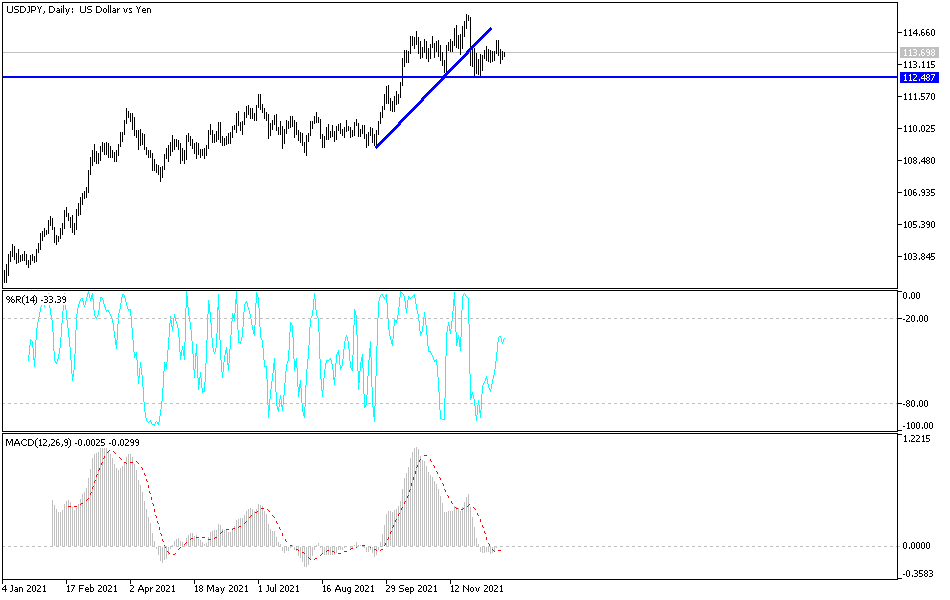

Technical Analysis

On the daily chart, the USD/JPY has returned to neutrality. The outlook will be bullish if it breaks the 114.20 resistance, and I still see that testing and moving below the 113.00 support level will still support further downward movement. So far I still prefer selling the currency pair from every bullish level.

The currency pair is not anticipating important US economic data, so risk appetite will have the strongest impact.