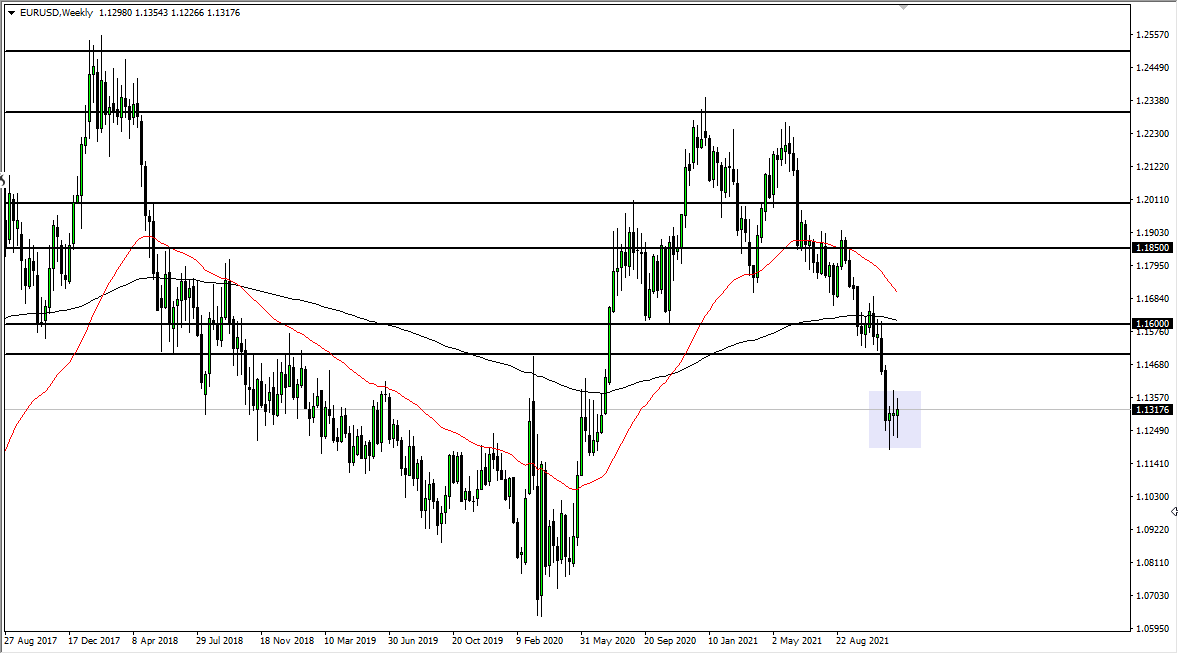

EUR/USD

The euro went back and forth last week, just as we did the previous week. That being said, it does look like the market is starting to favor the upside, so if we can take out the weekly candlestick from last week, I think it is very likely that the euro will probably go looking towards the 1.15 handle. On the other hand, it is not until we break out of the lavender box on the chart that I think we can make any headway. The alternate scenario is that we break down below the hammer from two weeks previously, opening up the euro for massive selling pressure down to the 1.10 level.

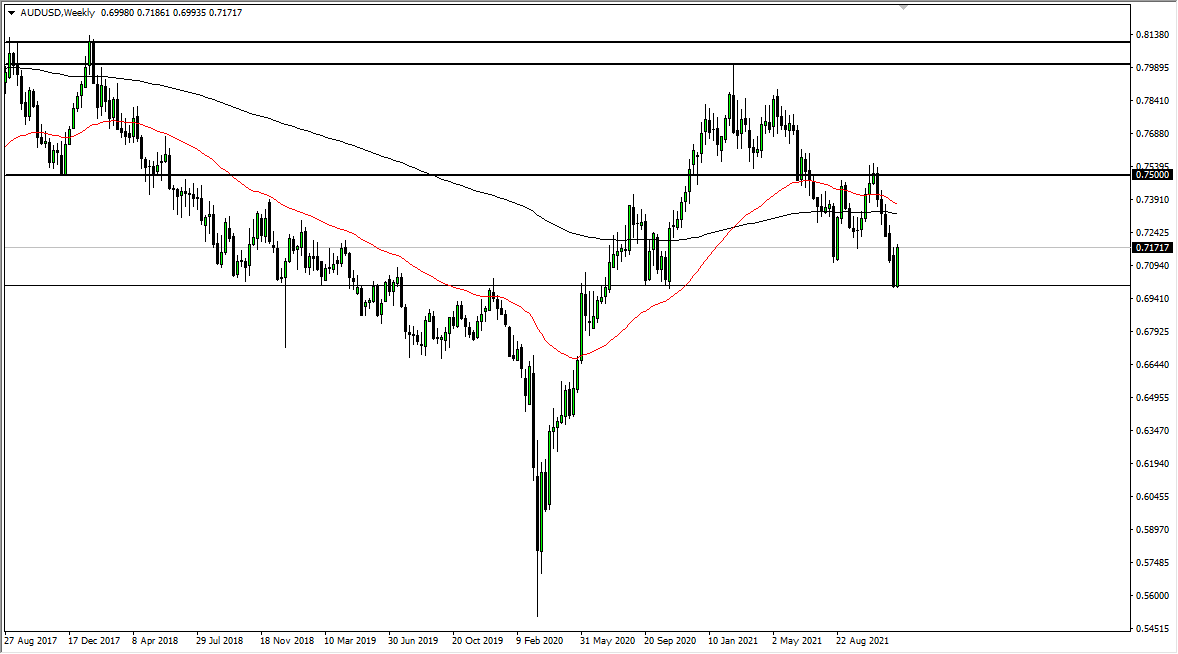

AUD/USD

The Australian dollar rallied rather significantly last week to break above the 0.7175 handle and hang about in that area at the end of the Friday session. At this point, the most important thing to pay attention to is the fact that the 0.70 level has offered massive support, and I think it is only a matter of time before that either shows itself as the “bottom”, or we break down below. Quite frankly, if we break down below that level, then the market is going to fall apart. However, if we break above the 0.72 level, then we'll flip to a bullish case for the Australian dollar.

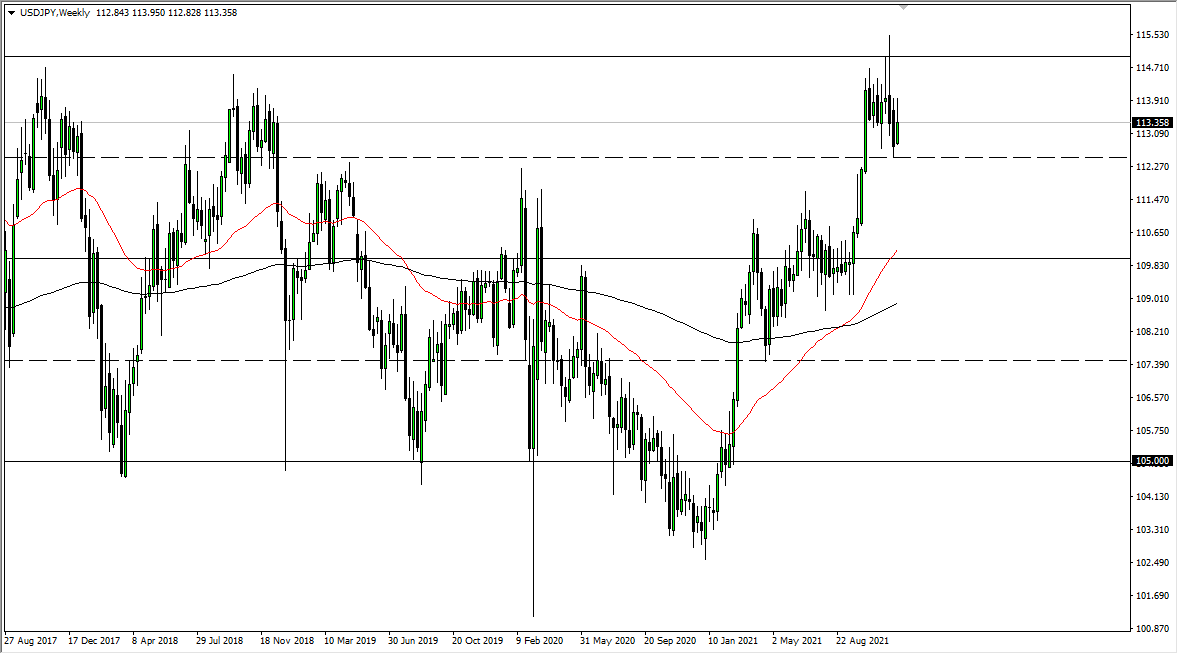

USD/JPY

The US dollar rallied a bit during the course of the last trading week but still struggles near the ¥114 level. I think at this point the pair is going to quiet down as we head into the end of the year scenario when traders simply step away from the market. The ¥112.50 level underneath should be support, while the ¥115 level above continues to be a major resistance barrier. Anything above there makes this market more or less a “buy-and-hold” scenario.

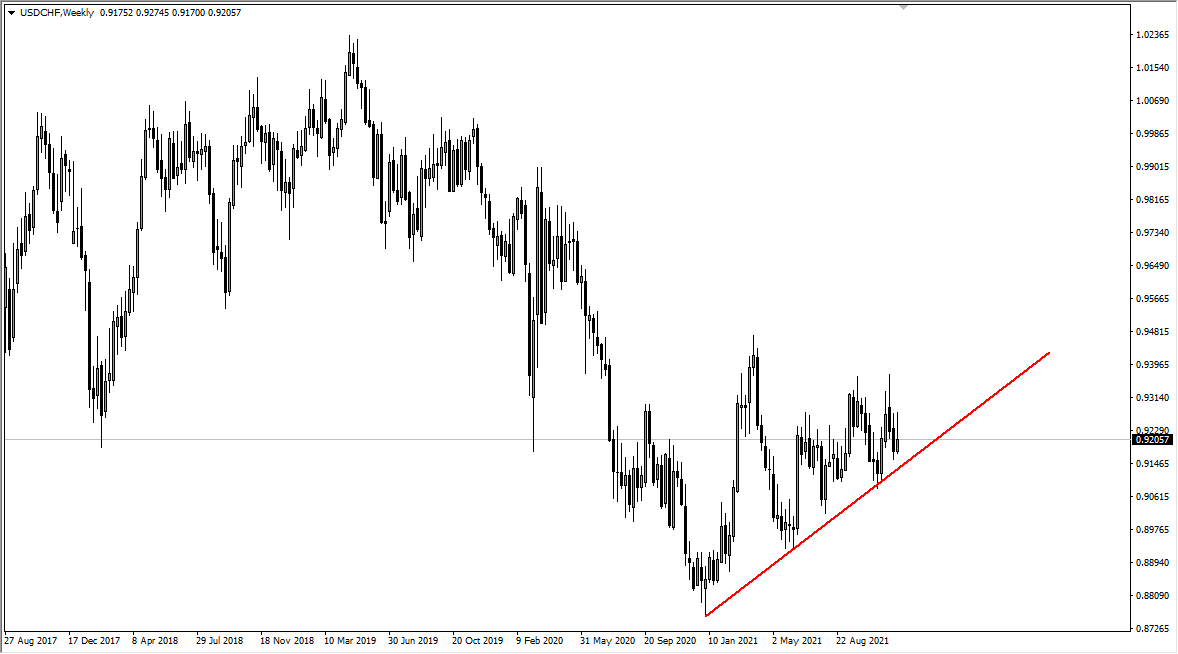

USD/CHF

The US dollar rallied against the Swiss franc last week but has given up the gains. Quite frankly, this is a market that I think will try to break down below the uptrend line, sending this market down to the 0.88 handle. If we do break this trend line that I have drawn on the chart, look out below. Otherwise, I would anticipate a lot of sideways nonsensical Brownian motion.