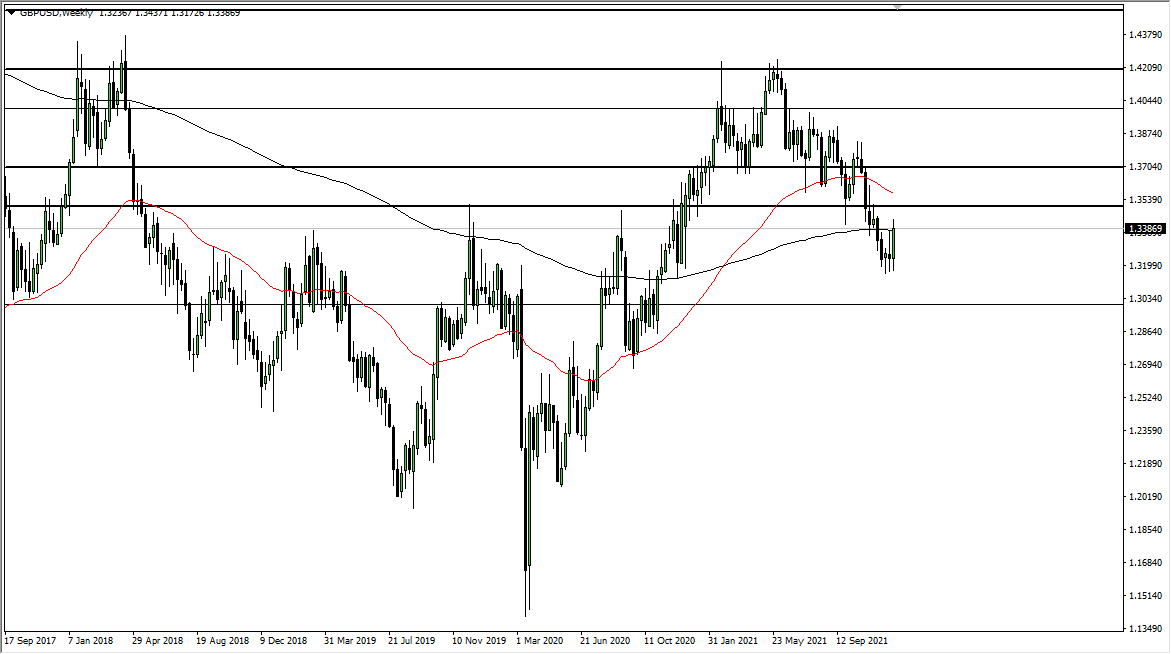

GBP/USD

The British pound definitely made a statement last week, breaking above the top of an inverted hammer. By doing so, it does suggest that we are ready to continue going higher, which I would suspect means that we are heading towards the 1.35 handle. Pullbacks at this point in time should be thought of as potential buying opportunities, but you should also keep in mind that we are trading between Christmas and New Year’s, so liquidity is a major issue, and you have to be cautious with your position size. Nonetheless, the British pound certainly looks as if it has become very bullish in very short order.

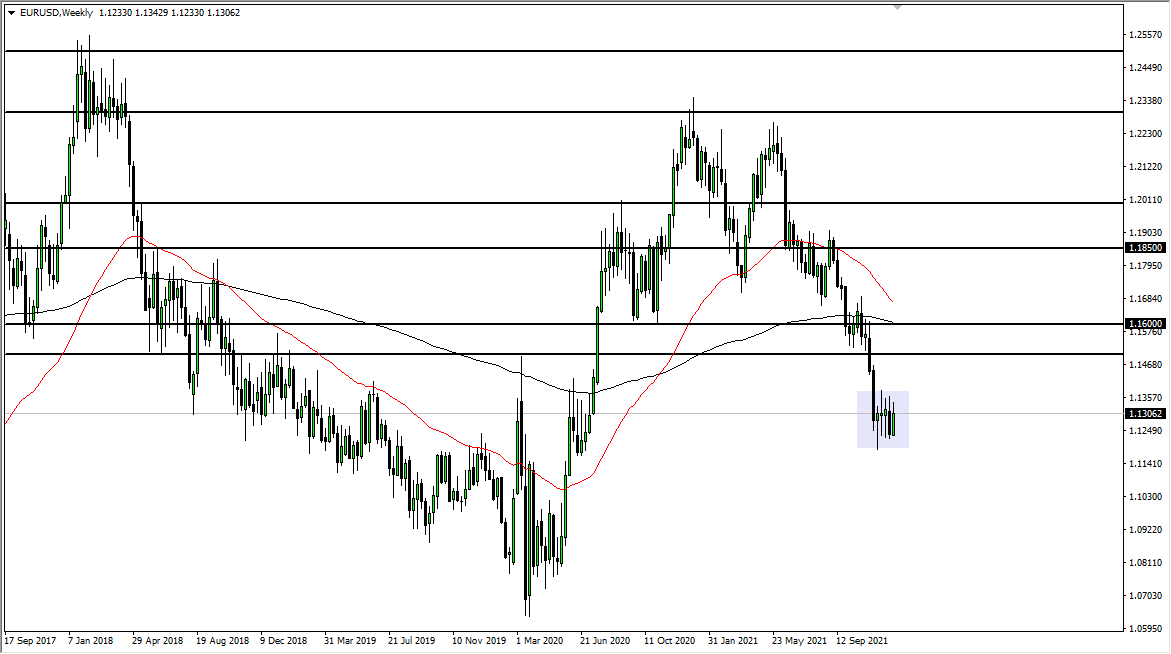

EUR/USD

The euro rallied a bit last week, but as you can see, we are still very much in the same range we have been in for a while. If you are looking for a place to watch your money just grind back and forth, this might be the best pair for you. I see nothing on this chart that would make me place a trade, but I do recognize that if we can break out above 1.14, that would be a very strong buy signal, just as a move down below the 1.12 level would be a strong sell signal. The fact that this week is so thin means I do not expect either one of those actually happen.

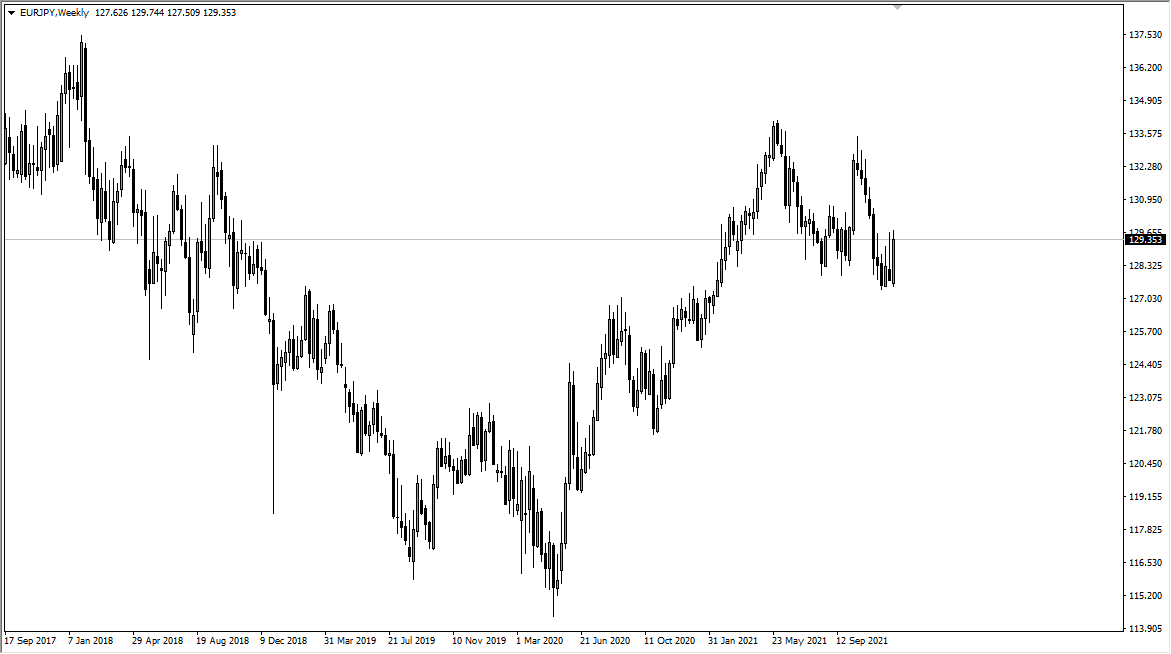

EUR/JPY

The euro rallied significantly against the Japanese yen last week to threaten the ¥129.50 level. This is an area that I think is going to continue to be important, and I suspect it is probably only a matter of time before we get above there. This is probably more to do with the Japanese yen than it is to do with the euro, based upon what I am seen across the board when it comes to JPY-related pairs.

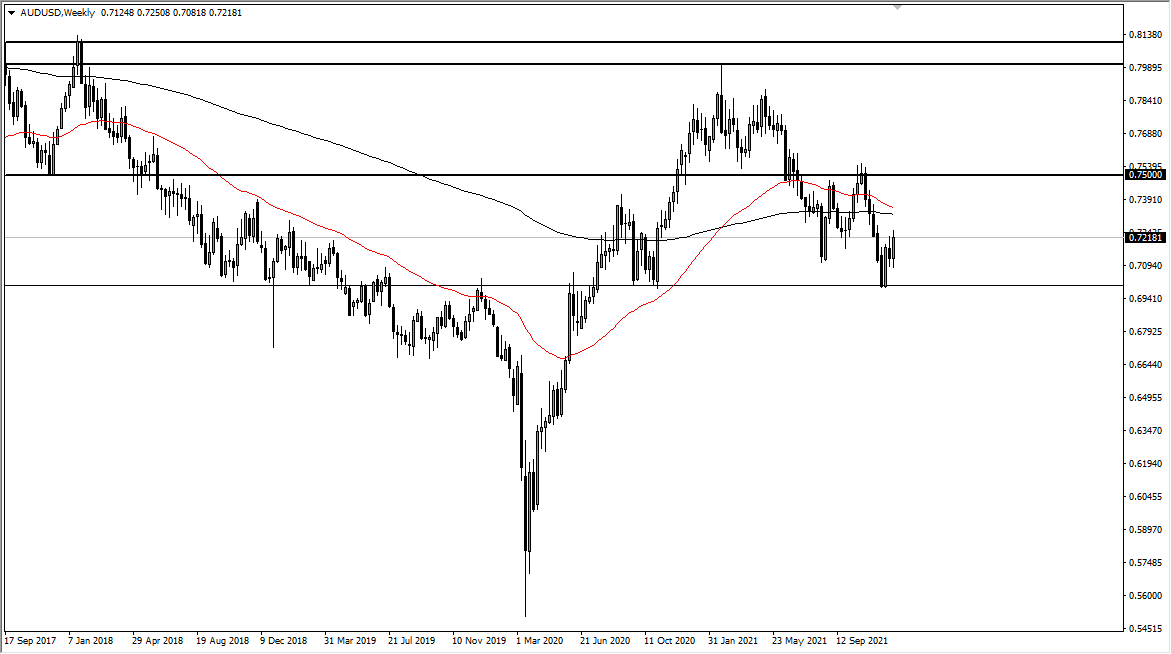

AUD/USD

The Australian dollar rallied enough last week to take out the top of the previous weekly candlestick, which is a good sign of strength. At this juncture, it is likely that we will continue to see more of a drift higher than anything else, as there is nothing on the horizon that should be moving this pair anytime soon. Once we get into January, we can start to take the moves a little bit more seriously.