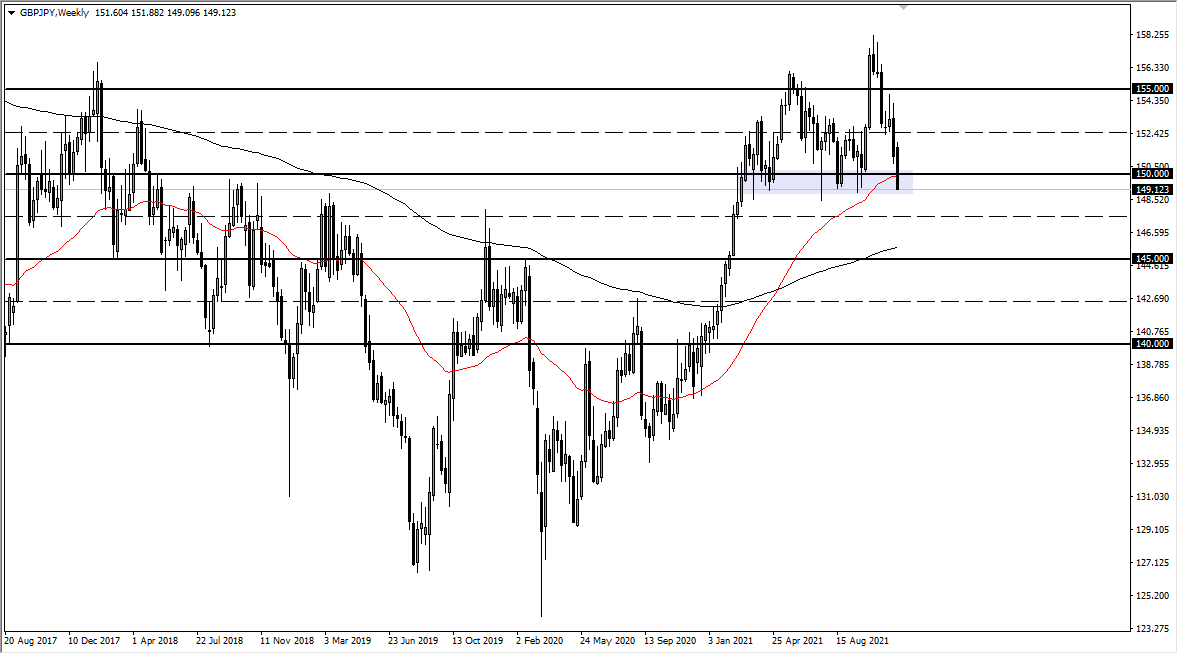

GBP/JPY

The British pound fell a bit last week as we have seen a major “risk off” attitude approach the markets. All of that being said, the market is very sensitive to risk appetite as the Japanese yen is considered to be a major safety currency, while the British pound will gain against it in times of “risk on.” At this point, it looks like there are serious cracks in the marketplace, and a move below the ¥149 level on a daily close could send this pair down to the ¥145 level rather quickly. Regardless, even if we rally from here, the market would have a lot of proving to do in order to become bullish.

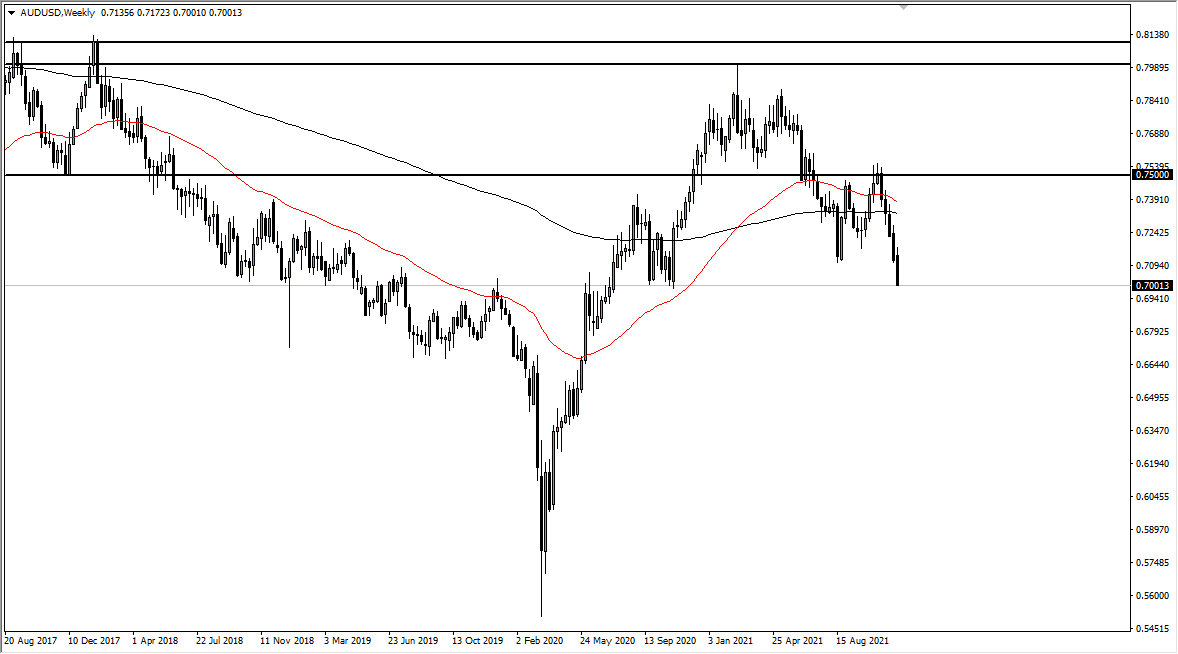

AUD/USD

The Australian dollar got absolutely hammered last week, reaching down towards the 0.70 level. This is an area that is a major support level, and if we break down below here, this market is likely to unwind quite drastically. If that is the case, then the Australian dollar will almost certainly have much further to go to the downside. I think at this point in time we are likely to see any breach of this area open up a move down to the 0.68 level rather quickly. Rallies at this point would not be trusted until we can recapture at the very least the 0.71 handle.

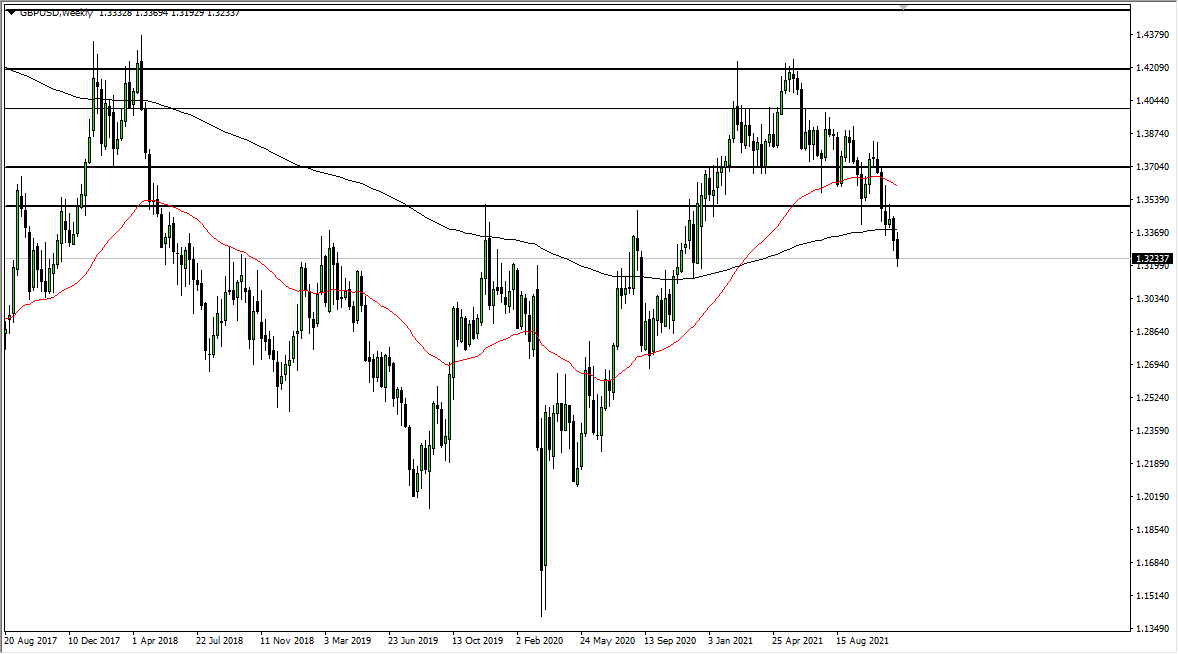

GBP/USD

The British pound fell last week, breaking down towards the 1.32 handle. This is a market that will continue to see a lot of noisy behavior, but I do think that eventually we will try to rally a bit. Longer term, I believe this market is one that you have to look at through the prism of selling signs of exhaustion, as I believe that we will probably go looking towards the 1.30 level eventually. As far as buying is concerned, we need to wipe out the 1.35 level to the upside.

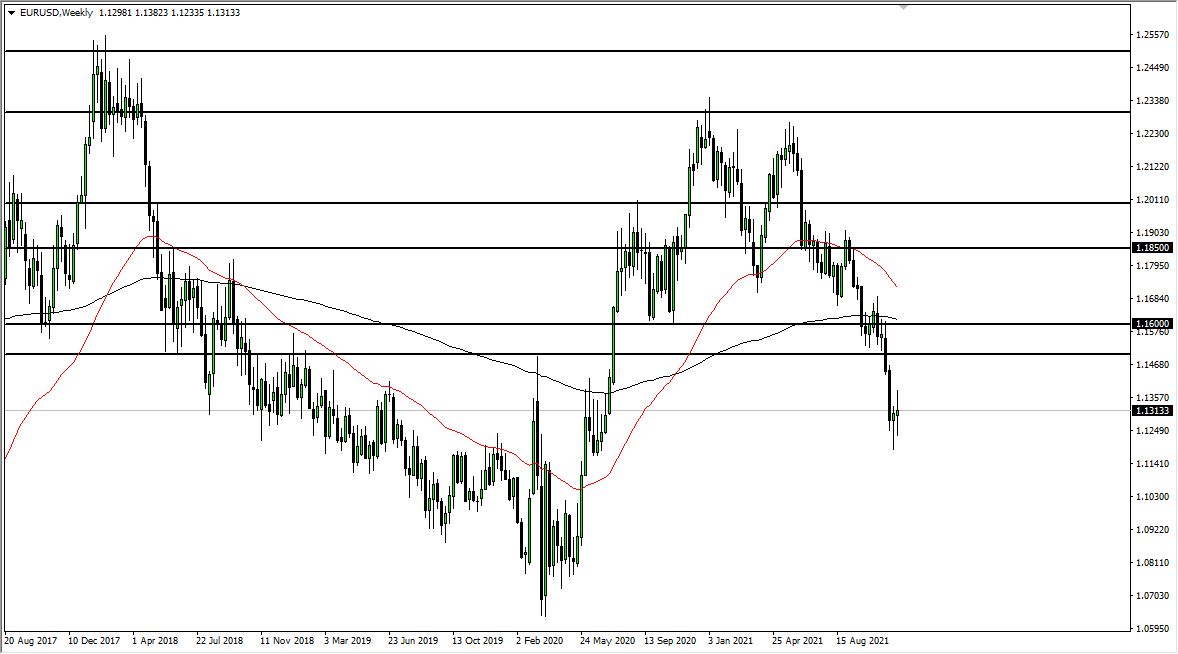

EUR/USD

The euro was all over the place last week but it looks as if there is still a significant amount of support just below, maybe the 1.1250 region. If we can break above the top of the candlestick for the week, then I think we will recover towards the 1.15 handle. If we break down below the bottom of it, we will almost certainly try to break the lows of the previous week, and then go looking towards 1.10 level. Regardless, this is a market that is oversold, so a bounce is to be expected.